Related Categories

Articles

Charlie Munger - RIP

With 99 years of age Charlie Munger, the right Hand of Warren Buffet passed away on the 28th Nov. 2023. Following short 33-Minutes long podcast (pl. click here below) was recorded in the year 2015, where Ten Griffin give us -also- some insights into the thinking of Charlie. Gr8 insights, nice quotes! Enjoy:

Some keywords:

- Mental Models-Concept

- Pattern Recognition (History & Business History)

versus

"Formula Learning-Only & Theoretic Models-Only" - Striving for Independence

- "Be smart by not being (too) dumb"

- MOAT

link Ten Griffin in X (former Twitter):

...

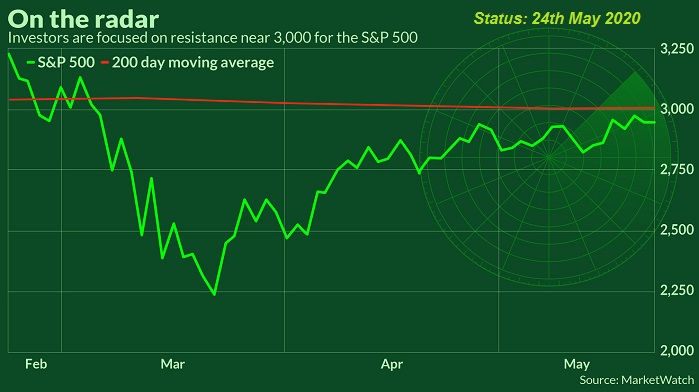

Magic 3k-level (S&P 500)

and 25k in the Dow Jones Industrial Average

Just looking at the market in these times, one thing jumps out across the charts. S&P 500 and the old Dow Jones Industrial Average are near round number-levels today. What I mean is near...

...price levels ending in zero zero zero. '000'.

I have always been entertained when stocks find support and resistance at big round numbers. Some have attributed this phenomenon to a behavioral bias called "round number bias" where people tend to gravitate to big round numbers such as 10, 100, and 1,000 as anchors. In fact, ...

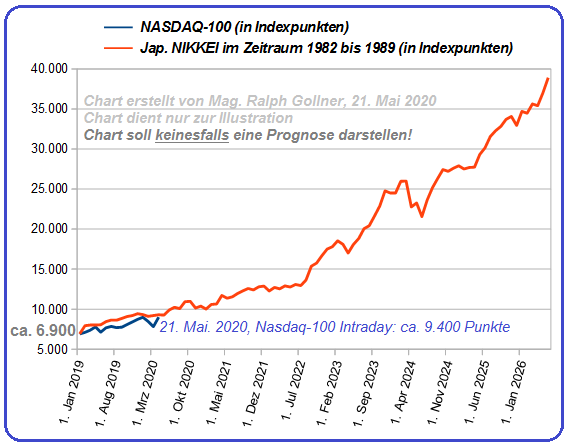

Blasen am Aktienmarkt als Zeichen von Kapitalmarktanomalien

(Märkte sind wohl doch nicht so effizient)

In medias res: Rationale/fast rationale Blasen & Intrinsische Blasen sind nur zwei Varianten von grundsätzlich vier "Blasenarten". Wir werden uns diese beiden etwas näher anschauen; Eine...

...Blase entsteht oft durch eine Verkettung vielfältiger Sachverhalte, die zu einer langfristigen Übertreibung der Wertpapierkurse, oder aber auch der Wirtschaftsaktivität eines Landes führen. So lässt sich die gesellschaftliche Ansteckung (Spekulationsfieber) mit dem Beispiel einer Epidemie ...

Volumen bei vier Aktien

(exemplarisch für viele USD-Aktien am Freitag, 15. Mai 2020)

Das Handelsvolumen oder Volumen ist die Anzahl der Aktien, die die Gesamtaktivität eines Wertpapiers oder eines Marktes

für einen bestimmten Zeitraum angibt. Das Handelsvolumen ist ein technischer...

...Indikator, welcher einem Anleger einen Trend oder eine Trendwende bestätigen kann. Volumentrading kann Anlegern dabei helfen, das Momentum eines Wertpapieres zu erkennen und den Trend zu bestätigen. Das Volumen ist also ein Maß dafür, wieviel von einem bestimmten finanziellen Vermögenswert in einem ...

Ein guter Ratschlag von "onemarkets"

Guter Rat ist also doch nicht teuer...

Hier von www.onemarkets.de

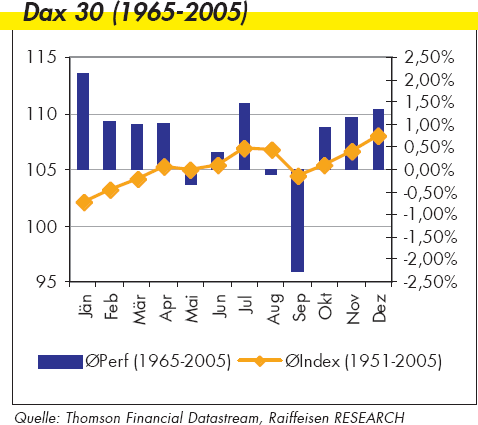

Sollten trotz des Hitzewitters die -doch unvermeidlichen- Sommergewitter auftreten, dann bitte nicht vergessen: Obwohl der DAX in den letzten 5 Jahren angestiegen ist, hat er in diesem Zeitraum zwischenzeitlich bereits sieben mal mehr als 1.000 Punkte verloren! Und dennoch steht er höher als im Jahr 2013 oder 2014...

Zur Info (onemarkets): Gerne blättere ich alle paar Monate in dem kostenlosen (!) onemarkets-Magazin (.pdf), um mir ein paar Ideen zu holen :-)

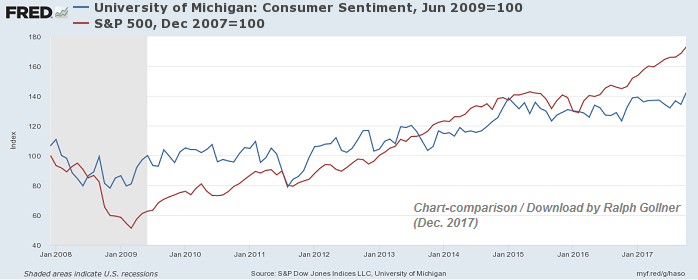

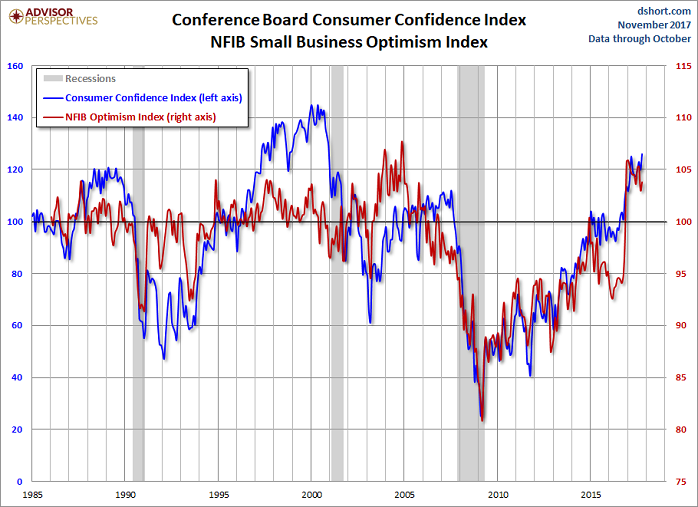

Konsumentenvertrauen (U.S.A.)

Conference Board-Consumer Confidence (Michigan Consumer Sentiment); Das Conference-Board Verbrauchervertrauen misst das Level des Verbrauchervertrauens in wirtschaftlichen Aktivitäten. Es ist ein leitender Indikator, da es die Verbraucherausgaben...

...vorhersehen kann, welches ein großer Teil der Gesamtaktivität der Wirtschaft ist. Höhere Lesungen weisen auf einen größeren Konsumentenoptimismus hin.

Anmerkung um EUR/USD-Währungspaar: Theoretisch (!) sollte eine höhere als erwartete Lesung als positiv/bullisch für den USD angesehen werden, während eine ...

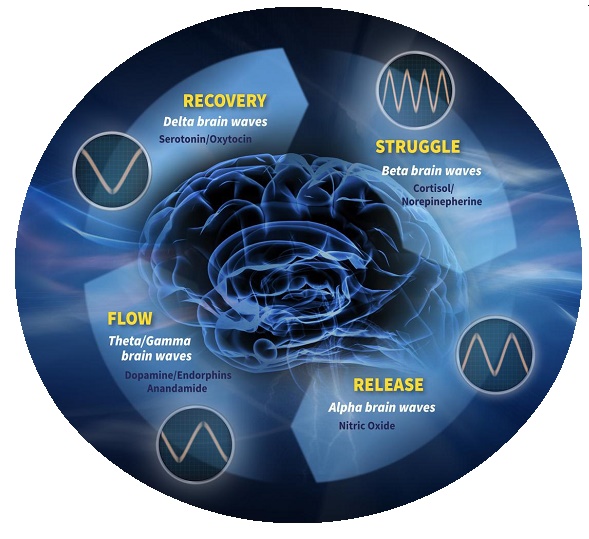

FLOW

Optimal state of consciousness

(Intelligent Risk-Taking "can" go up, Creativity goes up)

Flow ist ein Zustand höchster Konzentration auf eine Aufgabe. Fast so, als wenn du in einer Blase sitzen würdest; Du nimmst die Dinge um dich herum nicht mehr richtig wahr. Sie werden zum...

...Hintergrundrauschen, so wird Zeit und Raum relativ. So können sich Momente wie Stunden anfühlen oder Stunden in Bruchteilen einer Sekunde vergehen.

Im Flow bist du "im Fluss" - eine Entscheidung führt zur nächsten, die sofort ausgeführt wird. Alles passiert in rasender Geschwindigkeit und mit einer ...

US-Consumer confidence

"Consumer confidence increased for a fifth consecutive month and remains at a 17-year high," said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions improved moderately, while...

...their expectations regarding the short-term outlook improved more so, driven primarily by optimism of further improvements in the labor market. Consumers are entering the holiday season in very high spirits and foresee the economy expanding at a healthy pace into the early months of 2018."

links:

...

Herd behavior

This effect is evident when people do what others are doing instead of using their own information or making independent decisions. The idea of herding has a long history in philosophy and crowd psychology.

It is particularly relevant in the domain of finance, where it has been discussed in relation to the collective irrationality of investors, including stock market bubbles (Banerjee, 1992). In other areas of decision making, such as politics, science, and popular culture, herd behavior is sometimes referred to as "information cascades" (Bikhchandi, Hirschleifer, & ...

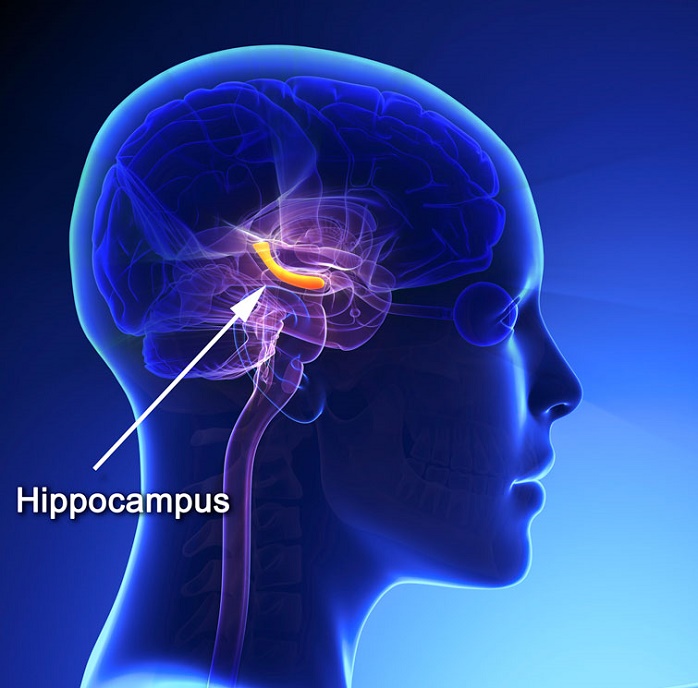

Hippocampus and the

"Whole-Brain State"

Imagine this: You've just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to invest your money "now". With each new opportunity that comes, you find yourself...

...still recalling that big loss and hesitate, or fail to pull the trigger.

This common experience amongst investors (or traders, of which the majority might be playing a loser's game...) has a biological root, and most often creates a negative psychological effect on you. These biological and psychological ...

Artificial Intelligence and the

Investment process

Using Artificial Intelligence (AI) in investment management is a possibility; But there are many aspects in the investment process where AI can and cannot function as a support. Even the most sophisticated machine learning...

...technologies can't replicate human creativity and ingenuity. As machines take over routine tasks, employees will have more time for work that demands uniquely human talent. Artificial intelligence can make humans vastly more productive. When machines take care of crunching data, conducting micro-analysis, and ...

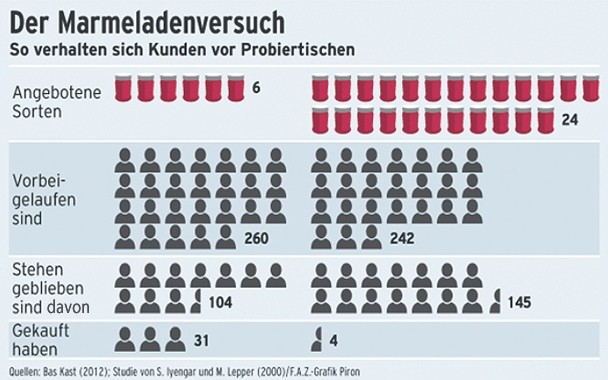

Der Marmeladenversuch oder

"Die Qual der Wahl"

In den Medien machen öfter Artikel die Runde, die zum Gegenstand die Neuroökonomie haben. Solche Artikel tragen zum Beispiel Überschriften wie "Gibt es ein schlaues Verhalten?" Für die Börse ist diese Thematik ein gefundenes Fressen. Denn...

...wer wüsste nicht gerne stets Bescheid, wie es mit den Kursen weiter geht. Was unter den etwas hochtrabend klingenden Begriffen Neuroökonomie, Behavioral Finance, Verhaltensökonomie oder für den Praktiker als "angewandte verhaltenswissenschaftliche Finanztheorie" firmiert, liefert ein paar ...

Wie viele Gefühle hat der Mensch?

Vorab stellt sich die Frage, wie relevant diese Frage für die "Behavioral Finance" ist? Nun, nicht nur für die Verhaltensökonomie ist die Auseinandersetzung mit Gefühlen extrem wichtig, auch für alle anderen Bereiche! Jeder hat Gefühle, aber...

...für viele Menschen sind sie nur schwer in Worte zu fassen. Noch schwieriger ist es, sie in Kategorien einzuordnen oder gar zu zählen.

Sortieren, definieren, kategorisieren

Bislang war der Gefühlspool der Menschheit - rein wissenschaftlich (!) gesehen – in sechs verschiedene Kategorien unterteilt: Glück, ...

Home Bias versus Cosmopolitan

Everyone is guilty of home country bias, let's be different:

Try to invest/be(come) COSMOPOLITAN !

For many people, there's no place like home. But if you're only investing at home, first: you are taking high(er) risks and 2nd sometime you're missing out...

...on big gains (in markets abroad). As you can see in the next chart, so far this year, the S&P 500 is up 11 percent. The Singapore Straits Times Index has returned 24 percent. And the MSCI World is up 15 percent. Those are solid returns. But other markets have done a lot better...like the 41 percent ...

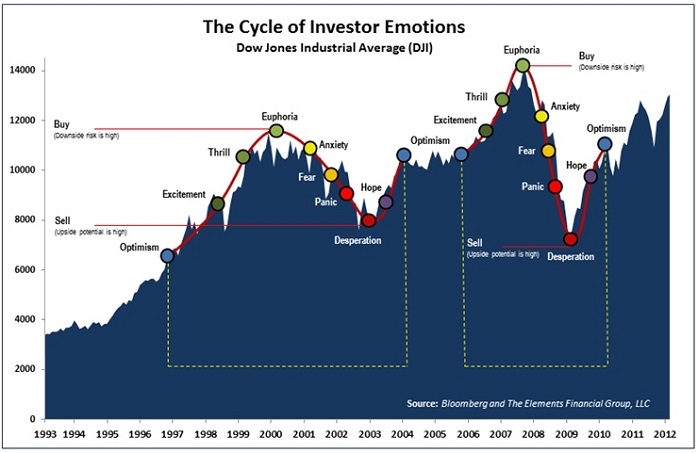

Mr. Market

"Remember that the stock market is a manic depressive." (Warren Buffett)

Rules of logic often don't apply SHORT-TERM in investment markets. The well-known advocate of value investing, Benjamin Graham, coined the term "Mr. Market! (in 1949) as a metaphor to explain the stock market.

Sometimes Mr. Market sets sensible share prices based on economic and business developments. At other times he is emotionally unstable, swinging from euphoria to pessimism. But not only is Mr. Market highly unstable, he is also highly seductive - sucking investors in during the good times with ...

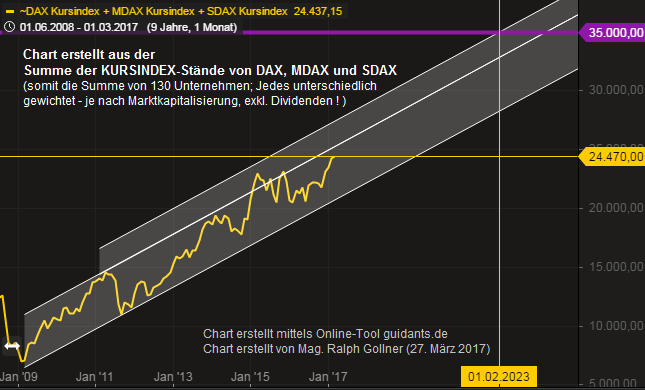

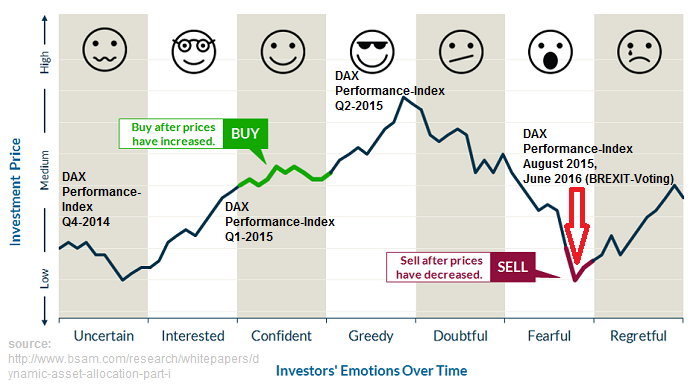

Psychologie & DAX

In persönlichen Gesprächen höre ich in letzter Zeit oft: Die Aktien steigen doch immer die letzten Jahre - "ist ja ganz einfach". Nun, so einfach ist es wohl nicht. You gotta have SKIN IN THE GAME ! Eine einfache Stütze ist jedoch ein langfristiger Anlagehorizont!

"It's about how hard you can get hit and keep moving forward.

How much you can take and keep moving forward.

That's how winning is done! "

Rocky Balboa

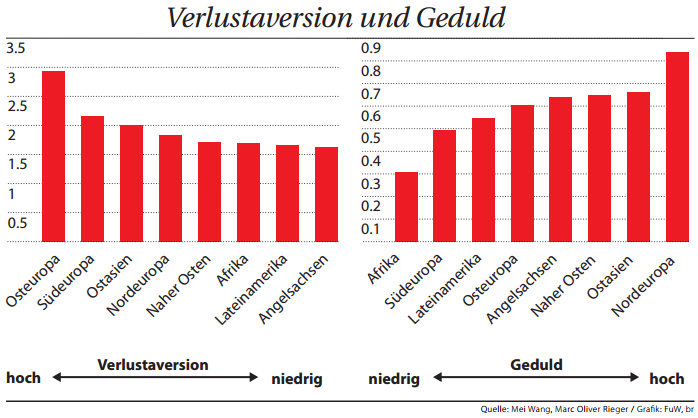

"Wie Kultur die Anleger beeinflusst"

Kulturelle Unterschiede auch in Finanzfragen - Nordeuropäer cool/er (geduldig)

Trotz der fortschreitenden Globalisierung gibt es weiterhin kulturelle Unterschiede. Auf der Welt werden rund 6.500 Sprachen gesprochen, die Essgewohnheiten sind...

...verschieden und auch das Sozialverhalten unterscheidet sich je nach Region. Die traditionelle Finanzökonomie jedoch zeigt sich von der kulturellen Vielfalt ziemlich unbeeindruckt. Sie behauptet: Wenn’s ums Geld geht, sind wir alle gleich. Jeder Anleger kann heute mit ein paar Klicks jedes Wertpapier ...

"Unser Gehirn kann nicht mit Geld umgehen, daher sind wir Idioten der Kapitalanlage":

So der Ex-Banker Roland Ullrich, der sich nun nach seinem Ausstieg aus der Banker-Welt, der Verhaltensökonomie und Hirnforschung verschrieben hat. Aus dem Literarischen wissen wir vom Rat eines guten...

... Vater-Freundes vom Buchautor Wenedikt Jerofejew:

"Fühlen muss man klug, nicht mit dem Kopf, aber klug."

Roland Ullrich erklärt also, dass wir Idioten der Kapitalanlage sind. Dies klingt hart, gibt er zu, "aber unser Gehirn ist ein hoch emotionales und soziales Organ und damit für rationale ...

"Made in Germany"

ist das beliebteste Label der Welt

Für mich ist es glasklar: Warren Buffet hat einen Home-Bias (gerechtfertigt oder nicht will ich nicht beurteilen). Haben wir in Österreich & Deutschland auch einen Home-Bias? Wenn ja, gerechtfertigt? Die US-Wirtschaft würde gerne...

...mehr exportieren - einfach wird das aber nicht. Das Label "Made in USA" jedenfalls ist laut einer weltweiten Umfrage nur mäßig beliebt. Im Gegensatz zu Waren aus Deutschland. Als Deutscher oder Österreicher könnte man also gerne sagen: "Schuster, bleib bei Deinen Leisten, aber..."

Laut einer neuen ...

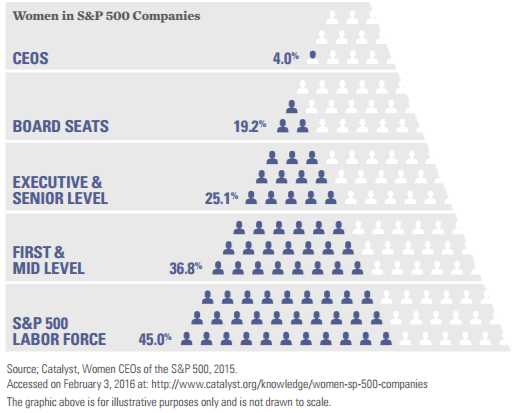

Why Invest in Women?

Research shows that companies that embrace gender diversity on their boards and in management often experience improved performance and profitability as a result. Consider the following: Invest in companies with women in CEO, board, or senior level positions, thereby...

...encouraging more companies to support a gender diverse workforce.

An Exchange-Traded-Fund (ticker: "SHE") seeks to help address gender inequality in corporate America by offering investors an opportunity to create change with capital and seek a return on gender diversity, says Kristi Mitchem, ...

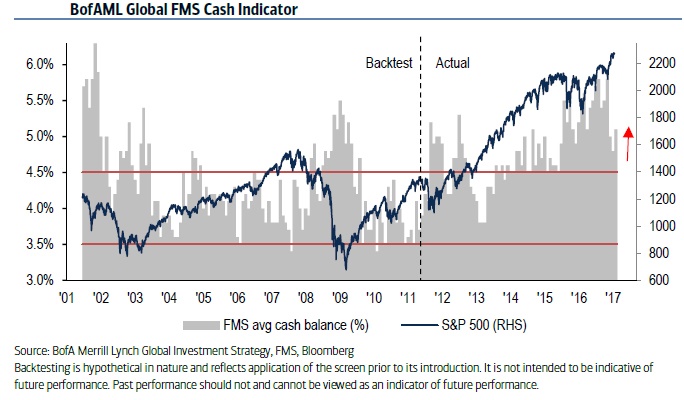

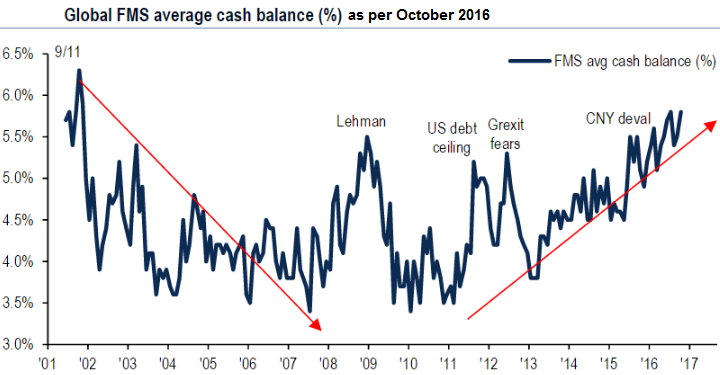

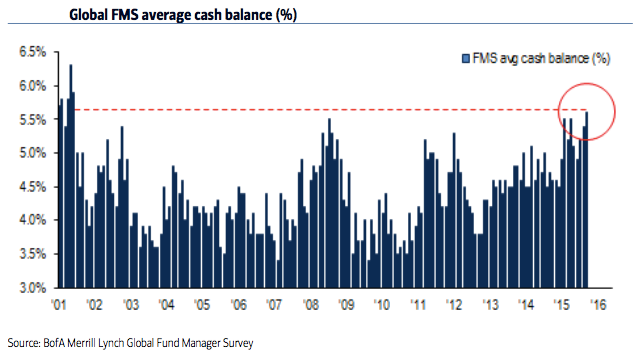

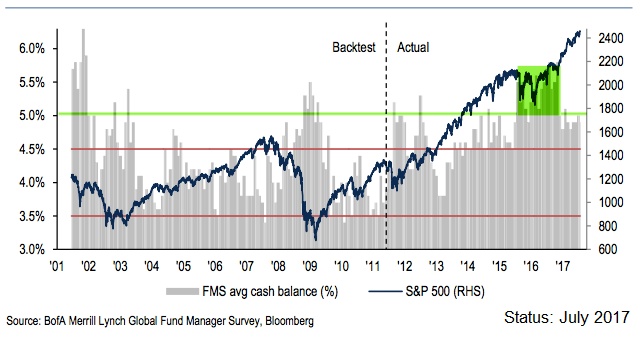

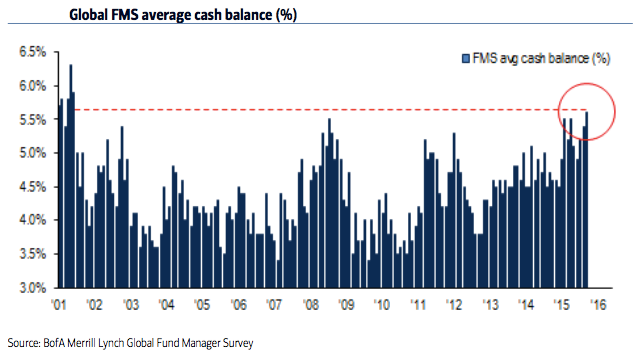

Cash Indicator and other great stuff from BofAML

(Jan./Feb. 2017)

The BofAML Fund Manager Survey (FMS) is a monthly survey of 200-250 primarily long-only investors. One of the key questions in this survey asks for cash balance as % of assets under management. A low cash balance indicates...

...investors are vulnerable to negative market shocks, while a high cash balance means investors could be underinvested & vulnerable to positive market shocks.

BofAML Global FMS Cash Rule - Bullish

(The rule)

♦ Buy equities when the FMS average cash balance rises to 4.5% or higher

♦ Sell equities ...

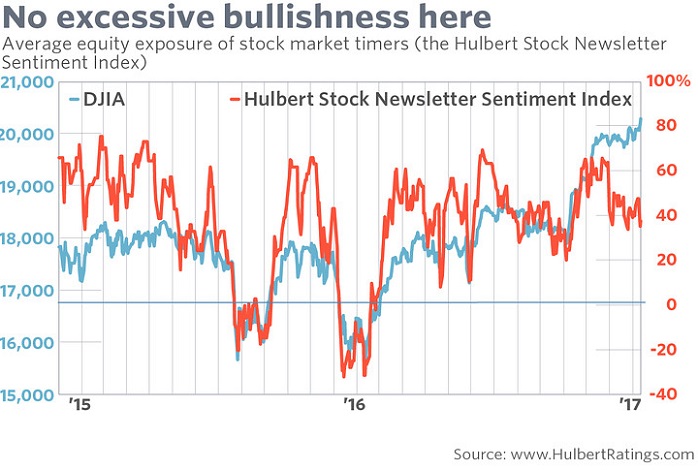

Stock Newsletter Sentiment

(HSNSI, Mark Hulbert)

Stock-market timers grow cautious, and that's good for equities. Market tops are usually characterized by stubbornly held bullishness, but that’s not what we're seeing today. Stock-market timers have been turning remarkably cautious. It's...

...surprising and bullish from a contrarian perspective, because market timers typically become more bullish as stocks power higher. Not this time, however.

Consider the average recommended stock-market exposure among the market timers Mark Hulbert monitors who focus on forecasting the S&P 500's ...

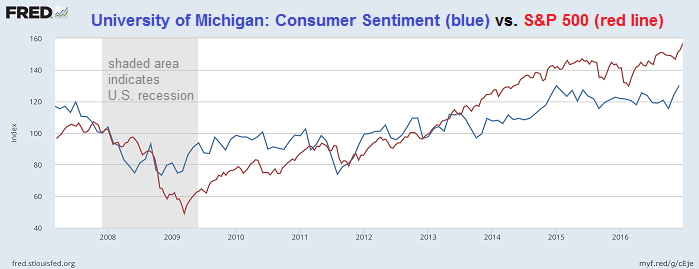

Consumer Sentiment vs. S&P 500

I created a chart comparing the Michigan Consumer Sentiment versus the U.S. Stock market (S&P 500) since the last recession (2008/2009). For the moment (Q1-2017) it seems that the famous "Animal spirits" have taken over...

The final reading of the University of Michigan's consumer sentiment for the United States rose to 98.5 in January 2017 compared to a preliminary figure of 98.1 and 98.2 in December 2016. It is the highest reading since January of 2004, due to a more optimistic outlook for the economy and job growth during the year ahead as well as ...

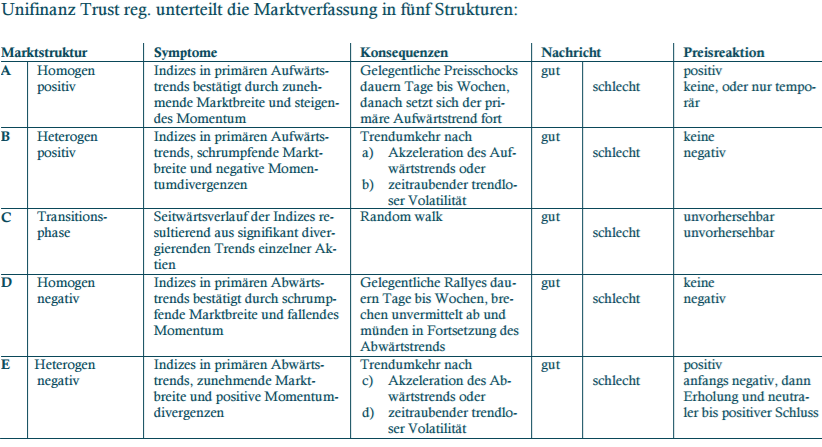

Marktstruktur, Marktbreite

(Phasen A bis E)

Die Aktienmärkte befinden sich evtl. noch immer in einer Transitionsphase (C-Struktur). Diese kann in einen Bullenmarkt münden, wenn es zu einer positiven Überraschung kommt, wie z.B. zu einer technologischen Innovation, die...

...ähnliche Phantasien auslöst wie das Internet ab 1996...Es kann (aber) auch zu einem Bärenmarkt kommen, wenn enttäuschende Entwicklungen auftreten. Nicht unähnlich verhält es sich mit den wichtigsten Devisen. Der Yen ist schwach, das Pfund reagiert auf eine wahrscheinlich zu negative Vorwegnahme der ...

Emotions and DAX-Index

(Q4-2014 - Q4-2016)

A team of personal trainers, scientists and nutritionists can design the most sophisticated diet and exercise plan but it will have no chance of success if it is impractical for most people to follow.

Therefore it is of utmost importance to understand investor behavior. Herein lies the paradox of the active versus passive debate; finding the optimal mathematical strategy is futile unless it factors in typical investor behavior. At the end of the day whether a portfolio is active or passive is therefore irrelevant. A strategy will only deliver ...

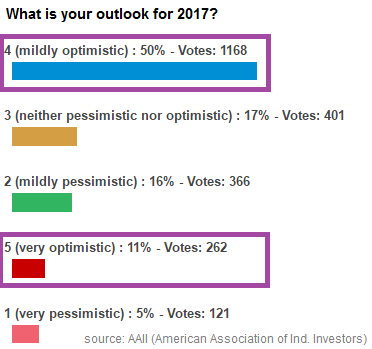

Shiny, happy people (!?)

Optimistic Individual Investors

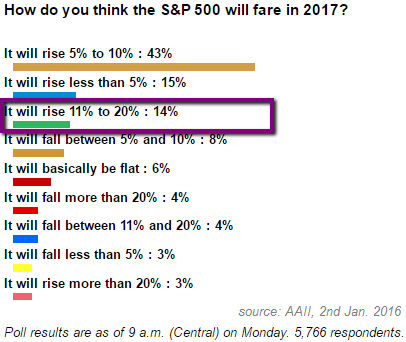

The American Association of Individual Investors is regularly asking its members for feedback on their surveys. At the start of the year they asked following, more focused: the possible annual return of the S&P 500; But first:

Only 21% Pessimists...The well known Stock-Market Index S&P 500 was the next center of interest, more specific: How the Index will eventually end the year 2017 measured in % (up OR down); Quick resumé is that 81% of the more than 5,000 respondents see NO LOSS ahead:

links:

Reminder (!): ...

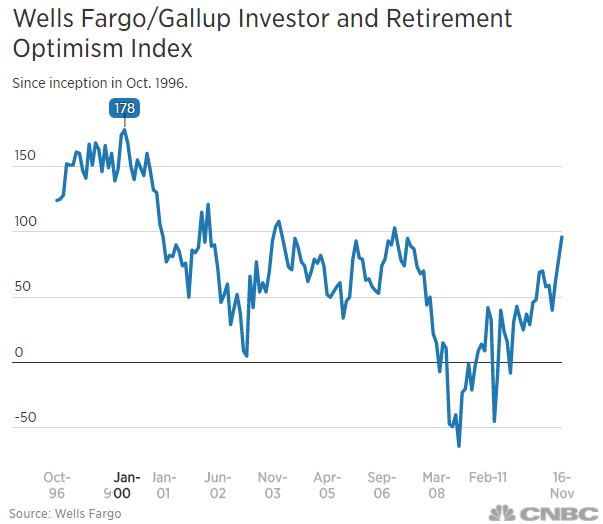

Positive Gallup Surveys (Nov./Dec. 2016)

-) Wells Fargo/Gallup Small Business Index at highest level since January 2008

-) Gallup Investor and Retirement Optimism Index jumps to 9-year high

Individual investor optimism jumped to a nine-year high in November 2016, according to the Wells Fargo/Gallup Investor and Retirement Optimism Index published in December 2016. The 96 read that month marked the third straight quarterly rise and was up from 79 in the third quarter 2016, the survey said. The last time the index approached the November level was before the financial crisis, in May 2007 ...

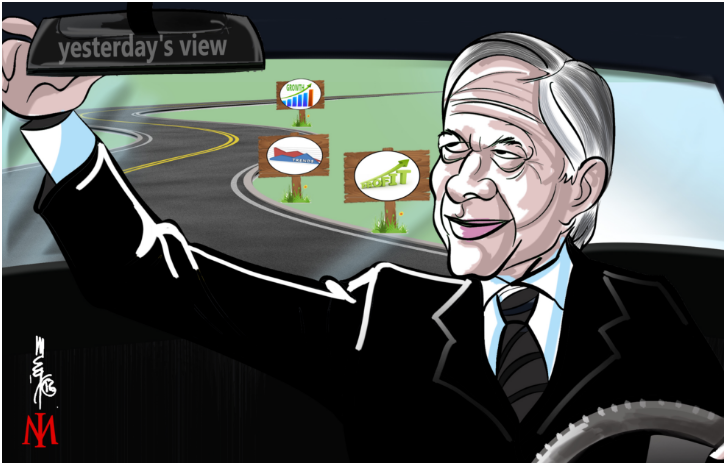

Investing in the Rearview Mirror

(Hindsight-Bias)

"In the business world, the rear view mirror is always clearer than the windshield." W. Buffett; "You can't see the future through a rearview mirror" Peter Lynch; "Too often, investors are more inclined to look at the rearview mirror...

...than the windshield." Francois Rochon; "Anchored in the present, one of the great ironies is that investors imagine the future to be what they see in the rear-view mirror. The windshield is simply too foggy." Quote by Frank Martin

"You cannot look at the future by naïve projection of the past" ...

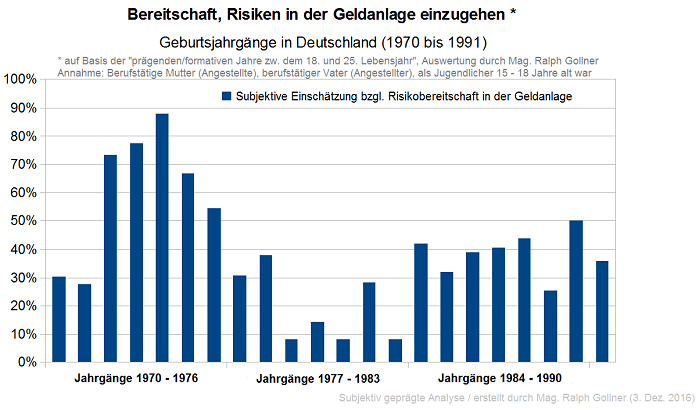

Behavioral Finance versus starrer Regulierungs-Wut?! Plausible/"Korrekte" Einschätzung vom Risiko und Wissen um die eigene Risikoaversion sind bei der Geldanlage unverzichtbare Bausteine, um eine passende mittel- bis langfristige Strategie erstellen zu können, die zur individuellen Person auch passt. Laut Gesetz sind Banken und Berater vor der Beratung eines Kunden verpflichtet einen Kundeninformationsbogen auszufüllen, welcher Sie nach seiner Risikoneigung befragt.

"GRASP THE BIG PICTURE HERE": www.private-investment.at/img/RisikoBereitschaft_BIG_PICTURE

Joachim Klement, CFA erklärte ...

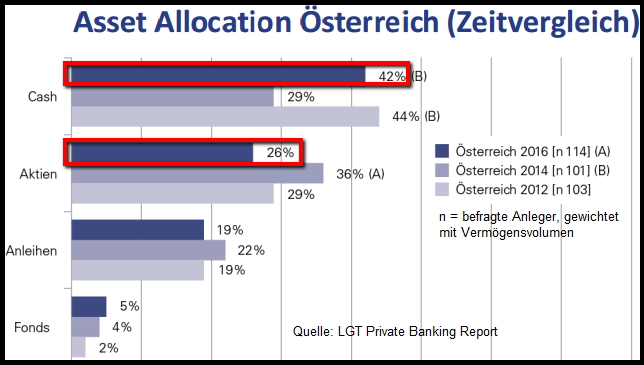

LGT Private Banking Report 2016

Studie im Auftrag von LGT; Durchführung: Abteilung für Asset Management der Johannes Kepler Universität Linz Leitung Univ.-Prof. Dr. Teodoro D. Cocca. Ziel: Befragung zum Kundenverhalten von Private-Banking-Kunden in Österreich, Deutschland und der Schweiz.

Stichtag/Zeitraum der Befragung: Jänner 2016

Stichtag/Zeitraum der Befragung: Jänner 2016

Ansicht EXKLUSIVE folgender Asset-Klassen: Rohstoffe, Derivate, Alternative Anlagen

Abgrenzung/Befragung von Anlegern mit einem "Frei verfügbaren Anlagevermögen" von:

♦ in Deutschland und Österreich mehr als EUR 500.000

♦ in der Schweiz mehr als CHF 900.000

♦ ...

BOFA Fund Manager Survey (Oct. 2016)

Cash Allocations are Close to 15-Year Highs

Cash levels jumped from 5.5% in September to 5.8% in October 2016. Investors' average cash balance was last this high in July 2016 (post-Brexit vote) and in Fall 2001.

More precise: The share of cash hasn't been higher than that since November 2001, shortly after the terrorist attacks in the U.S.

"This month’s cash levels indicate that investors are bearish, with fears of an EU breakup, a bond crash and Republicans winning the White House jangling nerves," said Michael Hartnett, the bank's chief ...

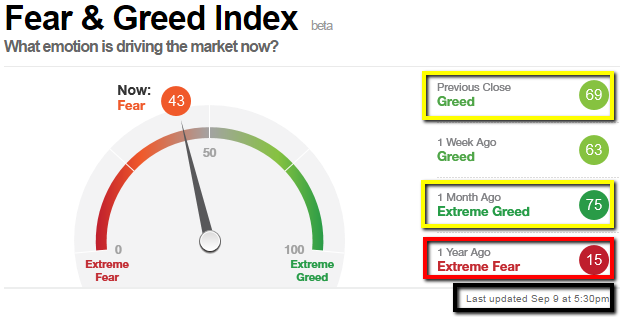

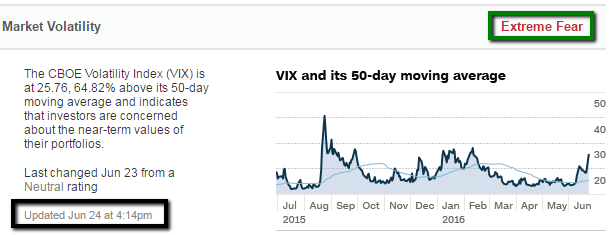

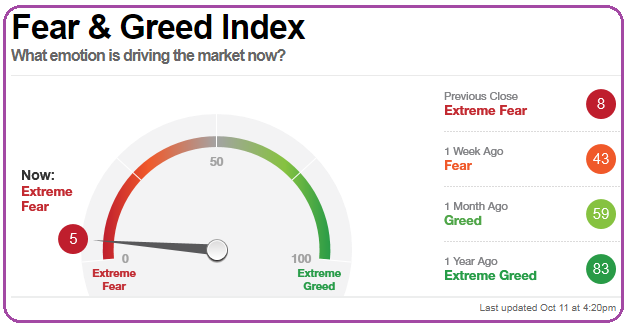

Fear & Greed (43 versus 69)

Now, that the Fear & Greed Index of http://money.cnn.com/data/fear-and-greed has fallen below the "50-points-threshold" this could give the markets the chance to breathe through for regaining momentum for the later months of the year 2016.

As can be seen from the screenshot above, the level of 43 is well below the readings of the weeks in August 2016 before, while the S&P 500 was at a level above 2,150 points. Now, that the US-Stock-Index has fallen BELOW its 2,150 points-threshold AND the Fear & Greed Index is below the 50-level there might be room for ...

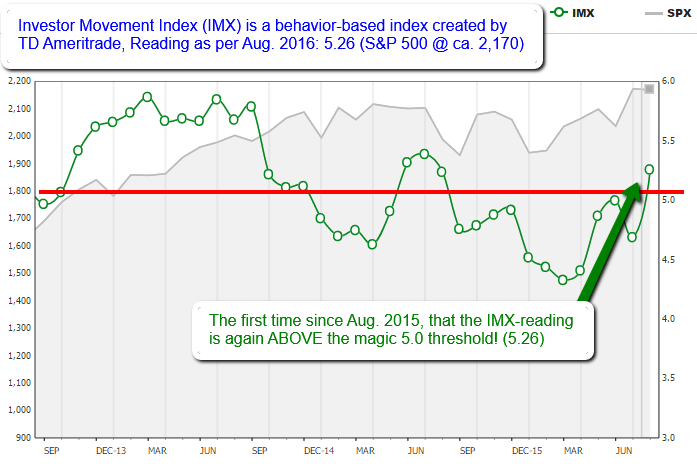

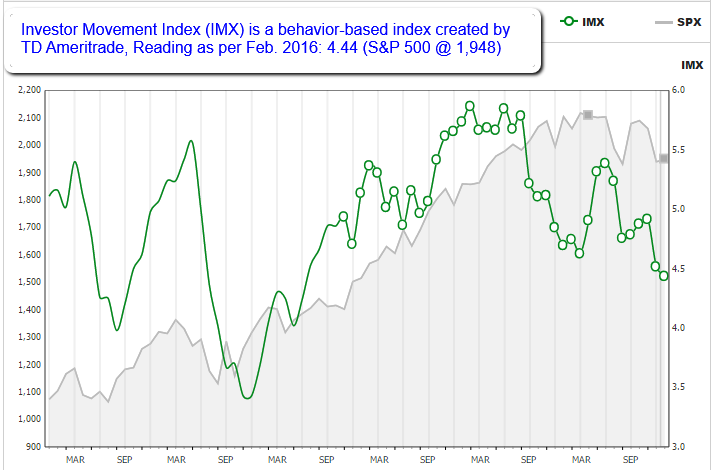

Investor Movement Index (IMX)

The Investor Movement Index, or the IMX, is a proprietary, behavior-based index created by TD Ameritrade designed to indicate the sentiment of retail investors. The IMX saw its largest ever single month increase in August as volatility hit a two-year low!

TD Ameritrade clients seemed to position their accounts for more exposure in August, as the volatility of the S&P 500 reached its lowest point since 2014. The lower overall volatility had the effect of increasing the relative volatility of many widely held positions, including Apple Inc. (AAPL) and ...

Einige Todsünden des DURCHSCHNITTSANLEGERS!

Ausschweifung, Maßlosigkeit, Habgier, Faulheit, Zorn, Neid und Hochmut. Die 7 Todsünden lassen sich auch auf das Anlageuniversum übertragen. FundResearch und Aberdeen Asset Management zeigen warnende Beispiele, die jeder Investor beherzigen sollte.

1. Ausschweifung: Der Verlockung schneller Schnäppchen widerstehen

"In unserer schnelllebigen Welt ist der Wunsch nach sofortigem Erfolg eine starke Triebfeder", erklärt Hartmut Leser, Vorstandsvorsitzender von Aberdeen Asset Management. Von diesem Reiz sollte man sich jedoch besser nicht verleiten ...

Viele Crashgurus unterwegs (Aug. 2016)

Aktuelle Stimmen aus der Börsenwelt (Mitte Aug. 2016):

-) Experten bezweifeln, dass der DAX 30 seine Rally nach dem Jahreshoch fortsetzen wird.

-) Das Jahreshoch des DAX 30 ist kaum von Bedeutung.

-) Experten geht die Rally zu schnell...

-) Kurse haben sich von den realwirtschaftlichen Faktoren abgekoppelt.

-) Nichts sieht gut aus.

-) Dow Jones, S&P 500 und Nasdaq schlossen am selben Tag auf Allzeithoch und der DAX 30 erreicht Jahreshoch:

-) Es knallten keine Sektkorken.

-) USA: 3-faches Allzeithoch von schlechter Stimmung begleitet.

-) Der Markt hat seine ...

BOFA Fund Manager Survey (July 2016)

Cash levels at a 15-year high

Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks. Following Long-Term chart still shows the elder, lower reading of 5.6%, the most recent reading is now 5.8%.

The S&P 500 has jumped about 8.5 percent since the lows hit in the days after Britain's move to leave the European Union, but that hasn't assuaged professional investors. Cash levels are now at 5.8 percent of portfolios, up a notch from June and at the highest levels since November 2001, according to the latest Bank of ...

Wissen ist nicht gleich "wissen"

Intelligenz bzw. Schläue spielt für uns in der Arbeitswelt eine wichtige Rolle. Doch der höchste Intelligenzquotient und das größte Allgemeinwissen bringen nichts, wenn nicht danach gehandelt wird. „Dumm ist der, der dummes tut“, sagt Forrest Gump...

...in dem beliebten Film mit Kultstatus und beweist damit trotz seiner deutlich dargestellten geistigen Behinderung eine erstaunliche Weisheit, findet auch Steve Tobak, Autor bei Entrepreneur, und hat zehn Dinge zusammengestellt, an denen wir schlaue Menschen erkennen.

Einige Eigenschaften -nicht total ...

Fear & Greed Index (three indicators selected)

post Brexit (26th June 2016)

Investors are driven by two emotions: fear and greed. Too much fear can sink stocks well below where they should be. So what emotion is driving the market now? CNNMoney's Fear & Greed index makes it clear.

They look at 7 indicators; here is a selection of three indicators which they are following closely and are now in Extreme-Fear-territory (see chart above and charts below):

Looking at the indicator "S&P 500 versus its 125-day moving average", the definition says, that if the Index lies SLIGHTLY above this ...

Künstliche Intelligenz

Roboter vermehren das Geld

Wer den Namen Bernhard Langer hört, denkt vermutlich zuerst an Deutschlands berühmtesten Golfspieler. Etliche Anleger kennen aber noch einen anderen Bernhard Langer - er ist Fachmann für computergestützte Anlagestrategien.

Bild-quelle: http://media.wix.com

Bild-quelle: http://media.wix.com

Der heuer 52-jährige B. Langer startete seine Karriere 1989 bei der Bayerischen Vereinsbank und kam 1994 zu Invesco. Der gebürtige Bayer lebt mit seiner finnischen Frau und seinen vier Kindern in der Nähe von München.

Interview vom April 2015, tlw. 2014 (Euro am Samstag, Mein ...

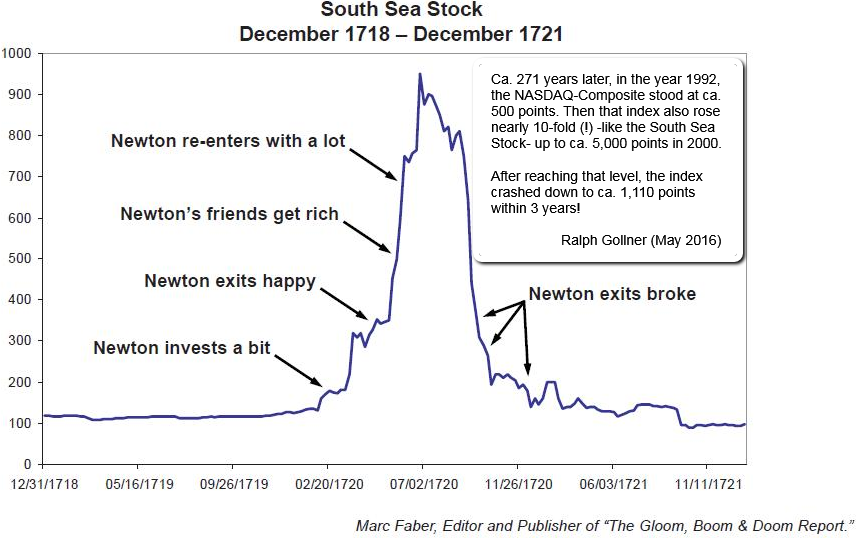

Bubbles (comparison years 1721 versus 2000)

South Sea Stock versus NASDAQ-Comp.

Bubbles can hit anyone! For practitioners of Schadenfreude, seeing high-profile investors losing their shirts is always amusing. But for the true connoisseur, the finest expression of the art comes...

...when a high-profile investor identifies a bubble, perhaps even makes money out of it, exits in time - and then gets sucked back in only to lose everything in the resultant bust.

An early example is the case of Sir Isaac Newton and the South Sea Company, which was established in the early 18th Century and ...

Mister Market (Psychogram)

In the investment world, we were first introduced to Mr. Market by Benjamin Graham in his 1949 book, The Intelligent Investor. Graham’s mentee, Warren Buffett, still calls this book "by far the best book on investing ever written."

Further he states that "chapters 8 and 20 have been the bedrock of my investing activities for more than 60 years. I suggest that all investors read those chapters and reread them every time the market has been especially strong or weak." Chapter 8 is devoted to Mr. Market.

To summarize, Mr. Market is often identified as having ...

Recency Bias (Q1/2016)

Recency Bias. We are all prone to recency bias, meaning that we tend to extrapolate recent events into the future indefinitely. Following the January 2016-sell-off period:

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 while the lowest recommended weighting came just after the lows of the financial crisis. That’s recency bias.

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 while the lowest recommended weighting came just after the lows of the financial crisis. That’s recency bias.

link/10 most common Behavioral Biases: https://rpseawright.wordpress.com

quote-source: https://artivest.co

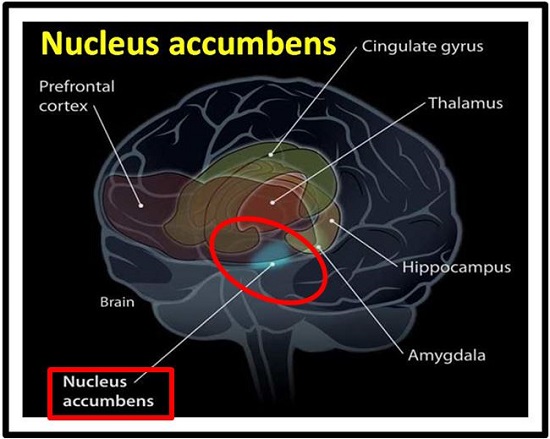

Oxytocin & Co. (Fear & Gier)

Stichworte: Nucleus Accumbens, Dopamin, Oxytocin, Adrenalin, Kontrollverlust

"Unser Gehirn ist süchtig nach Belohnungen"

Wer Geld gespart hat, überlegt, wie er es vermehren kann, etwa an der Börse. Aber unser Hirn kann nicht mit Geld umgehen, findet der ehemalige Investmentbanker Roland Ullrich. Im Interview verrät er, wie Anleger dennoch zum Ziel kommen.

Ärzte Zeitung: Herr Ullrich, was passiert in unserem Gehirn, wenn wir Geld in Aktien investieren?

Roland Ullrich: Gewinne und Verluste werden in unserem Gehirn in verschiedenen Arealen verarbeitet. Bei ...

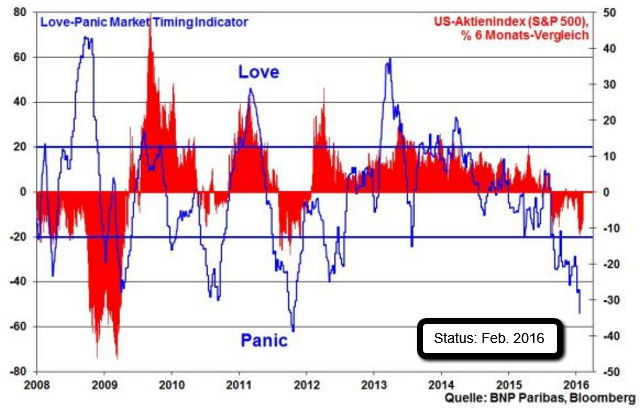

Love-Panic Sentiment (Feb. 2016)

Love panic is a sentiment indicator created by BNP and gives an idea if the equity market is in a phase that is either love, neutral, and panic. This is a contrarian indicator so a high reading would be considered too much love which can signal a market high.

Uniqueness:

Love panic is actually a sentiment indicator created by BNP and can therefore be a useful addition to risk management tools. Gerry Fowler, who is Global Head of Equity & Derivative Strategy for BNP Paribas, notes that many entities have approached creating a sentiment indicator and that ...

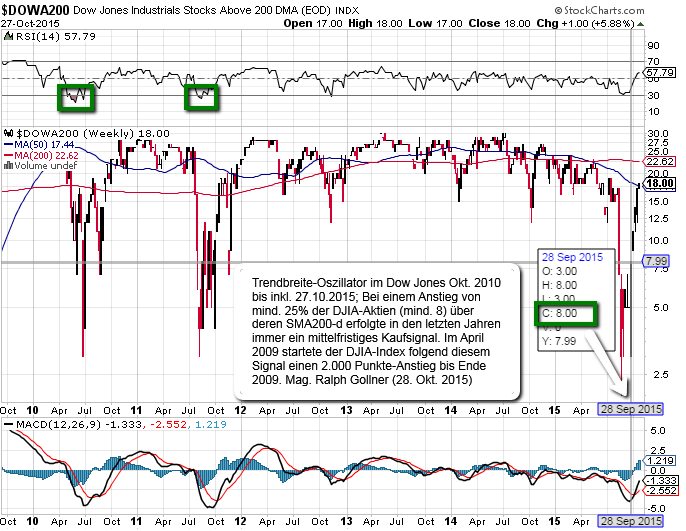

Dow Jones (IA) Trendbreite-Oszillator (kfr. MarktUNTERtreibung ?)

Vereinfacht gesagt wird mit diesem Oszillator die Marktbreite im Dow Jones Industrial Average (DJIA) gemessen.

Allgemein: Sofern eine Aktie über dem 200-Tage-Durchschnitt (SMA200) notiert, wird von einer guten Trendstärke gesprochen. Notieren mehr als die Hälfte aller DJIA-Aktien über dem SMA200, kann man von einer positiv(er)en Trendbreite im Markt sprechen. Je höher die Anzahl der Aktien > SMA200 ist, desto stärker und robuster sollte der Gesamtmarkt / der DJIA dastehen.

Sofern weniger als ca. 6 DJIA-Unternehmen ...

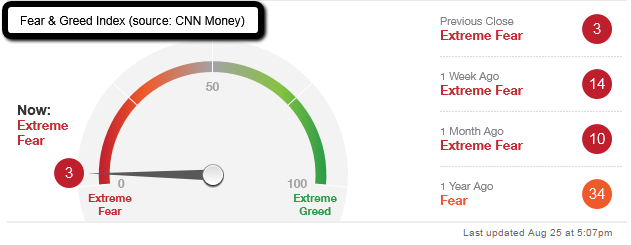

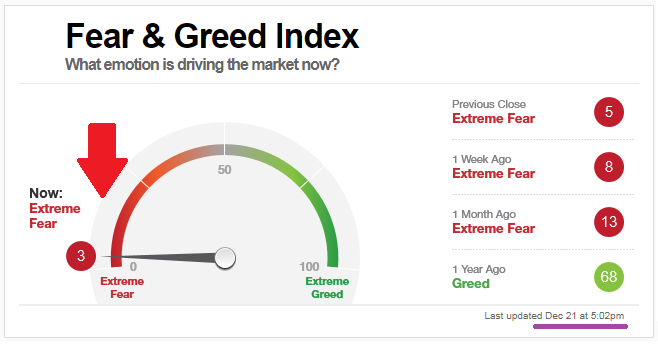

Fear & Greed (Index)

The last time the Index was near such low readings (3) was during the last correction in the US Financial markets, occuring in Oct. 2014. That time it took the index about one week to get out of that negative sentiment (such a quick turnaround may not be the standard).

In Oct. 2014 it took the US-markets about 7 trading days to come back to "normality". As mentioned such a speedy recovery may not be the norm and one has to remember the famous phrase Keynes said (the famous LTCM-fund & its Nobel laureates ignored that fact); Keynes had learned a valuable but ...

Cognitive biases (incl. the Snake Bite Effect)

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

Although the reality of these biases is confirmed by replicable research, there are often controversies about how to classify these biases or how to explain them. Some are effects of information-processing rules (i.e. mental shortcuts), called heuristics, that the brain uses to produce decisions or judgments. Such effects are ...

Anchoring (heuristic)

Anchoring is a particular form of priming effect whereby initial exposure to a number serves as a reference point and influences subsequent judgments about value. The process usually occurs without our awareness (Tversky & Kahneman, 1974), and sometimes it occurs when people’s price perceptions are influenced by reference points. For example, the price of the first house shown to us by an estate agent may serve as an anchor and influence perceptions of houses subsequently presented to us (as relatively cheap or expensive). These effects have also been shown in ...

Some of us are highly loss averse, but in general we’re all averse to losses to some degree. Empirical estimates find that losses are felt between two and two-and-a-half as strongly as gains. Thus the disutility of losing $100 is at least twice the utility of gaining $100. Evenutally loss aversion favors inaction over action and the status quo over any alternatives.

Therefore we avoid making investment decisions because we’re afraid we’ll make the wrong choices. We hang onto beaten-down stocks because it's too painful to sell and make those losses “real.” That’s not unusual. People tend ...

Related Articles

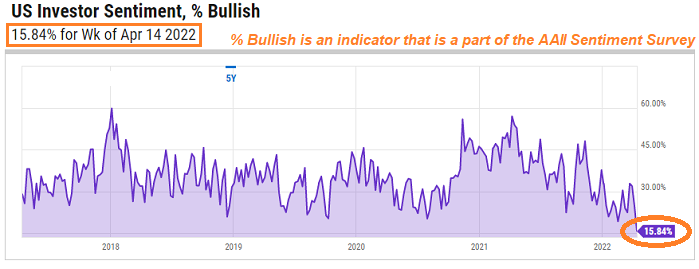

AAII-Bulls reading < 16%

(14th April 2022)

US Investor Sentiment, % Bullish is an indicator that is a part of the AAII Sentiment Survey. It indicates the percentage of investors surveyed that had a bullish outlook on the market. An investor that is bullish, will primarily think that...

...

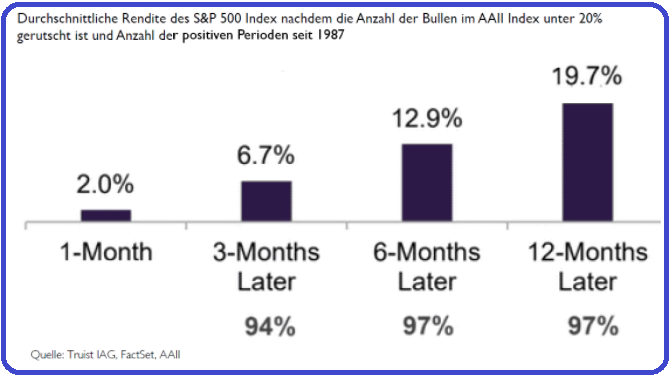

AAII-Bulls reading < 20%

(16.Feb 2022)

Die Geschichte der AAII-Befragungen zeigt uns, dass einer sehr geringe Bullenquote unter den Teilnehmern oft eine positive 12-Monatsperformance im S&P 500 folgt:

Am Mittwoch, 16. Feb. 2022, wurde von AAII eine geringe Bullenquote von 19,2% registriert, ...

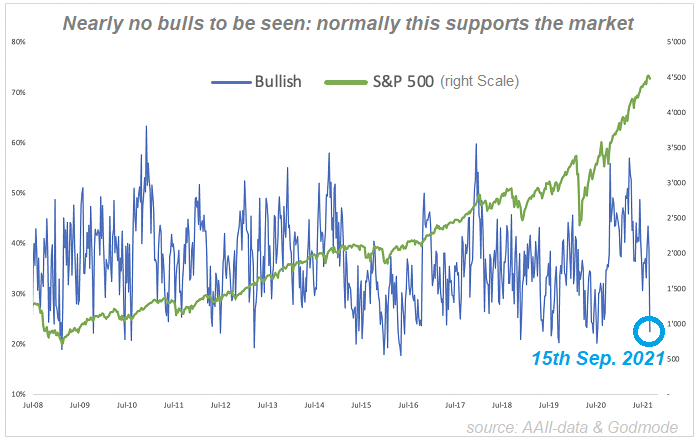

AAII Investment Survey

(15th & 22nd September 2021)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism experiened...

...a pretty ...

...a pretty ...

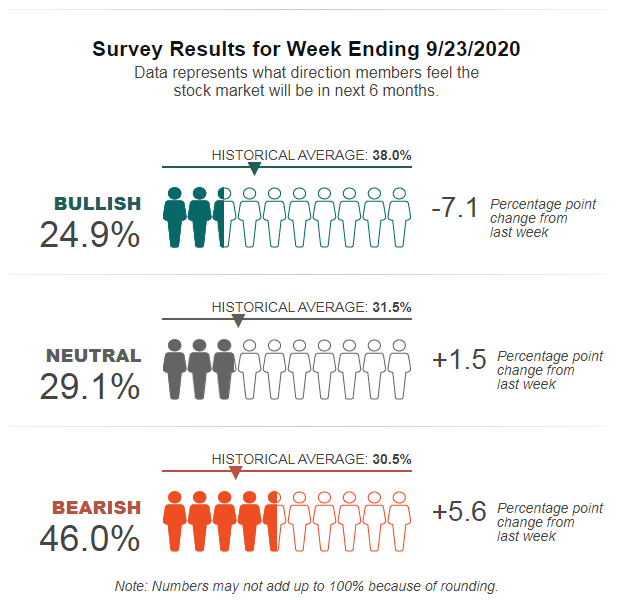

AAII Investment Survey (24th September 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism experiened...

...its largest ...

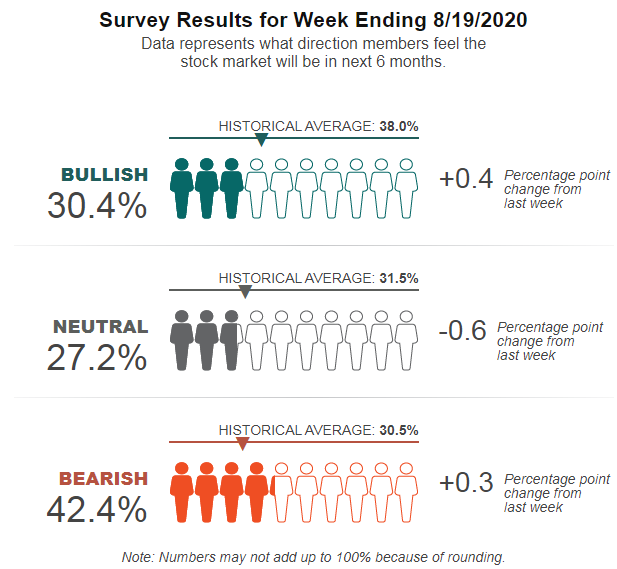

AAII Investment Survey (19th August 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Pessimism among...

...individual investors ...

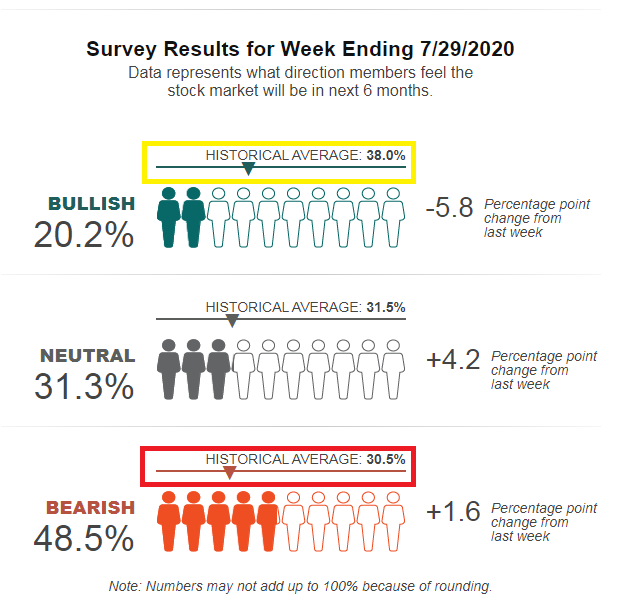

AAII Investment Survey (29th July 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism among individual investors about...

...

...

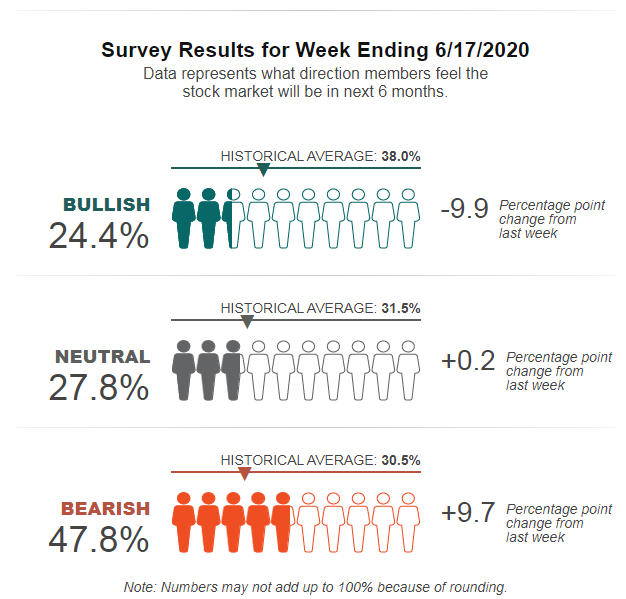

AAII Investment Survey

17th June 2020

Bullish sentiment, expectations that stock prices will rise over the next six months, fell 9.9 percentage points to 24.4%. Optimism remains below its historical average of 38.0% for the 15th consecutive week and...

...the 20th week this year.

Neutral ...

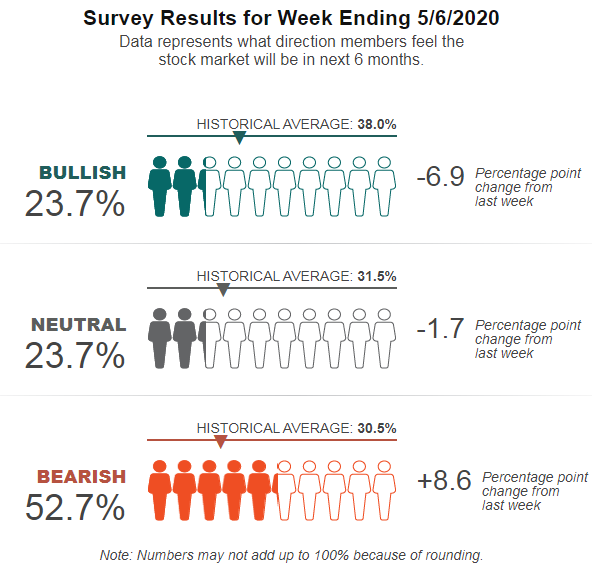

AAII Sentiment Survey (7th May 2020)

The level of pessimism among individual investors about the short-term direction of the stock market is at its highest level in more than seven years. The latest AAII Sentiment Survey also shows a drop in optimism and a decline in...

...neutral ...

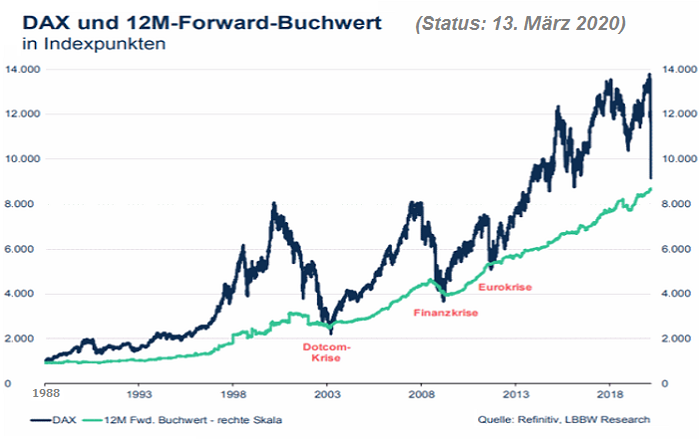

DAX in der Nähe seines Buchwertes

(13. und 16. März 2020)

Die Unternehmenskennziffer Buchwert je Aktie gibt die Höhe des auf die Aktionäre entfallenden Eigenkapitals pro Aktie an. Der Buchwert berücksichtigt nur den bilanziell ausgewiesenen Wert der Aktiva. Üblicherweise werden...

...die ...

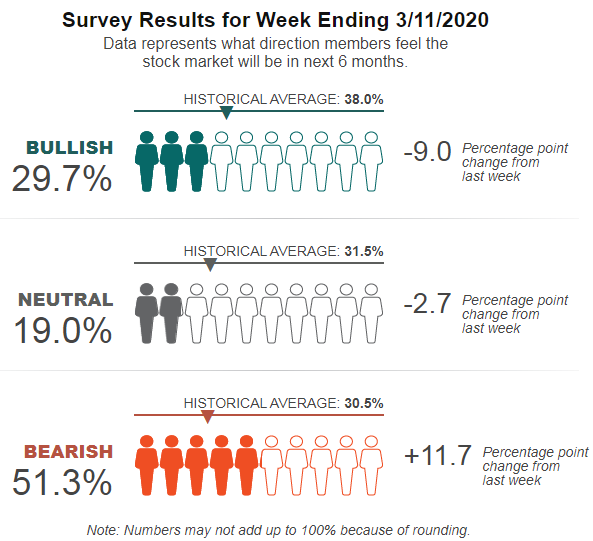

AAII Sentiment Survey (12th March 2020)

The percentage of individual investors expecting stocks to fall over the short term is at its highest level in seven years! The latest AAII Sentiment Survey also shows a steep drop in optimism and a continued decline in neutral sentiment...

Bullish ...

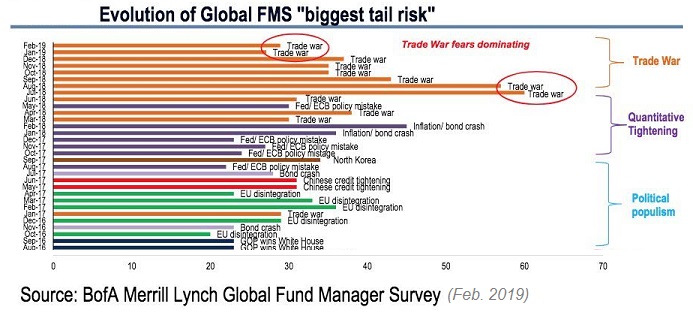

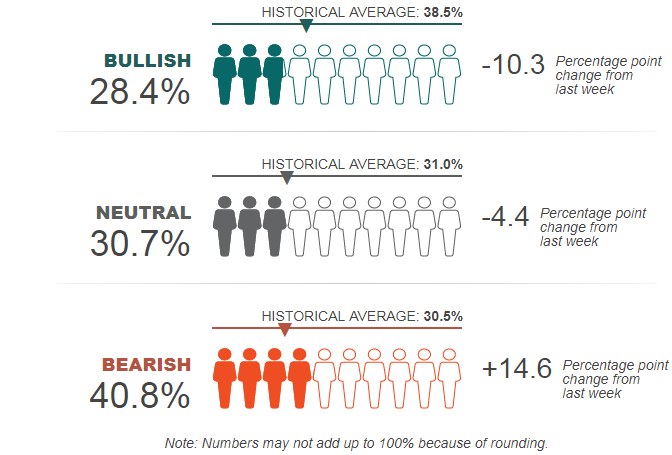

Fears in the years: 2016, 2017 and 2018

Among the key risks: a trade war tops the list of biggest tail risks cited by investors for the ninth straight month, though concerns have waned since summer highs. In December 2018, professional...

...money managers have turned sharply bearish in ...

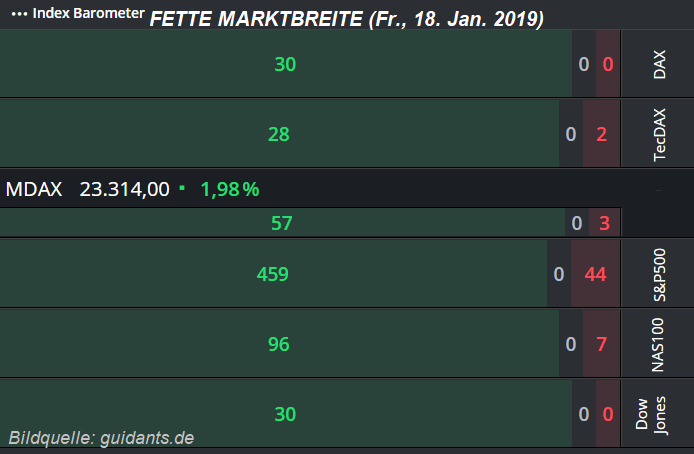

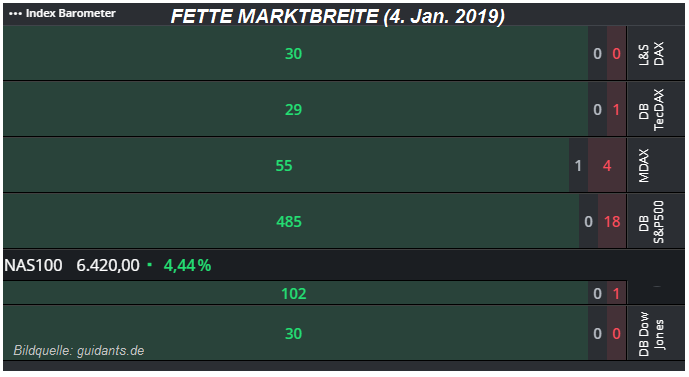

Die Marktbreite war heute so breit "wie nur möglich"

(am Fr., 4. Jan. 2019, gar noch breiter!)

Mehr oder weniger ist am 18. Jan. 2019 (Freitag) "ALLES" gestiegen, was an der Börse notiert - sei es in Europa, oder in den USA. Die Anzahl der steigenden Aktien versus fallender...

...Notierungen ...

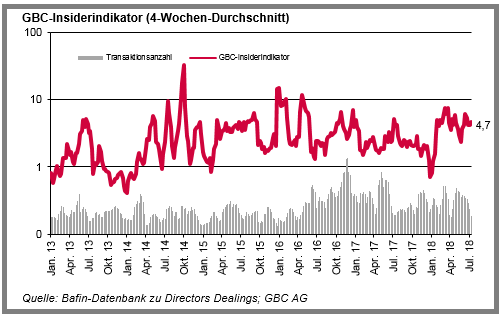

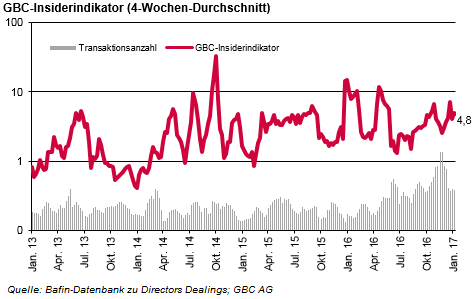

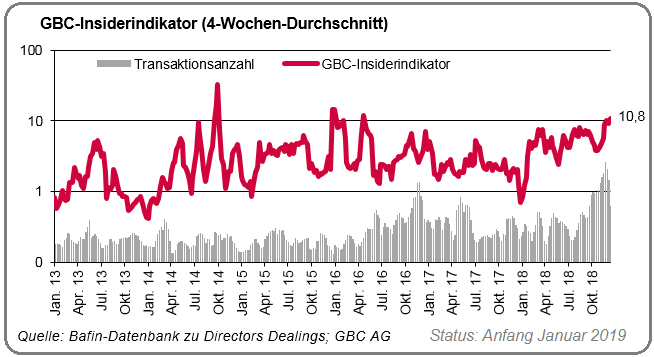

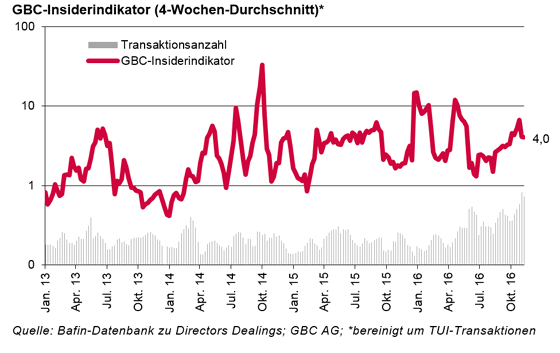

GBC-Insiderindikator (10. Jan. 2019)

Deutsche Insider kaufen so viel Aktien wie noch nie! GBC-Insiderindikator liegt bei über 10 Punkten. Die Transaktionen der deutschen Insider in den vergangenen Monaten liefern erneut einen Beleg für das antizyklische...

...Verhalten der Manager, ...

Die Marktbreite war heute so breit "wie nur möglich"

Mehr oder weniger ist heute "ALLES" gestiegen, was an der Börse notiert - sei es in Europa, oder in den USA. Die Anzahl der steigenden Aktien versus fallender Notierungen -je Subindex (DAX & Co.)- ist im folgenden Schaubild abzulesen:

In ...

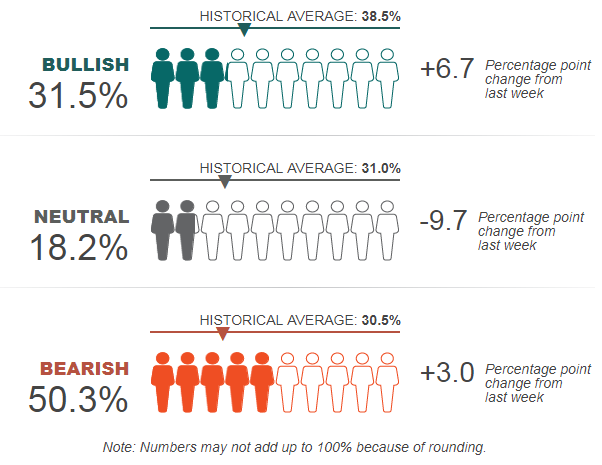

AAII Sentiment

Survey Results for Week Ending 26th Dec. 2018

Data represents what direction AAII-members feel what direction the stock market will be in next 6 months.

Half of individual investors now describe themselves as "bearish" for the first time since 2013. The latest AAII Sentiment ...

CNN Money

Fear & Greed Index (#3 "EXTREME FEAR")

Fear in the markets reached an extremely low level. Investor-Sentiment is therefore pretty negative; Below i tried to give you a chronological timeline of how the sentiment transformed into the current FEAR-Status...

...over the last months. ...

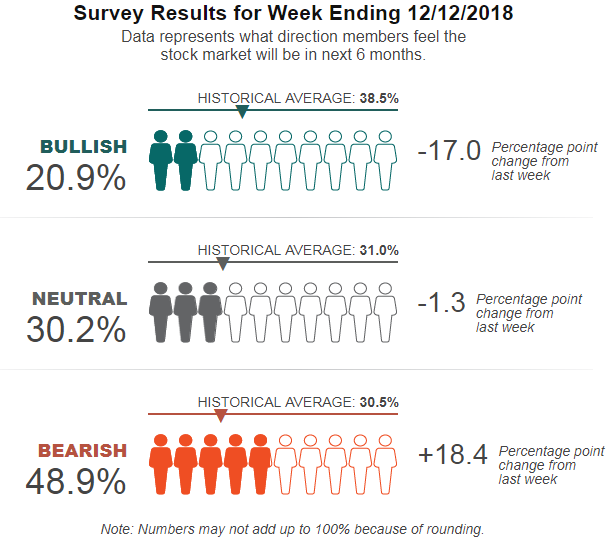

Pessimism among individual investors jumped to its highest level in more than five and a half years in the latest AAII Sentiment Survey. Optimism plunged, and neutral sentiment declined.

Bearish sentiment, expectations that stock prices will fall over the next six months, spiked by 18.4 ...

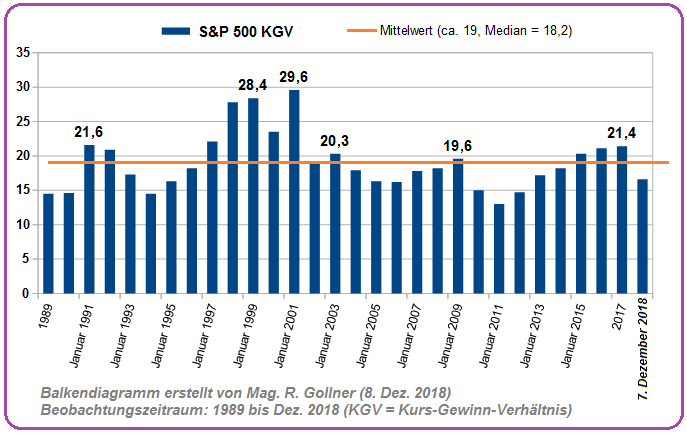

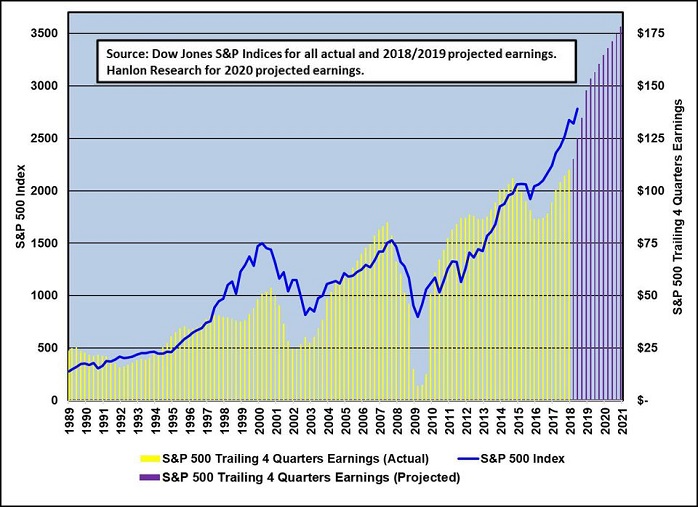

S&P 500 KGV

(Beobachtungszeitraum: 1989 bis Dez. 2018)

Langfristig steigen Aktienkurse, weil die zugrundeliegenden Unternehmen Gewinne erwirtschaften und sich damit der Wert des Unternehmens erhöht. In einer perfekten Welt würde damit die Wertentwicklung eines Unternehmens und...

...

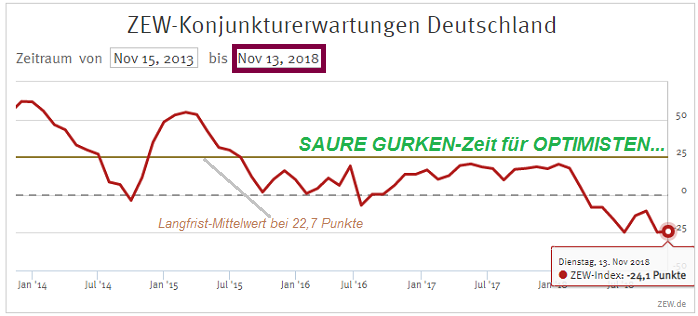

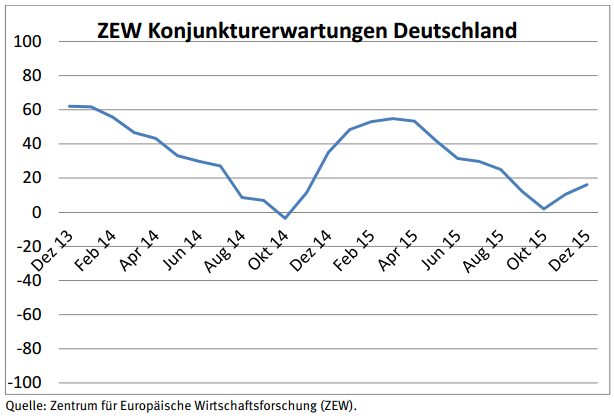

ZEW

(13. Nov. 2018)

Die erfahrenen Börsianer wissen es wohl: Seit April 2015 zappelt der DAX nervös auf und AB, insbesondere AUCH, weil die (ZEW-) Konjunkturerwartungen erstens (1.) UNTER ihrem langfristigen Mittelwert (22,7 Punkte) und zweitens (2.) gar...

...UNTER dem Null-Wert abgerutscht ...

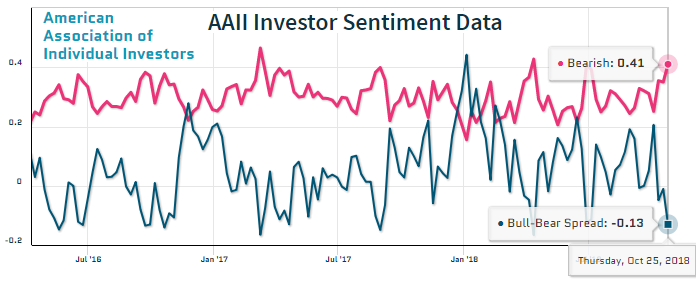

AAII Investor Sentiment

Pessimism about the short-term direction of the stock market is at its highest level in six months. The latest AAII Sentiment Survey also shows optimism among individual investors falling to an unusually low level. Bullish sentiment, expectations that...

...stock ...

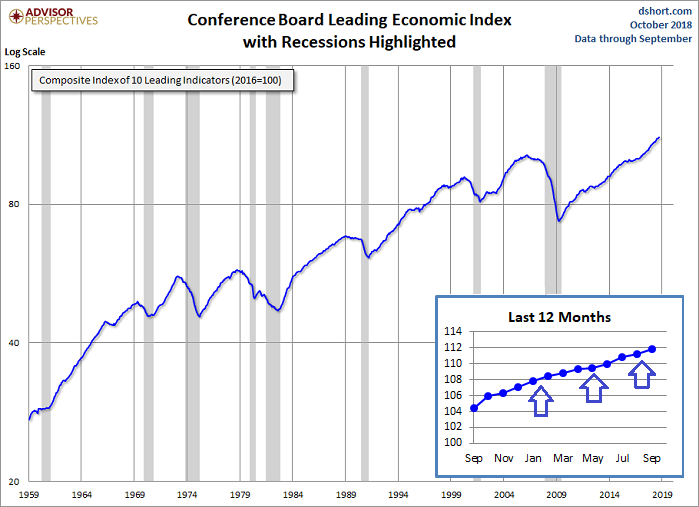

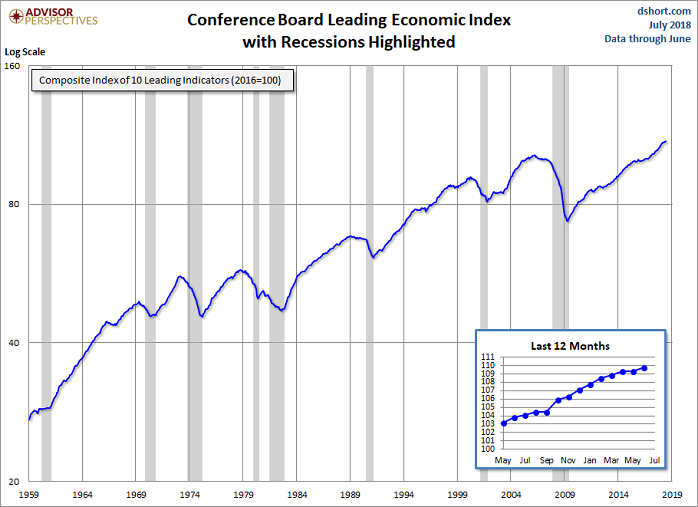

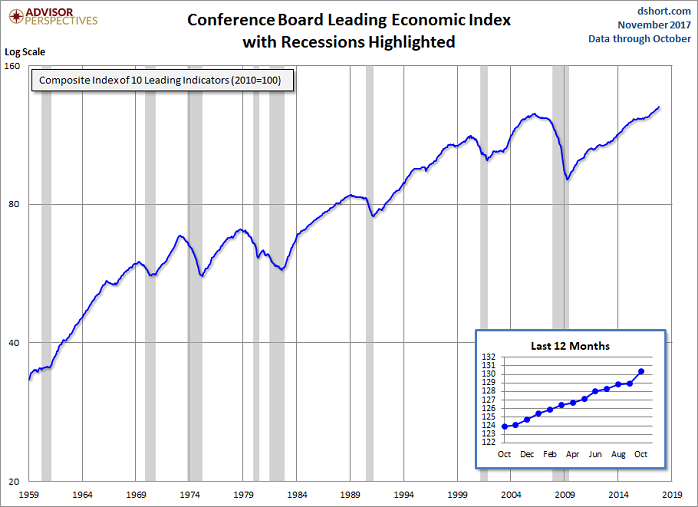

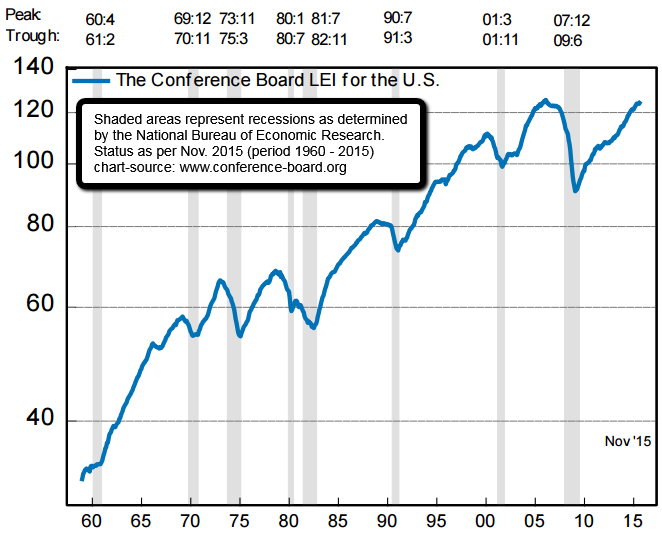

LEI-Indicator (predicting power)

Economy Remains on Strong Growth Trajectory Heading into 2019

The Conference Board Leading Economic Index (LEI) for the U.S. increased 0.5 % in September to 111.8 (2016 = 100), following a 0.4 percent increase in August, and...

...a 0.7 % increase in July. ...

BofAML's Fund Manager Survey Sees Global Outlook as Worst Since 2008

Survery taken at end of week (Friday: 12th Oct. 2018)

I liked the US-Industrial Production numbers of today. And the Stock Market "liked" the BAD SENTIMENT among the fund managers...

...(see survey statements in the ...

CNN Money

FEAR & GREED INDEX

(Status: 11th Oct. 2018 / After Market-Close)

Since the Index just reached an extreme level (< 20), my best guess would be, that we will be trying to find a floor in the S&P 500 these weeks (between 2,600 and 2,750 points), a level which could then serve...

...as ...

GBC-Insiderindikator

(August 2018)

Deutsche Insider weisen (aktuell) eine grundsätzlich positive Erwartungshaltung auf! Der GBC-Insiderindikator befindet sich seit Januar 2018 auf sehr hohem Niveau. Die deutschen Insider lassen sich seit nunmehr acht Monaten fast...

... ausschließlich auf ...

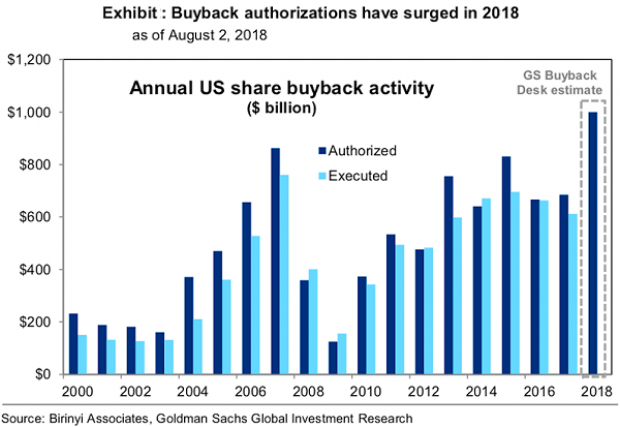

USD 1 trillion

Buyback volume

Companies in the S&P 500 will likely authorize a record USD 1 trillion in stock buybacks in 2018, according to an estimate released by Goldman Sachs in the first week of August. Buyback announcements have surged...

...to USD 754 billion so far this year, and the ...

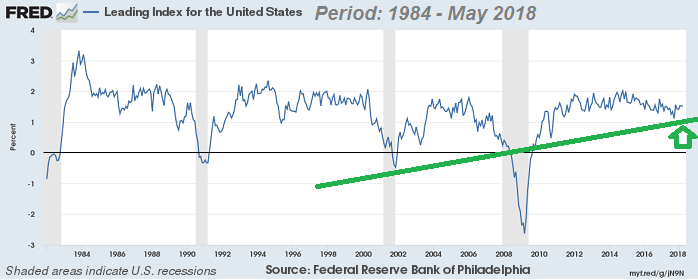

LEI-Indicator (predicting power)

The -latest- Conference Board Leading Economic Index (LEI) for June 2018 increased to 109.8 from 109.3 in May 2018. The Conference Board LEI for the U.S. increased in June, with positive contributions from the ISM® new orders index, the financial...

...

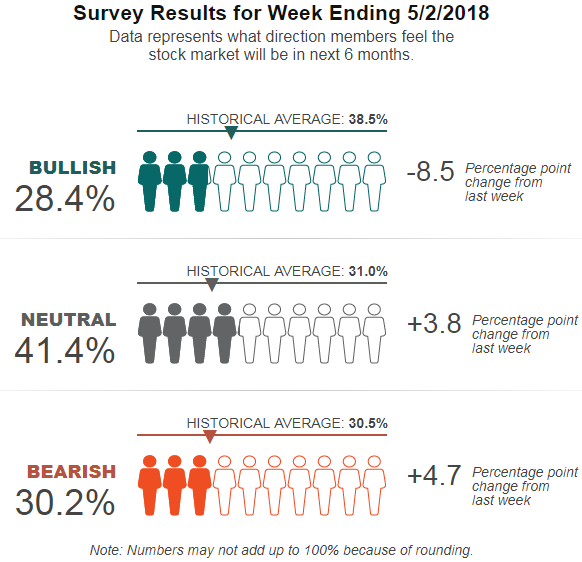

Survey Results for Week Ending 27th June 2018

Data represents what direction members feel the

stock market will be in next 6 months.

Pessimism among individual investors about the short-term direction of stock prices is above 40% for...

...just the second time this year. The latest AAII ...

S&P 500 and earnings

The single most important factor in equity market valuation -earnings data- may suggest continued fundamental strength. For investors questioning if the bull market can continue...

...or the next several years, the underlying trend in earnings growth could suggest >> ...

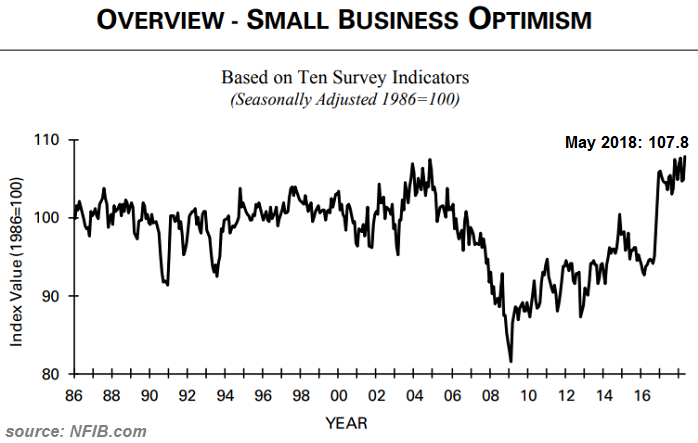

U.S. Small Business Optimism Index Soars

Hitting Several Records in May 2018

The Small Business Optimism Index increased in May to the second highest level in the NFIB survey's 45-year history. The index rose to 107.8, a three-point gain, with small businesses reporting high numbers in...

...

LEI-Indicator U.S.A.

(Status: May 2018)

It all -STILL- looks pretty stable; Definition: The leading index for each state predicts the six-month growth rate of the state's coincident index. In addition to the coincident index, the models include other variables that lead the...

...economy: ...

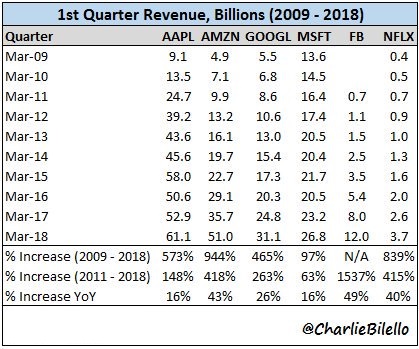

Great Revenue-Streams in the last years

(FANG & AAPL, MSFT)

Facebook, Amazon, Netflix, and Google's holding company parent Alphabet - known collectively on Wall Street by the acronym FANG - all outperformed the stock market last year, (year: 2017). While the...

...S&P 500 Index gained 19%, ...

The percentage of individual investors who described their short-term outlook for stocks as "neutral" is above 40% for the first time in almost two months. The latest AAII Sentiment Survey also shows a big drop in optimism and a rise in pessimism.

Bullish sentiment, expectations that stock ...

How One Can Apply Behavioral Finance

by C. Thomas Howard, PhD, 26th March 2018

Just some extracts here (full text under link below).

"We have to distance ourselves from the presumption that financial markets always work well and that price changes always reflect genuine information...The ...

BALANCING FLEXIBILITY and DISCIPLINE

One key to personal satisfaction and professional results might be the "Art of Balancing Flexibility with Discipline". Discipline in WHAT you do - your goals, your targets, pushing yourself, removing distractions and eventually focusing...

...on ...

History 1988 - year 2017

Optimism about the short-term direction of the stock market has been below average for 40 out of 50 weeks this year in the famous AAII Sentiment Survey. Given this trend, AAII was curious as to how the year 2017 compares to the 30 previous years.

...tracked by the ...

Friedrich August von Hayek (& Bitcoin, wie Vater und Sohn?)

1975 machte der Nobelpreisträger F. A. von Hayek (ein Wiener!) erstmalig den Vorschlag, durch eine freie (!!) Währungswahl die damalige Inflation zu stoppen. Hayek wollte damals nicht das staatliche Geld abschaffen; Er...

...wolle ...

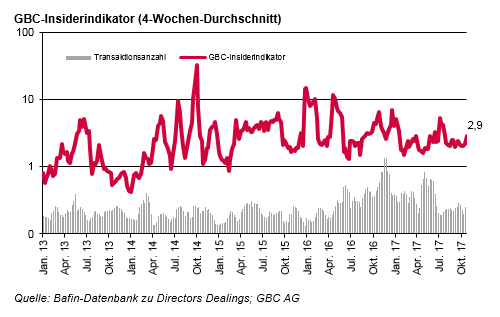

GBC-Insiderindikator

GBC-Insiderindikator steigt auf 2,9 Punkte, Insider sind wieder positiver gestimmt

Der GBC-Insiderindikator hat sich, bei einer allgemein niedrigen Transaktionsanzahl, weiter erholt. Während in den vorherigen Berechnungsperioden...

...(Zeitraum von jeweils vier Wochen) ...

LEI-Indicator (predicting power), Nov. 2017

The Conference Board Leading Economic Index® (LEI)for the U.S. increased 1.2 percent in October to 130.4 (2010 = 100), following a 0.1 percent increase in September, and a 0.4 percent increase in August 2017. "The US LEI...

...increased sharply in ...

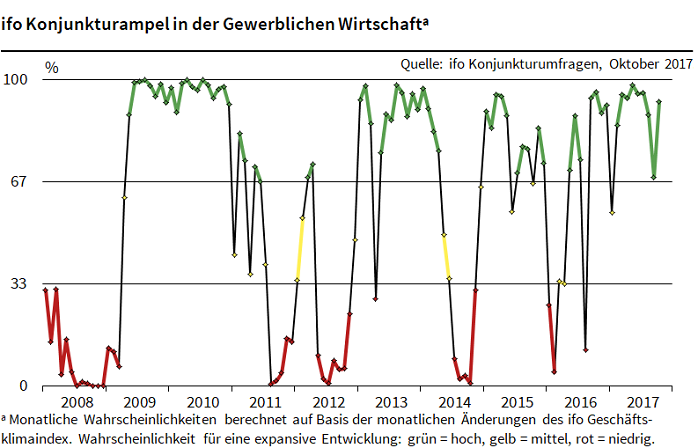

ifo Konjunkturampel

Die Stimmung in der deutschen Wirtschaft ist auf ein neues Rekordniveau gestiegen. Der ifo Geschäftsklimaindex kletterte im Oktober auf eine neue Bestmarke von 116,7 Punkten, nach 115,3 Zählern im September 2017. Von Ökonomen erwartet wurde ein Rückgang...

...auf 115,0 ...

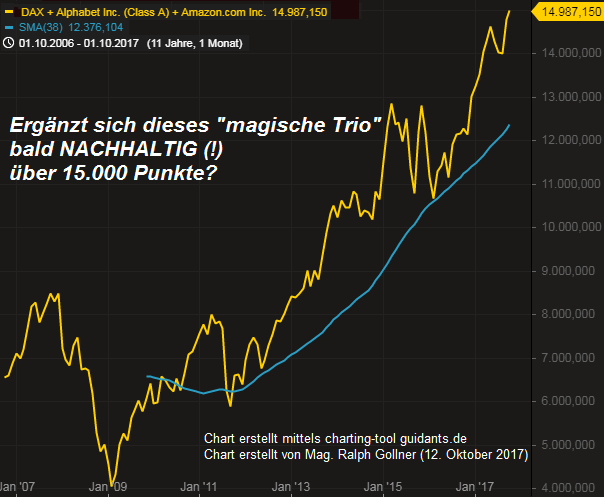

Magisches Trio ("Magic 15k")

Runde Marken üben auf Marktteilnehmer oft eine magische Anziehungskraft aus >> bzgl. Kauf-, Verkaufsignale. Im Folgenden habe ich die runden Marken vom DAX-Perf.Index, von Amazon und Google einfach addiert; Notfalls sehe ich einen...

...ersten Support bei ca. ...

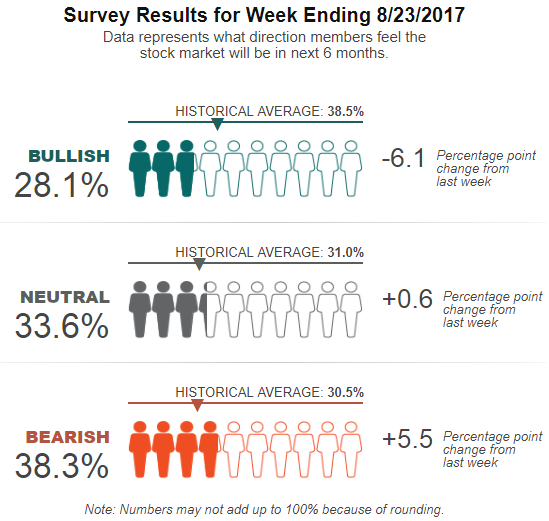

The latest AAII Sentiment Survey shows pessimism among individual investors being at its fifth highest level of the year. The jump in pessimism occurred as optimism dropped. Bullish sentiment, expectations that stock prices will rise over the next...

...six months plunged 6.1 percentage ...

"CASH-levels"

BAML survey of global fund managers

Among the various ways of measuring investor sentiment, the BAML survey of global fund managers is one of the better as the results reflect how managers are allocated in various asset classes. These managers oversee a combined USD 600bn...

...

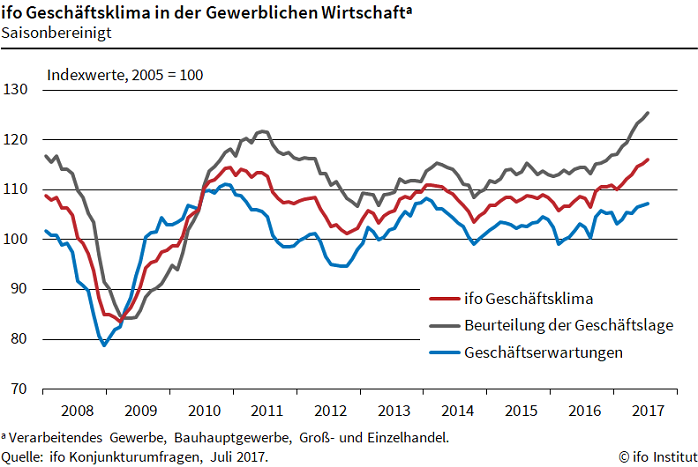

ifo (Juli 2017)

Der ifo-Geschäftsklimaindex ist im Juli zum dritten Mal in Folge auf einen neuen Rekordwert gestiegen. "Die Stimmung in den deutschen Chefetagen ist euphorisch", sagte der Präsident des Ifo-Instituts, Prof. Dr. Clemens Fuest, in München.

"Die Unternehmen waren seit der ...

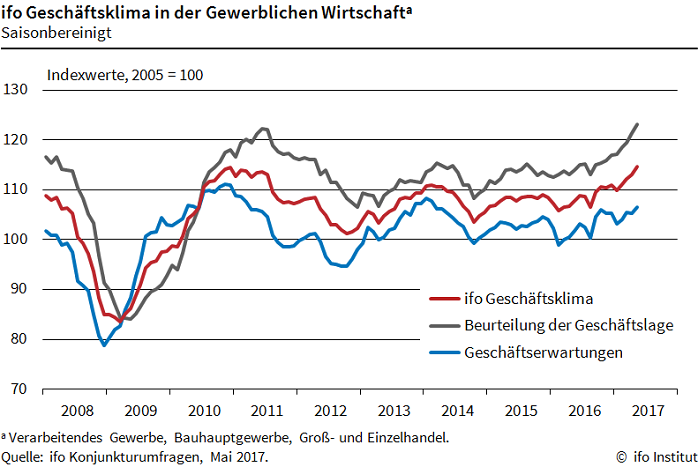

ifo Geschäftsklimaindex so hoch wie nie

In den deutschen Chefetagen herrscht Champagnerlaune. Der ifo Geschäftsklimaindex stieg im Mai von 113,01 auf 114,6 Punkte. Dies ist der höchste gemessene Wert seit 1991. Sowohl die aktuelle Lage als auch die Erwartungen wurden von den Unternehmen...

...

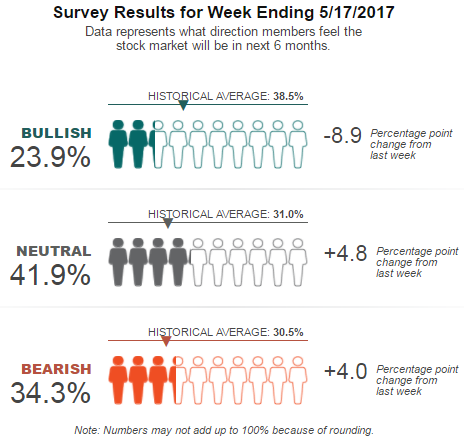

AAII Investor Sentiment (17th May 2017)

Optimism among individual investors about the short-term direction of stock prices fell to a new 2017 low in the latest AAII Sentiment Survey. At the same time, the percentage of individual investors describing their outlook as "neutral" is at a new...

...

...

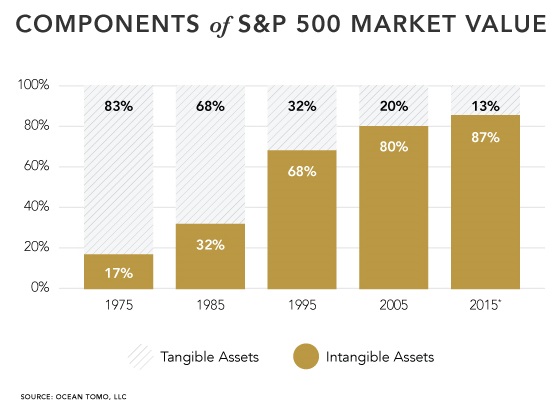

Price-Sales valuation versus Price-Book

Companies and their investors have dramatically shifted their capital from tangible, asset-based businesses (aligned with the bottom two needs) to intangible, asset-light organizations. According to research by Ocean Tomo, in 1975, tangible assets...

...

Behavioral Finance

(Definition #2)

Let's examine how Behavioral Finance compares to conventional finance, introduce you to three important contributors to the field and take a look at what critics have to say.

But why is behavioral finance necessary?

When using the labels "conventional" or ...

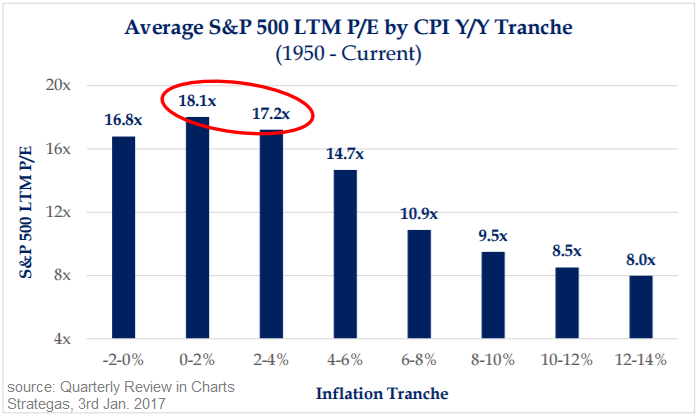

Valuation S&P 500 (P/E under Inflation)

In the context of the inflation outlook in the U.S. and the developed world, there appears to be little risk for earnings multiples in the short term. Historically, zero to 2% inflation has remained the sweet spot for valuations. Even slightly...

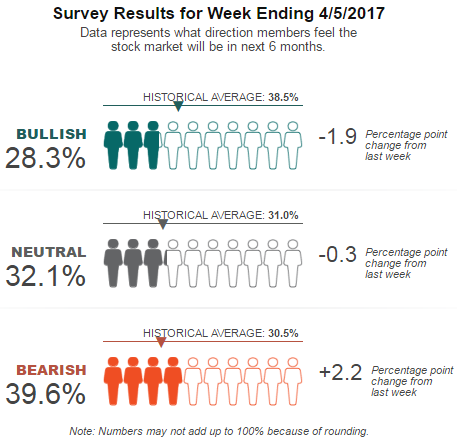

...

Pessimism among individual investors about the short-term direction of stock prices rose to nearly 40%, while at the same time, optimism fell below 30%.

Pessimism is above its historical average for 11 of the last 12 weeks, while optimism is below its historical average for the same amount ...

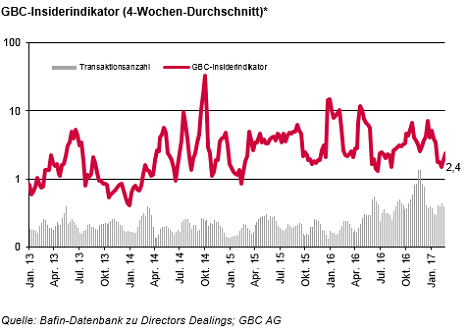

Der GBC-Insiderindikator (24. März 2017)

GBC-Insiderindikator verbessert sich auf 2,4 Punkte; Stimmung in den deutschen Vorstandsetagen wird optimistischer. Der Wert des GBC-Insiderindikators legte gegenüber der Vorwoche wieder leicht auf 2,4 Punkte (KW 11-2017: 1,4 Punkte) zu.

Zuvor hatten ...

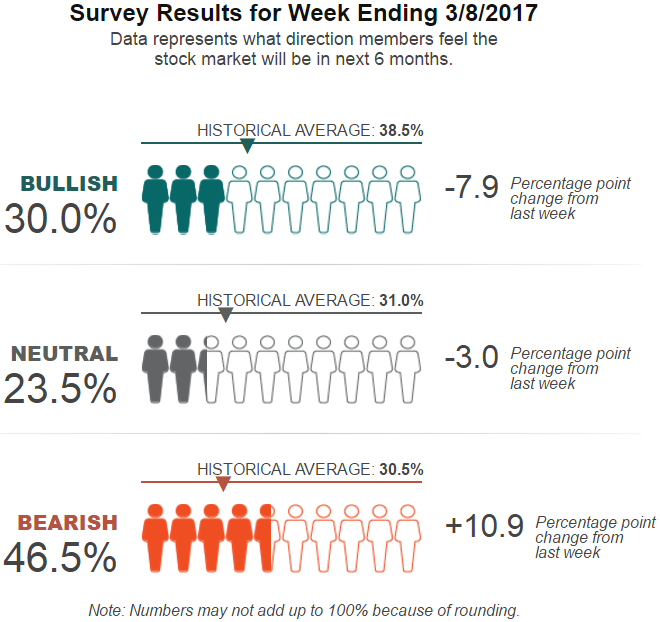

Weekly AAII Sentiment Survey (8/9th March 2017): Pessimism surged to its highest level since February 2016. Past occurrences of unusually high levels of bearish sentiment have a mixed record of being followed by bigger-than-average six-month gains in the S&P 500.

Pessimism among individual ...

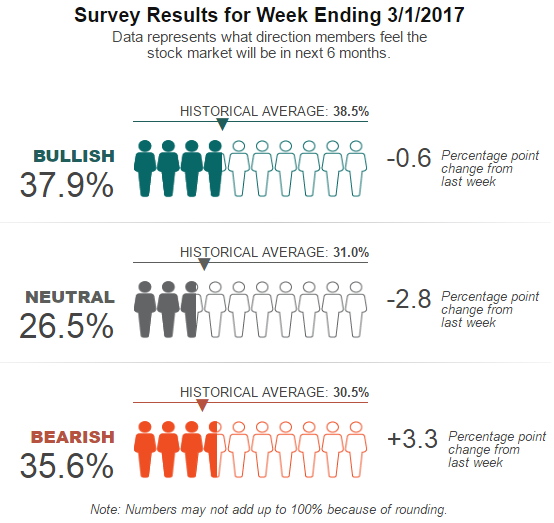

AAII Investor Sentiment (1st March 2017); Pessimism about the short-term direction of stock prices rose to a post-election high, though optimism remains near its historical average.

Pessimism among individual investors about the short-term direction of stock prices is at its highest level in ...

Der GBC-Insiderindikator (11. Feb. 2017)

Stabile Entwicklung beim GBC-Insiderindikator; Transaktionsanzahl insgesamt rückläufig. Der GBC-Insiderindikator hat sich in den vergangenen Wochen in einem sehr positiven Bereich stabilisiert. Der aktuelle Wert von...

...4,8 Punkten (Vorwoche: 4,8 ...

Der GBC-Insiderindikator (Anfang Dez. 2016)

Neuer Rekordwert bei den Insiderkäufen; Die deutschen Insider sind in Kauflaune, bei einer weiterhin vergleichsweise niedrigen Verkaufsbereitschaft. Alleine seit Anfang November, also im Zeitraum, der die Wahl Trumps...

Quelle: http://financial.de

Quelle: http://financial.de

...

Gedanken am Vortag der US-Präsidentschaftswahl

(Montag, 7. Nov. 2016; 18:04 MEZ)

Die Börsen diesseits, als auch jenseits des Atlantiks, also in Europa und U.S.A., sowie die asiatischen Börsen sind grundsätzlich alle nach mehreren (!!) Verlusttagen in Folge tlw. dick im Plus. Höchste Zeit somit, ...

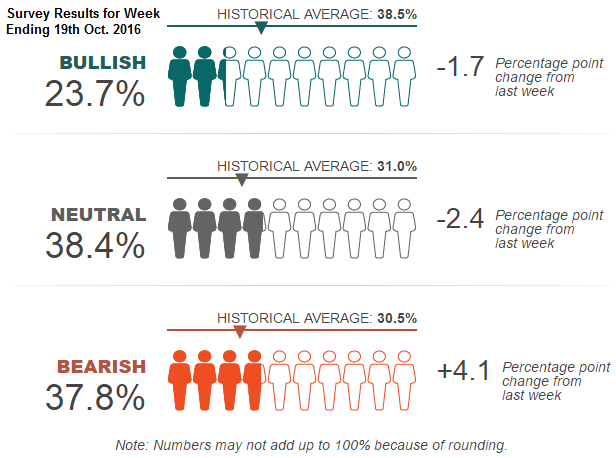

AAII Investor Sentiment (20th Oct. 2016)

Bullish sentiment, expectations that stock prices will rise over the next six months, fell last week 3.3 percentage points to 25.5%. This week, that gauge fell more than 1.7% to reach only 23.7%.

The drop of ca. 1.7% puts optimism below its ...

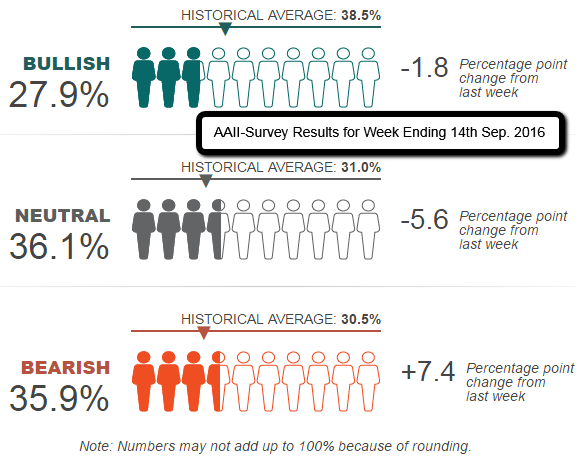

AAII Investor Sentiment (Sep. 2016)

The AAII Investor Sentiment Survey has become a widely followed measure of the mood of individual investors. Pessimism rose to its highest level since last June, while neutral sentiment fell to a level not seen since February 2016.

Pessimism jumped to a ...

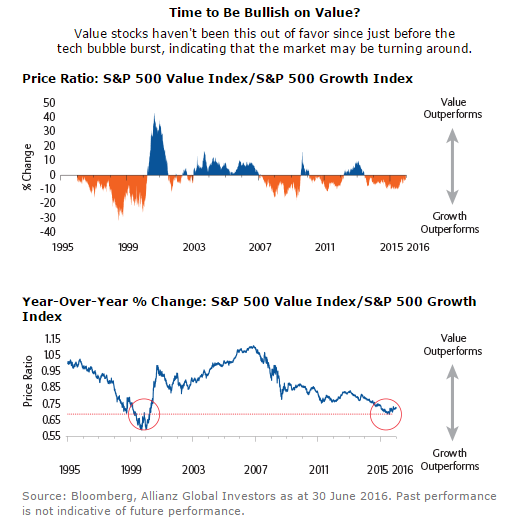

Since 2009 the market has paid less attention to traditional value factors like price-to-earnings (P/E) ratios and dividend yields - despite the fact that these factors have provided sizable return premiums over the long term.

Clearly, everything has its season, and it is fair to say that it ...

Learn about your personality

We are scared of making a wrong choice versus making a bold decision (?). We should overcome our fear of making mistakes and should take an active role in shaping our (own) future. Take control!

"Overcome your fear of making a mistake.

Take a bold stance, an ...

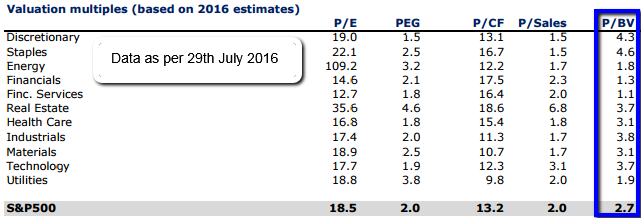

S&P 500 Price-Book-Value (July 2016)

Some investors put more "faith" in the Price/Book Value ratio than the P/E ratio when assessing the valuation of stocks or the stock market as a whole. As a result, Forbes conducted a historical review of Bloomberg data for the S&P 500.

The average ...

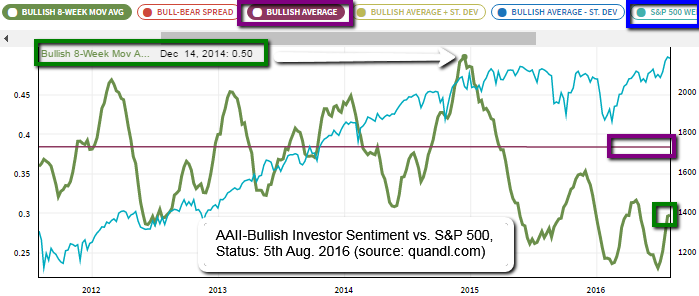

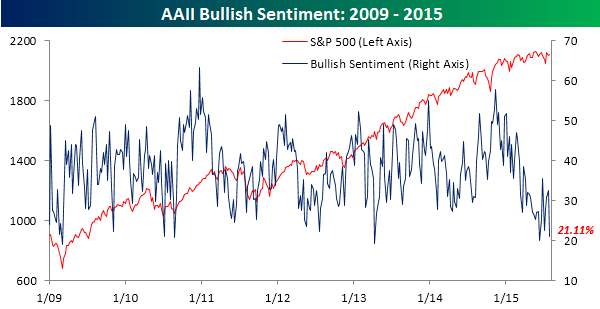

AAII-Bullish Investor Sentiment vs. S&P 500

(07/2011 - 5th Aug. 2016)

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 1.5 percentage points to 29.8% as per 4th August. Optimism was last lower on 29th June 2016 (28.9%).

This is the 39th ...

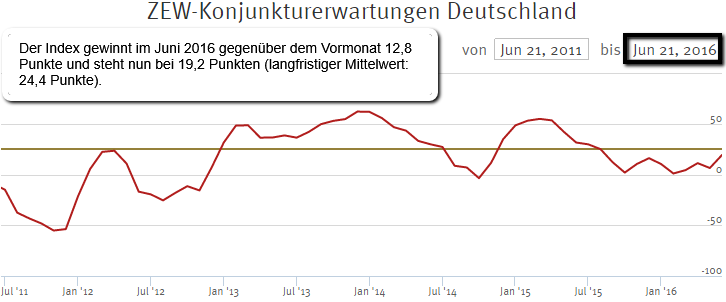

ZEW-Konjunkturerwartungen Juni 2016

Die ZEW-Konjunkturerwartungen für Deutschland legen im Juni 2016 zu!

Der Index gewinnt gegenüber dem Vormonat 12,8 Punkte und steht jetzt bei 19,2 Punkten (langfristiger Mittelwert: 24,4 Punkte). "Die verbesserten Einschätzungen der Finanzmarktexperten ...

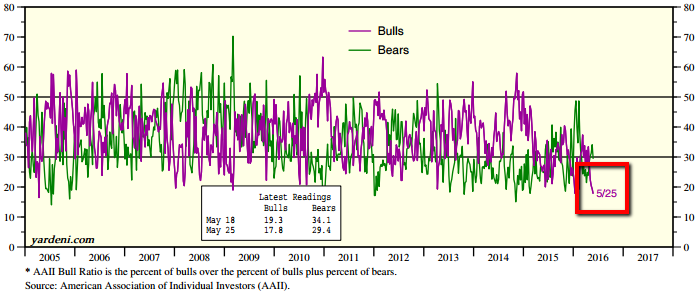

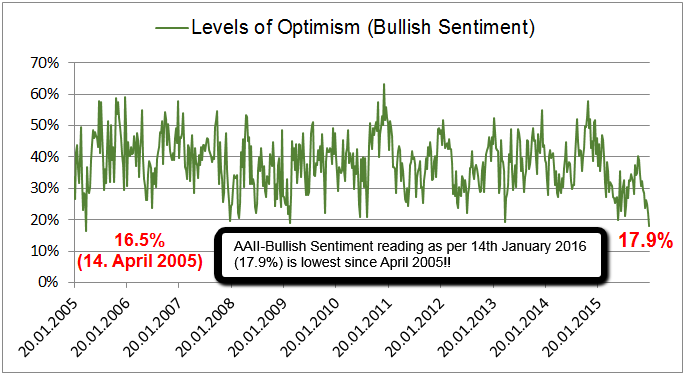

AAII Investor Sentiment (Bulls: LT-LOW)

The percentage of individual investors optimistic about short-term gains occurring in the stock market is at its lowest level in 11 years (17.8%). This is the lowest level of optimism recorded by that survey since 14th April 2005 (16.5%).

At the same ...

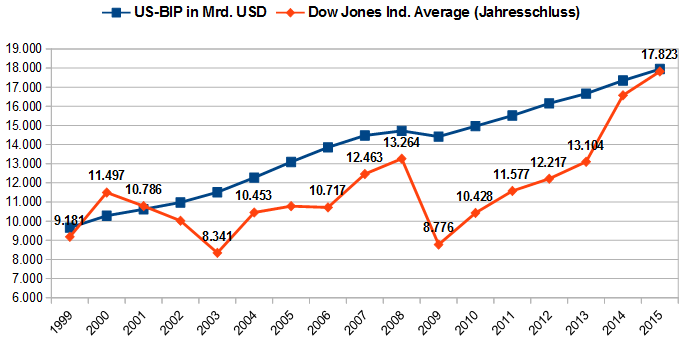

US-BIP & US-Aktienmarkt

(Wirtschaftswachstum vs. S&P 500)

...

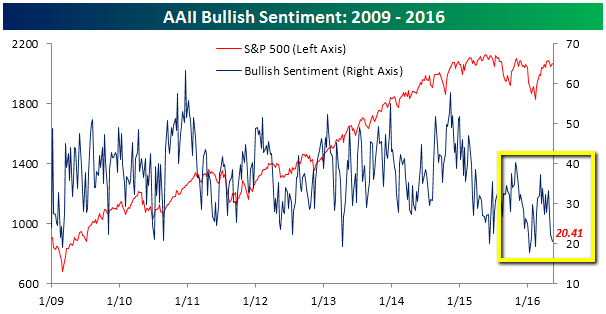

...AAII Investor Sentiment vs. S&P 500 (2009-2016)

Optimism among individual investors about the short-term direction of stock prices remained at a three-month low according to the latest AAII Sentiment Survey. Pessimism is at an 11-week high, and neutral sentiment edged higher.

chart-source: ...

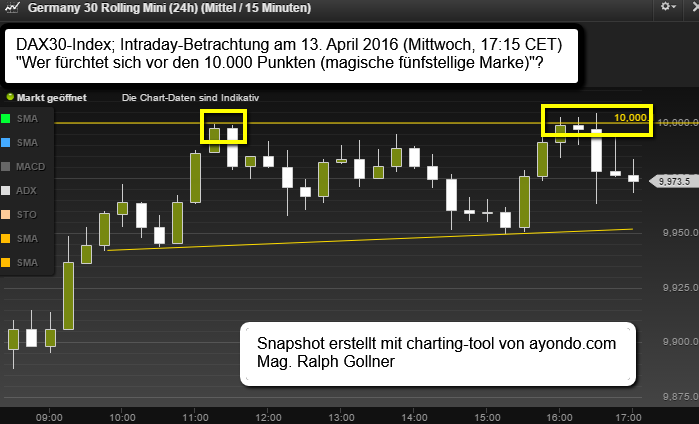

magischer Punktestand (10.000 im DAX)

oft gesehen, oft überwunden...

Das Kursziel im Kopf (zwei wichtige Hinweise in diesem Zusammenhang):

♦ Die -für Viele- magischen 10.000 Punkte haben an sich eigentlich keinen Wert, aber das Ganze lässt sich psychologisch erklären: Menschen setzen ...

Methods for Valuing a Stock Based on Profitability and Growth (by T. Howard)

Your goal is not to identify the profitability and growth stars of tomorrow. Your goal is to have a good handle on a company’s true profitability and growth potential so that you value it correctly.

You should even ...

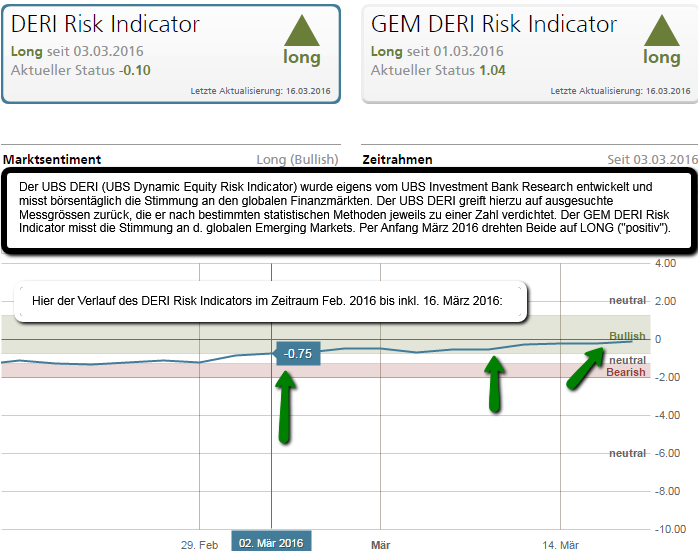

UBS DERI Indicator dreht auf LONG (positiv)

Statusbetrachtung per 19. März 2016; Sowohl aus der globalen Sicht der Aktienmärkte, als auch von Emerging-Markets-Seite her gibt es positive Signale durch die UBS DERI Indikatoren ("Long" seit Anfang März 2016):

Quelle: ...

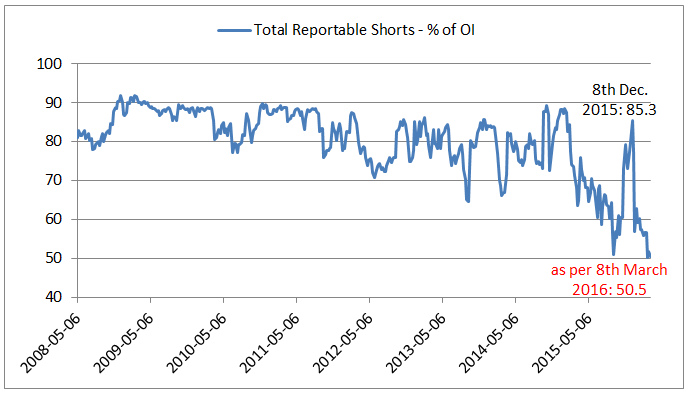

Commitment of traders data for S&P 500 Stock Index on the Chicago Mercantile Exchange

Commitment of Traders - S&P 500 Stock Index - Futures and Options - Percent of Open Interest

Total Reportable Shorts - % of Open Interest (for S&P 500 as per 8th March 2016: 50.5)

data: ...

Investor Movement Index (IMX)

The Investor Movement Index, or the IMX, is a proprietary, behavior-based index created by TD Ameritrade designed to indicate the sentiment of retail investors.

source: https://www.tdameritrade.com/research/imx.page

source: https://www.tdameritrade.com/research/imx.page

Investor Movement Index Summary for Feb. ...

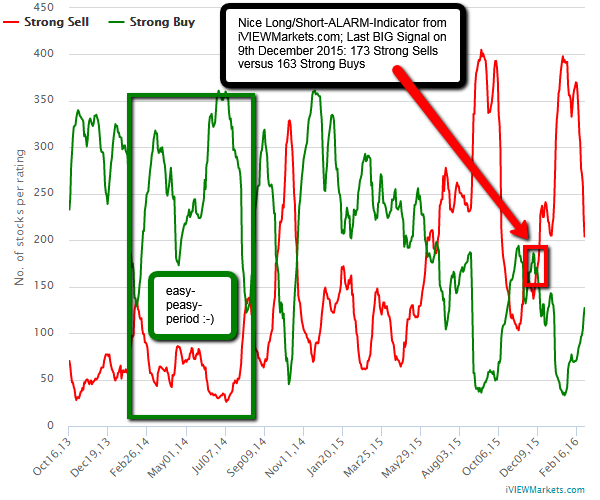

Strong Buy vs. Strong Sell - Indicator

source: iVIEWMarkets.com

The Strong Buy to Strong Sell ratio is a properietary quantative rating of the S&P 500 universe. The ranking of the securities strength is comprised of multiple factors with statistical price series being the main calculation.

...

...

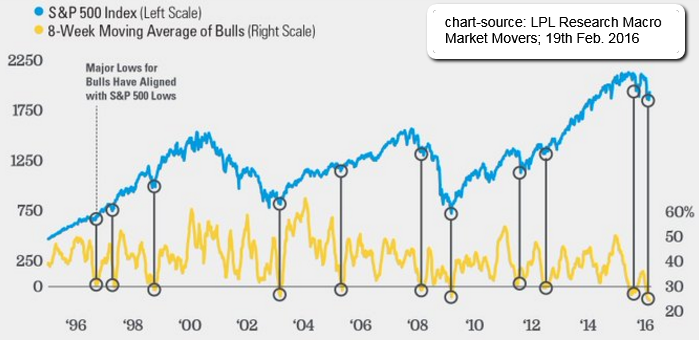

AAII Sentiment / 8week-Average (LongTerm-LOW)

The AAII 8-week moving average of bulls is below the 25%-threshold. This marks a lower level than in March 2003 and March 2009! The lack of bulls suggests, that a big majority may be betting on a big bad outcome.

My opinion: On average, the ...

BOFA Fund Manager Survey (Jan/Feb. 2016)

Fund Managers' Current Asset Allocation

Among the various ways of measuring investor sentiment, the BAML survey of global fund managers is one of the better as the results reflect how managers are allocated in various asset classes.

The managers ...

Oil - (final) Morning Star?

(daily candle formation Wed., 10th Feb. 2016 - Friday, 12th Feb. 2016)

As can be seen in the following example a MORNING STAR is characerised by 3 candles, in which the doji (the candle inbetween the 3-candle-formation) represents the indecision of the market ...

Super Bowl Indicator

You may not know it, but the winner of this year’s Super Bowl may be a predictor of how the stock market performs in 2016. A Carolina Panthers' victory would lead to a rising Dow Jones Ind. Average in 2016 - in theory...

There’s a long and kind of complicated history to ...

There’s a long and kind of complicated history to ...

AAII Bullish Investor Sentiment (01/2005 - 01/2016)

Each week, AAII asks its members a simple question: Do they feel the direction of the stock market over the next six months will be up (bullish), no change (neutral) or down (bearish)? Here the most recent reading:

In the graph above I put ...

Fear & Greed Index (short Video/Definition)

The last time I made a posting about the Fear Index it stood at only 3!! on 25th Aug. 2015. From that time onwards the S&P 500 stopped its sharp Short-Term-drop and made a quick Short-Term-turnaround to the upside (Status on 22nd Jan. 2016=14).

...

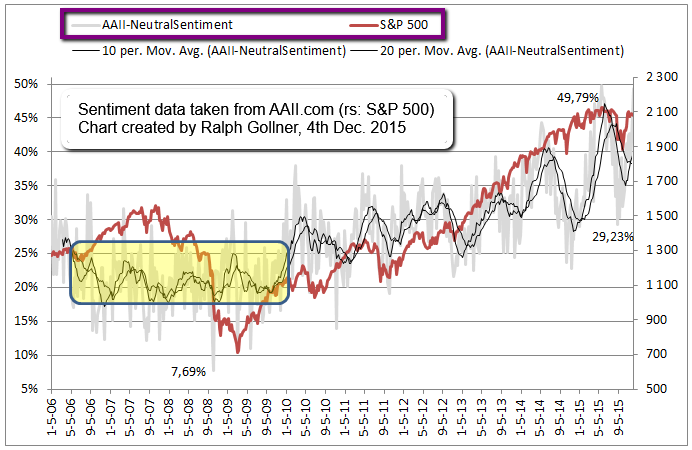

AAII Neutral Investor Sentiment (record streaks) & 1988 similarities

Time to recap on the bag of mixed signals of 2015. Therefore please find the AAII-Neutral-Investor-Sentiment-readings of summer 2015 right here below:

As per 9th July 2015 the 14-week streak of neutral sentiment readings at ...

As per 9th July 2015 the 14-week streak of neutral sentiment readings at ...

LEI-Indicator (Nov. 2015 and history)

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.4 percent in November to 124.6 (2010 = 100), following a 0.6 percent increase in October, and no change in September.

“The U.S. LEI registered another increase in November ...

ZEW Doppeltief? (Okt. 2014, Okt. 2015)

♦ Die ZEW-Konjunkturerwartungen für Deutschland legen im Dezember 2015 zum zweiten Mal in Folge zu

♦ ZEW-Konjunkturerwartungen Deutschland 16,1 Punkte (+5,7 ggü. Vormonat) Quelle/download: http://download.zew.de

Quelle/download: http://download.zew.de

Der Index steigt gegenüber dem Vormonat um ...

AAII Neutral Investor Sentiment (2006-12/2015)

The percentage of individual investors describing their six-month outlook as "neutral" is at its highest level since May 2015. The surge in neutral sentiment occurred as both optimism and pessimism fell.

AAII Sentiment Survey (3rd Dec. 2015), ...

Are you conquering your FEAR?

source: http://www.cnbc.com

Certified financial planner Geri Eisenman Pell, CEO of Pell Wealth Partners, notes that the study of behavioral finance—how and why people make the financial decisions they do—has taught today's financial planners to talk to investor ...

Der Fachbereich Behavioral Finance beschäftigt sich vereinfacht ausgedrückt mit der Psychologie der Anleger. Die Aktionäre als Handelnde und ihre typischen Verhaltensweisen stehen im Mittelpunkt des Interesses. Es geht grundsätzlich darum aufzuzeigen, wie Anlageentscheidungen tatsächlich ...

Der Fachbereich Behavioral Finance beschäftigt sich vereinfacht ausgedrückt mit der Psychologie der Anleger. Die Aktionäre als Handelnde und ihre typischen Verhaltensweisen stehen im Mittelpunkt des Interesses. Es geht grundsätzlich darum aufzuzeigen, wie Anlageentscheidungen tatsächlich ...

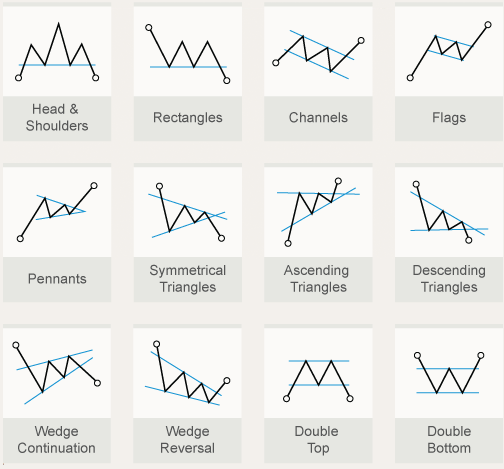

Patterns (Muster / Charttechnik)

Chartmuster: Die wichtigsten Formationen

Quelle: http://3.bp.blogspot.com

Quelle: http://3.bp.blogspot.com

Wer an der Börse dauerhaft Erfolg haben möchte, ist auf vernünftige Handelssysteme angewiesen. Diese Regeln zeigen, wann der beste Ein- und Ausstiegszeitpunkt für einen Handel gekommen ...

Der Berliner Psychologe Gerd Gigerenzer beklagt den statistischen Analphabetismus unter Ärzten, warnt vor den Tücken der "Truthahn-Illusion"...

...und empfiehlt, sich bei Finanzgeschäften und der Partnerwahl auf das Bauchgefühl zu verlassen.

Gigerenzer, 65, erforscht als Direktor am ...

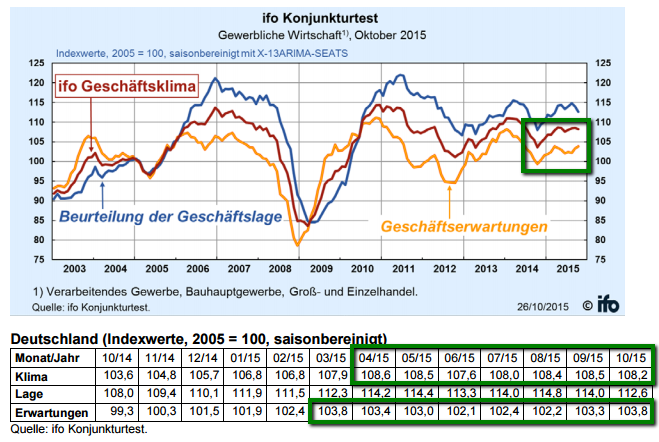

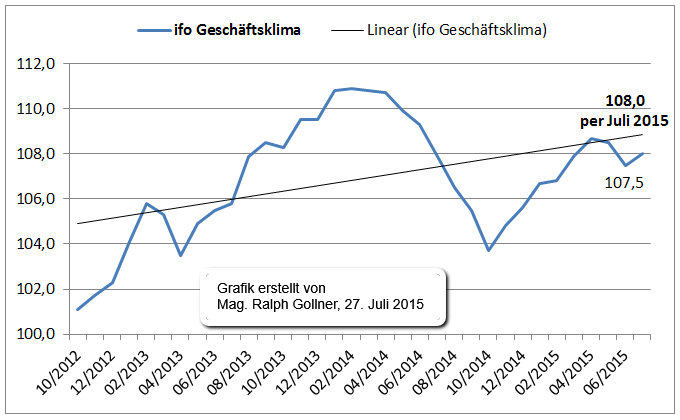

ifo-Geschäftsklima steigt im Okt. 2015

Resumé: "Deutschland hält sich wacker"

Geschäftsklima hält sich weiter über 108 Punkten; Geschäftserwartungen-Index hält sich über 103 Punkten

Quelle (Bild/Text): https://www.cesifo-group.de

Der ifo-Geschäftsklimaindex für die deutsche Wirtschaft wird ...

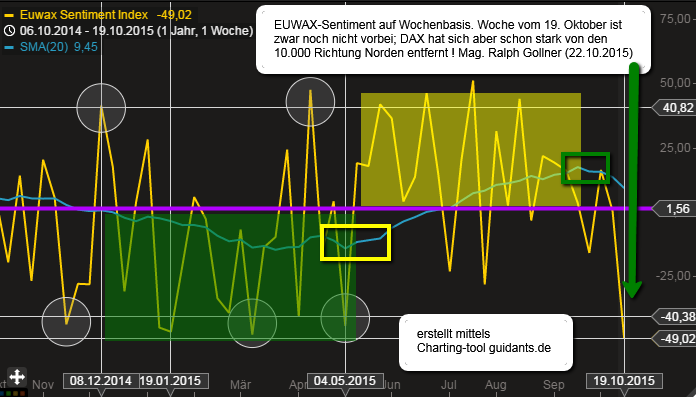

EUWAX-Sentiment versus DAX (update Betrachtung Q4-2014 bis 22. Okt. 2015)

Probehalber wird versucht, mittels dem geglätteten EUWAX-Sentiment möglicherweise ruhigeres Fahrwasser im DAX von (Hoch-)Risikoperioden zu unterscheiden.

Exemplarisch anbei die Sicht auf das EUWAX-Sentiment ...

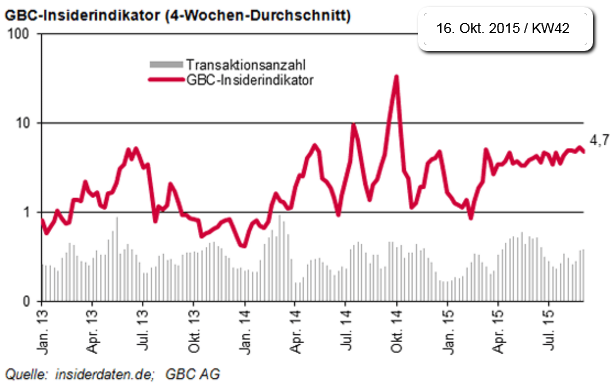

GBC-Insiderindikator (Directors' Dealings), Okt. 2015

Seit April 2015 bietet der GBC-Insiderindikator, welcher die Stimmung der deutschen Führungskräfte börsennotierter Unternehmen widergibt, keine Überraschungen mehr. (Textquelle und Grafik: financial.de)

Seitdem hat sich der ...

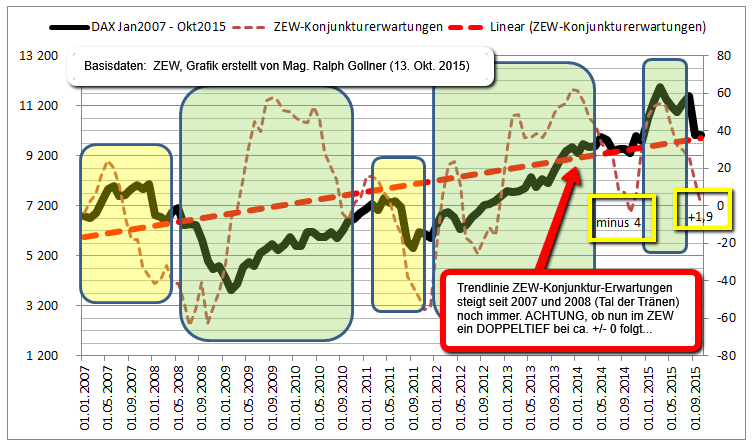

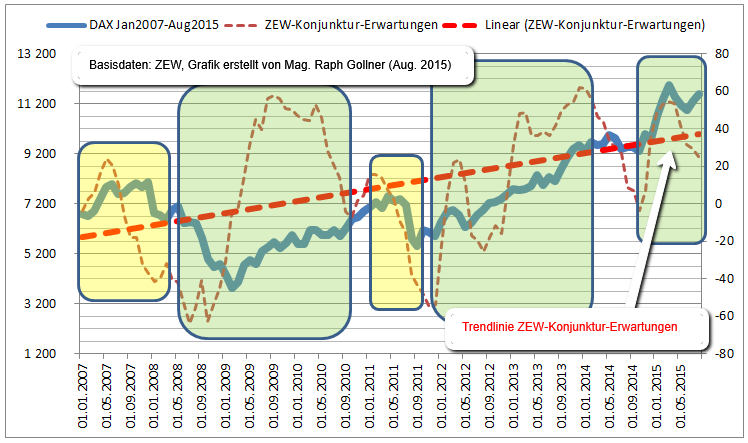

ZEW-Konjunkturerwartungen Deutschland versus DAX (Okt. 2015)

Folgend der Vergleich des ZEW-Konj.erwartungen-Index Deutschland VERSUS den DAX Performance-Index im Zeitraum Jan. 2007 bis Okt. 2015 (Stand 13. Okt. 2015; linke Skala DAX, re. Skala ZEW):

Man muss, wie im letzten Okt. 2014 ...

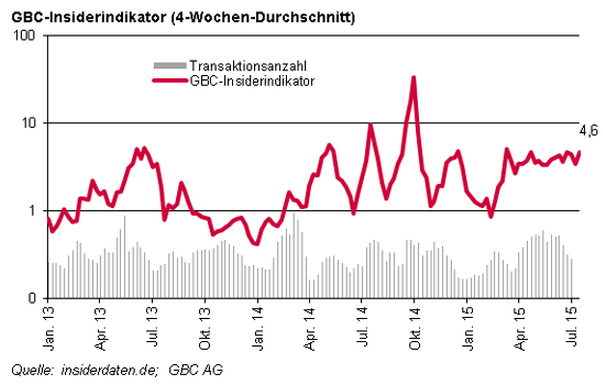

Der GBC-Insiderindikator (Directors' Dealings), Mitte Aug. 2015

Der GBC-Insiderindikator befindet sich mit 4,6 Punkten per 14. Aug. 2015 trotz Turbulenzen an den Aktienmärkten auf hohem Niveau.

Bereits seit April 2015 bewegt sich der GBC-Insiderindikator, ungeachtet unterschiedlicher ...

ZEW-Konjunkturerwartungen Deutschland versus DAX (Aug. 2015)

Folgend der Vergleich des ZEW-Konj.erwartungen-Index Deutschland VERSUS den DAX Performance-Index im Zeitraum Jan. 2011 bis Aug. 2015 (Stand 1. Aug. 2015; linke Skala DAX, re. Skala ZEW):

Aktuell hat sich der ...

Investor Sentiment (as per month-end July 2015)

Text/charts - source: https://www.bespokepremium.com

The latest survey (Status/30th July 2015) of investor sentiment from the American Association of Individual Investors (AAII) showed a large drop in bullish sentiment:

After climbing up to ...

Is the Old Continent still a contrarian play? (July 2015)

European fear may be profitable for greedy investors (...as Analysts hate European stocks)

as Michael Brush http://www.marketwatch.com/Journalists/Michael_Brush is writing about Europe being a contrarian play: There’s one telling measure ...

as Michael Brush http://www.marketwatch.com/Journalists/Michael_Brush is writing about Europe being a contrarian play: There’s one telling measure ...

Neuroeconomics (of simple choice) / Video Antonio Rangel (Video ca. 12:33 min.)

-) what is different about Mother Theresa and Bernard Madoff?

-) what is different about the brain of some people versus the brain of other people?

Neuroeconomics is (also) the combination between social sciences ...

Benjamin Graham (teacher of Warren Buffet / Prof. at Columbia University)

„The explanation cannot be found in any mathematics but it has to be found in investor psychology” (B. Graham)

Furtheron he goes "You can have an extraordinary difference in the price level mereley because not only ...

AAII Sentiment Survey vs. SPX (Q4-2014 - 23rd July 2015)

In the following chart a direct comparison (only) of the AAII-Bullish-Sentiment-8week-average versus the S&P 500, starting from the Q4-2015:

The intermediate low (bullish Sentiment/8week-average) was registered on the 2nd July at ...

Der GBC-Insiderindikator (Directors' Dealings)

Folgend der bekannten Aussagen zu Directors' Dealings wie "Aufsichtsräte und Vorstände haben einen tieferen Einblick in die Geschäfte ihres Unternehmens" oder "Die besten Kenner sitzen im Unternehmen selbst" kann mittlerweile in den USA seit ...

ifo-Geschäftsklima steigt im Juli 2015 versus Juni 2015

Basisdaten: http://www.cesifo-group.de

Der ifo-Geschäftsklimaindex für die deutsche Wirtschaft, ermittelt durch die branchenübergreifende Befragung von 7.000 deutschen Unternehmen, ist im Juli 2015 kräftiger angestiegen als von den meisten ...

EUWAX-Sentiment versus DAX (update Betrachtung Q1-2014 bis 24. Juli 2015)

Probehalber wird versucht, mittels dem geglätteten EUWAX-Sentimet möglicherweise ruhigeres Fahrwasser im DAX von (Hoch-)Risikoperioden zu unterscheiden. Exemplarisch anbei die Sicht auf das EUWAX-Sentiment ...

Home-builder confidence strong (> 50)

source: Marketwatch

A gauge of confidence among home builders remained at 60 in July, the strongest reading in almost a decade, according to National Association of Home Builders/Wells Fargo data released today (16th July 2015).

“This month’s reading is in ...

"Contrarian (?)" / put-call ratio at high level (1.45), last high was in Oct. 2014

Betting Against the "Crowd"

It is known that options traders, especially option buyers, are not the most successful traders. On balance, option buyers lose about most of the time. Although there are certainly ...

The Psychology of Investor Behavior (part2/2)

Scott Bosworth, CFA, Vice President of Dimensional Fund Advisors presents Part Two of The Psychology of Investor Behavior Video Series (Behavioral Finance). Some topics:

-) Words on Eugene F. Fama, Richard Thaler, John Maynard Keynes, Daniel ...

The Psychology of Investor Behavior (part1/2)

Scott Bosworth, CFA, Vice President of Dimensional Fund Advisors presents Part One of The Psychology of Investor Behavior Video Series (Behavioral Finance). Some topics:

-) Are we working against ourselves when we invest?

-) Do our instincts betray ...

UBS Global Emerging Markets DERI (UBS GEM DERI)

UBS Dynamic Equity Risk Indikator ("UBS Global Equity Markets DERI")

Die UBS Dynamic Equity Risk Indikatoren ("UBS DERI" und "UBS Global Equity Markets DERI") wurden eigens vom – von anderen Geschäftsbereichen von UBS unabhängigen – UBS Investment ...

AAII Investor Sentiment (bullish Investors LOW @ 20%) versus Greece discussions, June 2015

in this context the short BBC-article should be mentioned, where the German Chancellor Angela Merkel has warned that time is running out for a deal to keep Greece in the eurozone. Speaking after the G7 ...

AAII Investor Sentiment (June 2015)

My Input with referring to articles of other authors (11th June 2015):

Contrarian investors should pay particular attention to the unusually low bullish reading in last week’s survey. There are about 160,000 AAII members. The typical member is a male, with a ...

EUWAX-Sentiment versus DAX (Berachtung Q1-2014 bis 11. Juni 2015)

Probehalber wird versucht, mittels dem geglätteten EUWAX-Sentimet möglicherweise ruhigeres Fahrwasser im DAX von Hochrisikperioden zu unterscheiden. Exemplarisch anbei die Sicht auf das EUWAX-Sentiment (20Tage-geglättet) im ...

Topics covered in this Behavioral Finance-video:

In this episode of Symmetry Shorts, Symmetry's John McDermott, Ph.D., describes how investor overconfidence, self-bias, and perceived control can lead to negative outcomes.

John explains that Decision-Making and the outcomes involve internal ...

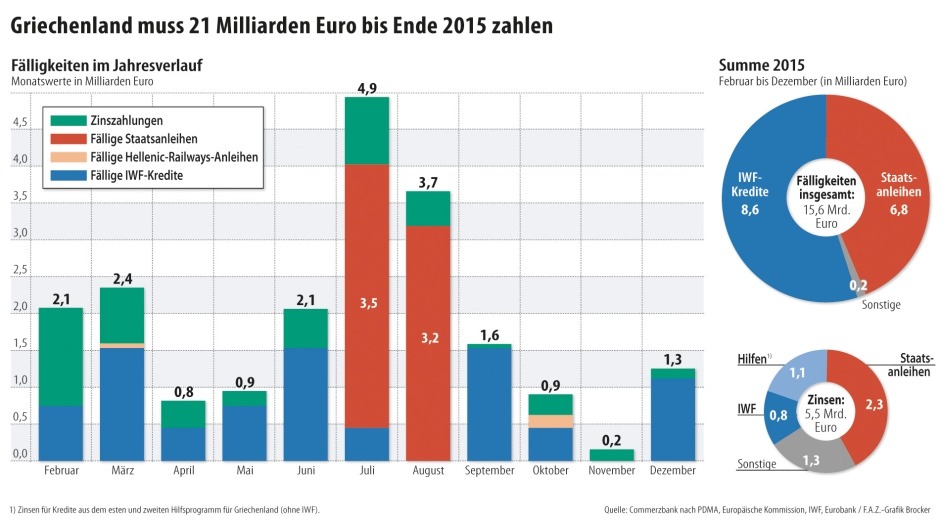

It is payback time for Greece in 2015 (faz.net)

...besonders Juli, August, September könnte ein heisser Tanz auf dem Vulkan werden!

Bildquelle: http://media1.faz.net

Robert J. Shiller, Co-Winner of the 2013 Nobel Prize in Economics published a New York Times Bestseller:

Irrational Exuberance is about something far more important than the current situation in any given market because the book explains the forces that move all markets up and down. It shows ...

Der ifo Index für die Weltwirtschaft ist auf 99,5 Punkte gestiegen, von 95,9 Punkten im Vorquartal

Sowohl die Lagebeurteilung als auch die Erwartungen verbesserten sich. Die WES-Experten gehen in diesem Jahr für die Welt von 2,3 Prozent Wirtschaftswachstum aus. Die Weltkonjunktur gewinnt ...

Konjunkturerwartungen weiter auf hohem Niveau (O-Ton ZEW)

Die ZEW-Konjunkturerwartungen für Deutschland sind im Januar 2015 im Vergleich zum Vormonat um 1,8 auf 54,8 Punkte gestiegen (langfristiger Mittelwert: 24,7 Punkte). Dies ist der fünfte Anstieg in Folge. Höher notierte der Index zuletzt ...

IFO Index als Taktgeber für den deutschen Aktienmarkt (Beispiel aus dem Sommer 2014)

Der ifo-Geschäftsklimaindex (kurz ifo) ist der wichtigste und bedeutendste Geschäftsklimaindex für Deutschland.

Der ifo dient als Frühindikator für die konjunkturelle Entwicklung Deutschlands.

Vorgehensweise

...

Société Générale argues that CAPE "now" (July 2014) needs an adjustment for tax change

Paul Craven, well known presenter on Behavioral Finance topics (< 22 Min. - Video)

"from biases to bubbles"

30. Oktober 2006 (www.FAZ.net)

„Der Markt braucht Zeit“

Schon mal was vom Januar-Effekt gehört? Der Januar ist einer der besten Börsenmonate - in der Vergangenheit jedenfalls stiegen die Aktienkurse in den ersten Wochen des Jahres überproportional stark.

Doch weil immer mehr Anleger von ...