Related Categories

Related Articles

Articles

LEI-Indicator (predicting power)

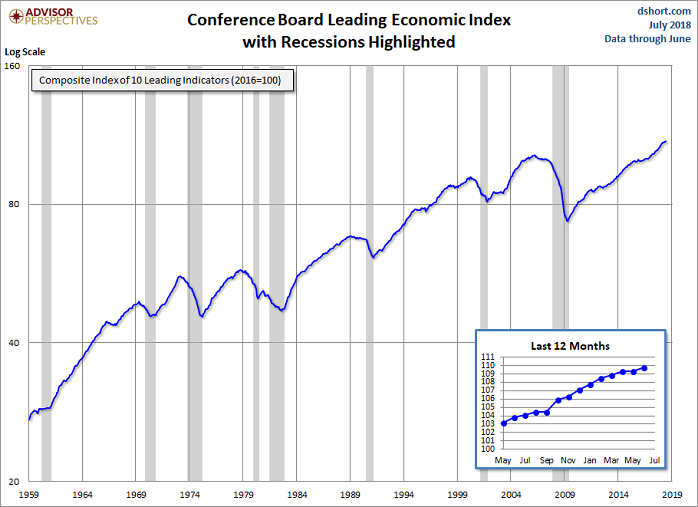

The -latest- Conference Board Leading Economic Index (LEI) for June 2018 increased to 109.8 from 109.3 in May 2018. The Conference Board LEI for the U.S. increased in June, with positive contributions from the ISM® new orders index, the financial...

...components and consumer expectations more than offsetting the only negative contribution from building permits. Over the first half of 2018, the leading economic index increased 2.5 percent (about a 5.1 percent annual rate), slower than the growth of 3.2 percent (about a 6.5 percent annual rate) over the second half of 2017. However, the strengths among the leading indicators have remained widespread.

source: www.conference-board.org

"The U.S. LEI increased in June, pointing to continuing solid growth in the U.S. economy," said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. "The widespread growth in leading indicators, with the exception of housing permits which declined once again, does not suggest any considerable growth slowdown in the short-term."

About The Conference Board Leading Economic Index® (LEI) for the U.S.

The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.

The ten components of The Conference Board Leading Economic Index® for the U.S. include:

Average weekly hours, manufacturing

Average weekly initial claims for unemployment insurance

Manufacturers’ new orders, consumer goods and materials

ISM® Index of New Orders

Manufacturers' new orders, nondefense capital goods excluding aircraft orders

Building permits, new private housing units

Stock prices, 500 common stocks

Leading Credit Index™

Interest rate spread, 10-year Treasury bonds less federal funds

Average consumer expectations for business conditions

AS LONG AS THE LEI is trending upwards in a sustainable manner, we should be positive for the near-time future development (statistics-source, LEI = a Crystal Ball? www.valuewalk.com/2014/08/is-the-lei-a-crystal-ball)