Related Categories

Related Articles

Articles

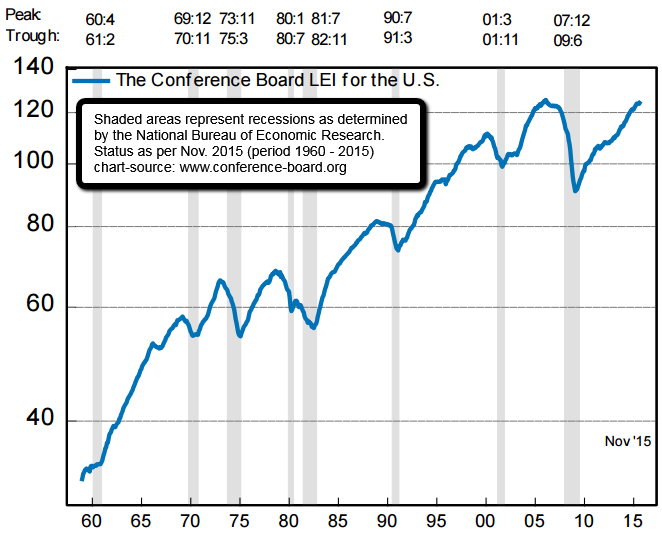

LEI-Indicator (Nov. 2015 and history)

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.4 percent in November to 124.6 (2010 = 100), following a 0.6 percent increase in October, and no change in September.

“The U.S. LEI registered another increase in November (2015), with building permits, the interest rate spread, and stock prices driving the improvement,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “Although the six-month growth rate of the LEI has moderated, the economic outlook for the final quarter of the year and into the new year remains positive.”

source: https://www.conference-board.org

As indicated under following graph (1) as per 2014 from http://www.valuewalk.com one can see the possible predicting power of the LEI for recessions (period 1965 up to 2014):

Larger, longer-lasting pullbacks are usually driven by deteriorating economic or fundamental data that can be foreshadowed by the LEI. (Note that the stock market is one of the 10 components of the LEI, though that does not detract from its usefulness as a predictor. Stock market movements and the nine other components of the index have proven to be a powerful combination.)

In the period 1960 up to 2014, the year-over-year increase in the LEI has been at least 6.3% in 178 of 654 months. Not surprisingly, the U.S. economy was not in recession in any of those 178 months. Thus, it is highly unlikely that the economy is (falling deeper into rececssion-mode or is) in a recession AS LONG AS THE LEI is trending upwards in a sustainable manner! (statistics-source: http://www.valuewalk.com)

further info: https://www.conference-board.org