Related Categories

Related Articles

Articles

Black Swans 2016

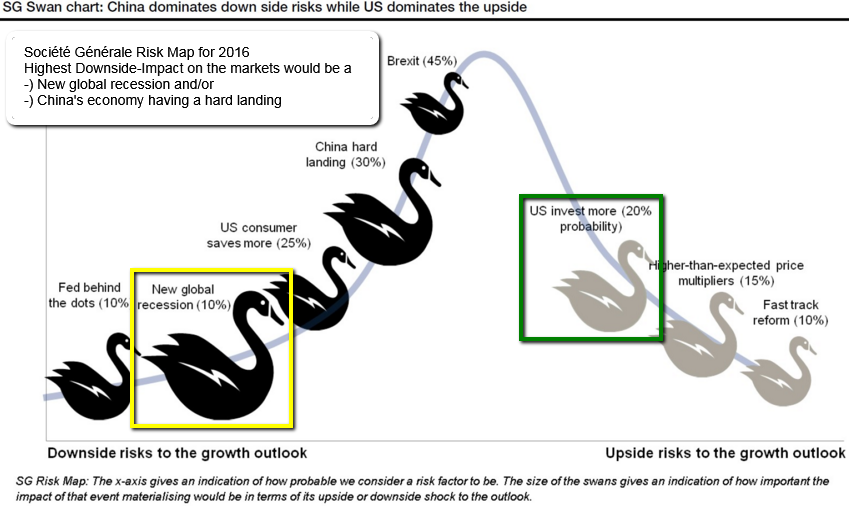

Société Générale has come out with their list of what the bank considers to be potential “black swans” to the market.

France’s third largest bank publishes this list as part of their Global Economic Outlook.

Black swans are by nature unlikely and extremely difficult to predict. Still, the SocGen’s list is a useful way of understanding some of the upcoming risks in the market that could sway investor sentiment and opinion. In the latest edition of the report the bank still sees an excess of potential downside risks to the global economy. The greatest of these risks, slated at only a 10% probability but with maximum impact potential, is a new global recession. The report mentions as well that a hard landing in China could have similar effects.

As I (Ralph Gollner) believe, that a recession is the most important (if not the only one?/"sustainable") reason for a longlasting/sharp market correction, I still believe that the global economy has strength and is building up momentum in Europe, therefore evading such a scenario in 2016. The "occurence" of a recession (after/)during periods of lofty valuations, see partly PE-Ratios in the US, can lead to sharp drops in the markets (please also recheck the current Shiller-PE in order to know where we are standing right now/as per Dec. 2015).

I believe the 10% recession-probability with its obvious high impact on the markets is the key-fear-point for the investor. Therefore one has to follow anticipating fundamental indicators, which correlate somewhat with economic-downturns. I am following the Conf. Board Leading Economic Index (LEI) for the U.S., which is published monthly, but also the ZEW for the German and European area. These are regular publications on economic developments which the prudent investor should analyse in order to form his picture about the current state of the global economy.

If recessionary-hints are on the horizon/appearing in the course of 2016, one should emphasise the importance of the technical levels in the equity-markets/support-lines of Aug. 2015 - established at following Index-levels (during the Aug.-Sell-Off) - and their potential Stop-Loss-relevance:

Dow Jones Industrial Average: 15,500 points

S&P 500: 1,860

Nasdaq Composite: 4,300

Nasdaq 100: 3,800

DAX (German Stock-Market): 9,250

Other Black-Swan-Points like a BREXIT I am not considering now, also a hard landing fo the Chinese economy does not sound real to me, since China has several instruments at their hands, being it currency reserves or a variety of fiscal and monetary options. In fact I am missing the upside-probability of a strong European consumer or an Investment-boom in Europe starting (maybe) in HY2-2016 with rising momentum up to YE-2017. Therefore I (currently) see much more upside-potential for the European markets than downside-risks.

Remark on the Brexit risks: The SG team argues that a Brexit remains a 45% probability, with the referendum on the subject due by 2017. Moreover, SG says: markets do not seem to be pricing in this notable risk factor.

Summary of downside risks and their probability (source: SG)

45% – Great Britain leaves the EU (Impact: low)

30% – China’s economy has a hard landing (Impact: high)

25% – U.S. consumers save more than expected (Impact: medium)

10% – Fed hikes too late (Impact: medium to high)

10% – New global recession (Impact: high)

Upside risks and their probability (source SG)

20% – Stronger investment and trade (Impact: medium to high)

15% – More fiscal accommodation (Impact: medium)

10% – Fast track reform (Impact: low)

sources: http://www.visualcapitalist.com, http://www.valuewalk.com