Related Categories

Articles

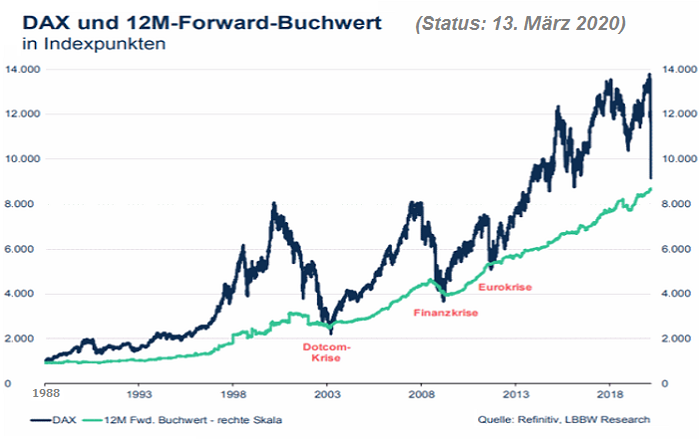

DAX in der Nähe seines Buchwertes

(13. und 16. März 2020)

Die Unternehmenskennziffer Buchwert je Aktie gibt die Höhe des auf die Aktionäre entfallenden Eigenkapitals pro Aktie an. Der Buchwert berücksichtigt nur den bilanziell ausgewiesenen Wert der Aktiva. Üblicherweise werden...

...die Buchwerte nach dem Niederstwertprinzip ja zu den ursprünglichen Anschaffungskosten ausgewiesen (falls dieser unter dem aktuellen Wert liegt, wird entsprechend der niedrigere Wert angegeben). Reminder: Die Bilanz sagt also nichts über mögliche stille Reserven aus, das errechnete KBV ...

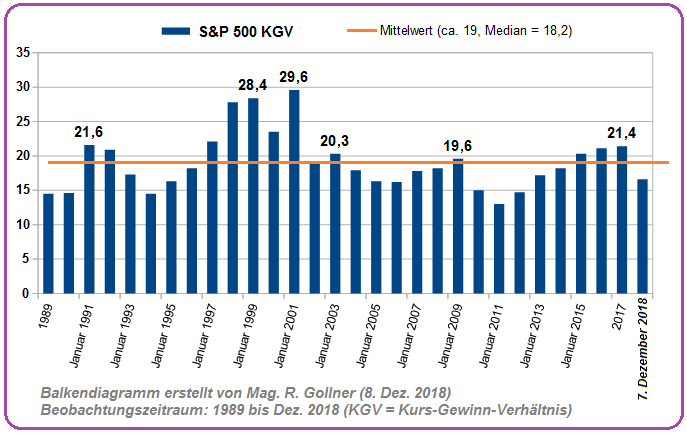

S&P 500 KGV

(Beobachtungszeitraum: 1989 bis Dez. 2018)

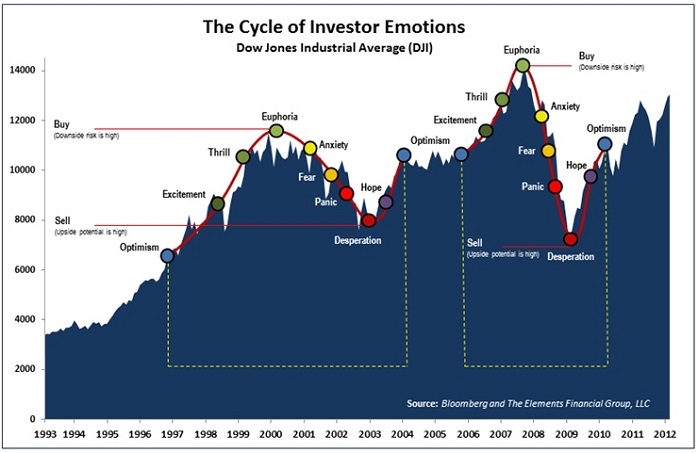

Langfristig steigen Aktienkurse, weil die zugrundeliegenden Unternehmen Gewinne erwirtschaften und sich damit der Wert des Unternehmens erhöht. In einer perfekten Welt würde damit die Wertentwicklung eines Unternehmens und...

...Börsenkurs parallel verlaufen. In der Realität sind Börsenkurse aber durch Emotionen und Erwartungshaltungen geprägt, die Abweichungen in die eine oder andere Richtung verursachen.

Dabei spielt die Bewertung des Unternehmens eine maßgebliche Rolle. Jedem Unternehmen wird von den Anlegern ein bestimmtes ...

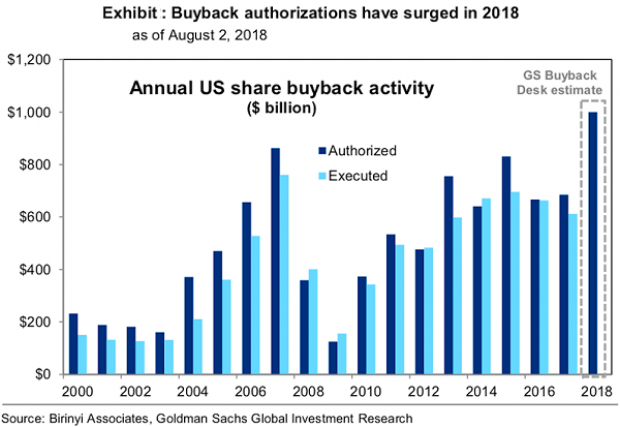

USD 1 trillion

Buyback volume

Companies in the S&P 500 will likely authorize a record USD 1 trillion in stock buybacks in 2018, according to an estimate released by Goldman Sachs in the first week of August. Buyback announcements have surged...

...to USD 754 billion so far this year, and the bank said that the corporate tax cuts and strong cash flow have played the most relevant role in the increase. If the current trend holds, authorised buybacks will rise 46% this year compared to 2017.

Let's also keep in mind that the current S&P 500 Market Cap is at a current level of ca. USD 23.9 ...

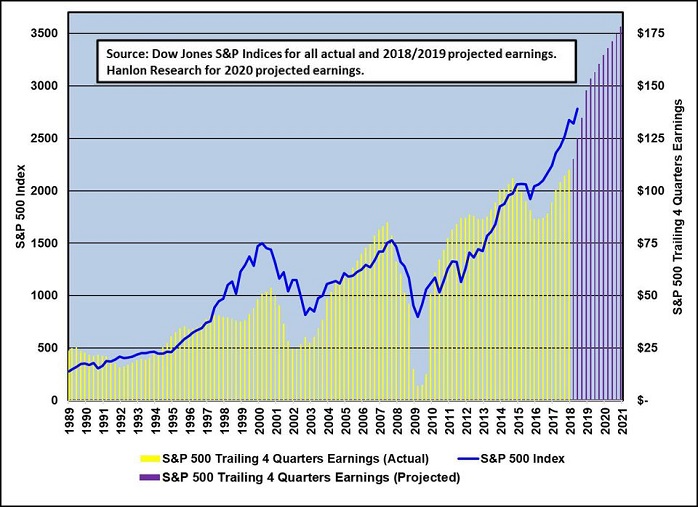

S&P 500 and earnings

The single most important factor in equity market valuation -earnings data- may suggest continued fundamental strength. For investors questioning if the bull market can continue...

...or the next several years, the underlying trend in earnings growth could suggest >> the answer is yes. In the chart above, the relationship between the historical S&P prices and the reported TTM earnings are plotted.

The bars in purple reflect earnings estimates, using analysts' projections through 2019 and then applying a 2% quarterly growth rate, approx. 8% annual earnings growth, ...

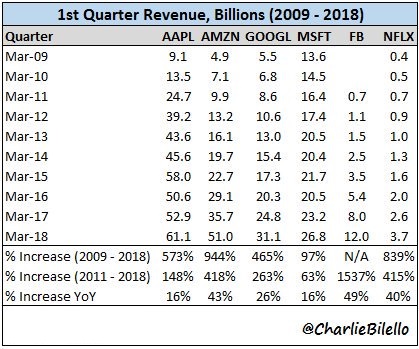

Great Revenue-Streams in the last years

(FANG & AAPL, MSFT)

Facebook, Amazon, Netflix, and Google's holding company parent Alphabet - known collectively on Wall Street by the acronym FANG - all outperformed the stock market last year, (year: 2017). While the...

...S&P 500 Index gained 19%, Facebook rose 53%, Amazon jumped 56%, Netflix added 55% and Google rose a relatively meager 33%. All but Google also beat the average gain of 37% for just tech stocks in the S&P Index.

Investors see the foursome as a collective bet on the new economy and the strength of digital businesses like ...

Friedrich August von Hayek (& Bitcoin, wie Vater und Sohn?)

1975 machte der Nobelpreisträger F. A. von Hayek (ein Wiener!) erstmalig den Vorschlag, durch eine freie (!!) Währungswahl die damalige Inflation zu stoppen. Hayek wollte damals nicht das staatliche Geld abschaffen; Er...

...wolle es lediglich dem Wettbewerb mit "privatem Geld" aussetzen - so die Aussage. Eine relativ "fantastische" Idee zu jener Zeit, noch dazu war 1976 das Internet kaum bekannt und wurde nur vom US-Militär und einigen Wissenschaftlern benutzt - somit erschien die Aussage mehr als Utopie als ernsthaft (gar ...

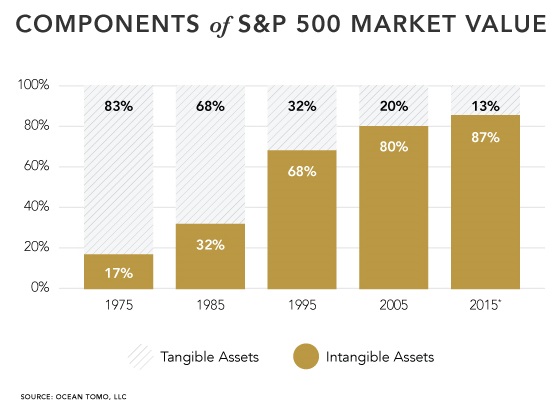

Price-Sales valuation versus Price-Book

Companies and their investors have dramatically shifted their capital from tangible, asset-based businesses (aligned with the bottom two needs) to intangible, asset-light organizations. According to research by Ocean Tomo, in 1975, tangible assets...

...made up 83% of the market value of the S&P 500 companies. By 2015, the numbers had flipped completely, and intangible assets constituted 87% of market/corporate value.

This fundamental change signals something profound about the future of finance and financial markets.

Put simply, the finance ...

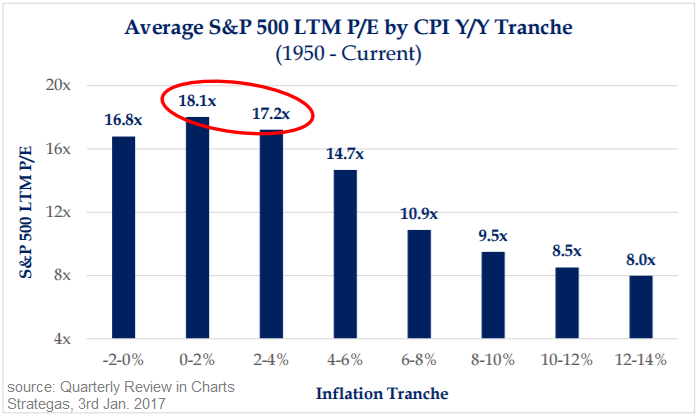

Valuation S&P 500 (P/E under Inflation)

In the context of the inflation outlook in the U.S. and the developed world, there appears to be little risk for earnings multiples in the short term. Historically, zero to 2% inflation has remained the sweet spot for valuations. Even slightly...

...higher readings, say 2-4%, don't appear to lead to meaningful multiple erosion. It's only when investors see signs of deflation (< 0%) or greater than 4% inflation that multiples appear mostly greatly at risk.

♦ 130.89 x 18.1 = 2,369 points S&P 500

♦ 135.14 x 18.1 = 2,446 points S&P 500

♦ 135.12 x ...

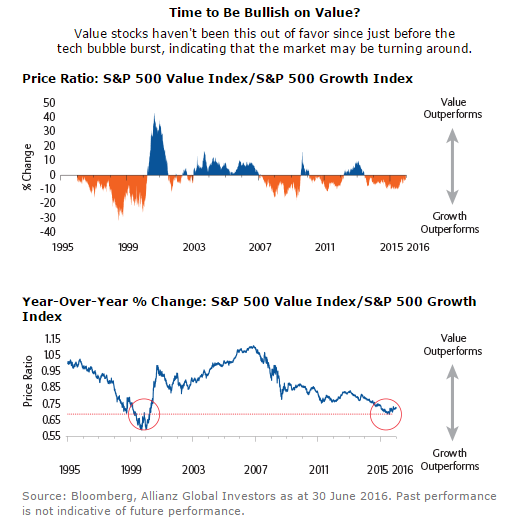

Since 2009 the market has paid less attention to traditional value factors like price-to-earnings (P/E) ratios and dividend yields - despite the fact that these factors have provided sizable return premiums over the long term.

Clearly, everything has its season, and it is fair to say that it has been a long, cold winter for value investors who are committed to the style. Indeed, value has not been this out of favor since the high-flying days of the tech bubble in the late 1990s.

It is important to remember, however, that growth/value cycles tend to be mean-reverting and, on average, ...

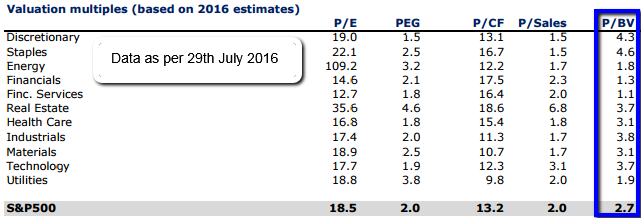

S&P 500 Price-Book-Value (July 2016)

Some investors put more "faith" in the Price/Book Value ratio than the P/E ratio when assessing the valuation of stocks or the stock market as a whole. As a result, Forbes conducted a historical review of Bloomberg data for the S&P 500.

The average Price/Book Value ratio of the S&P 500 for the period December 1990 - August 2015 was ca. 2.87 (according to the mentioned Forbes-article). In comparison, the Price/Book Value ratio of the S&P 500 as of 28th/29th July 2016 was 2.7 at a S&P 500 level of ca. 2,160 - 2,170 points (history-quote taken from ...

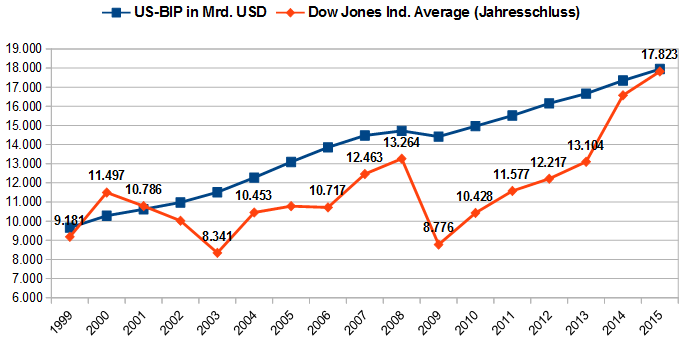

US-BIP & US-Aktienmarkt

(Wirtschaftswachstum vs. S&P 500)

Grafik: Mag. Ralph Gollner (19. Mai 2016)

Grafik: Mag. Ralph Gollner (19. Mai 2016)Auch Star-Investor Warren Buffet hat dies in einem Kommentar darlegt (Original-Artikel: http://archive.fortune.com). Die Aktienmärkte und die Konjunktur korrelieren ...

Methods for Valuing a Stock Based on Profitability and Growth (by T. Howard)

Your goal is not to identify the profitability and growth stars of tomorrow. Your goal is to have a good handle on a company’s true profitability and growth potential so that you value it correctly.

You should even be willing to buy a low-profitability and low-growth company as long as the price is right.

Please check out the whole article on quick (& dirty) Valuation examples:

http://www.aaii.com/journal/article/methods-for-valuing-a-stock-based-on-profitability-and-growth

Remember the famous Ben Graham ...

Société Générale argues that CAPE "now" (July 2014) needs an adjustment for tax change

Related Articles

Some of us are highly loss averse, but in general we’re all averse to losses to some degree. Empirical estimates find that losses are felt between two and two-and-a-half as strongly as gains. Thus the disutility of losing $100 is at least twice the utility of gaining $100. Evenutally loss ...

Anchoring (heuristic)

Anchoring is a particular form of priming effect whereby initial exposure to a number serves as a reference point and influences subsequent judgments about value. The process usually occurs without our awareness (Tversky & Kahneman, 1974), and sometimes it occurs when ...

Cognitive biases (incl. the Snake Bite Effect)

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

...are tendencies to think in certain ways that can lead to systematic deviations from a standard of rationality or good judgment, and are often studied in psychology and behavioral economics (behavioral finance).

Although the reality of these ...

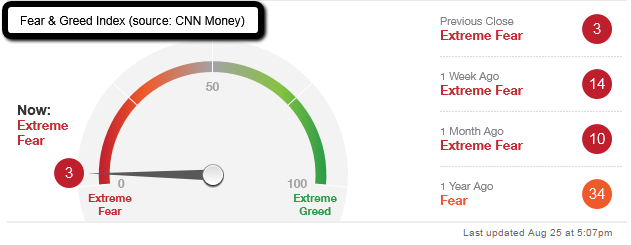

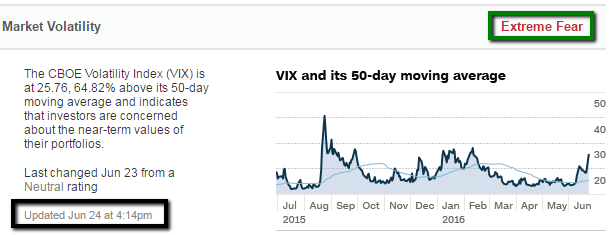

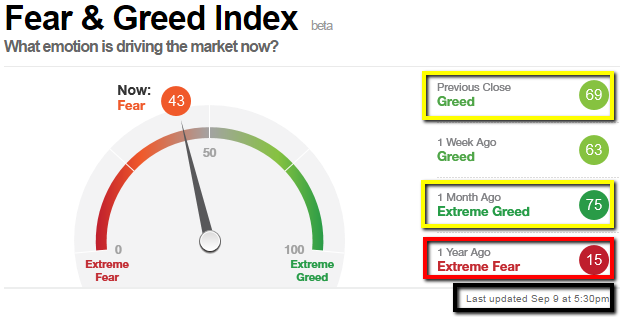

Fear & Greed (Index)

The last time the Index was near such low readings (3) was during the last correction in the US Financial markets, occuring in Oct. 2014. That time it took the index about one week to get out of that negative sentiment (such a quick turnaround may not be the standard).

...

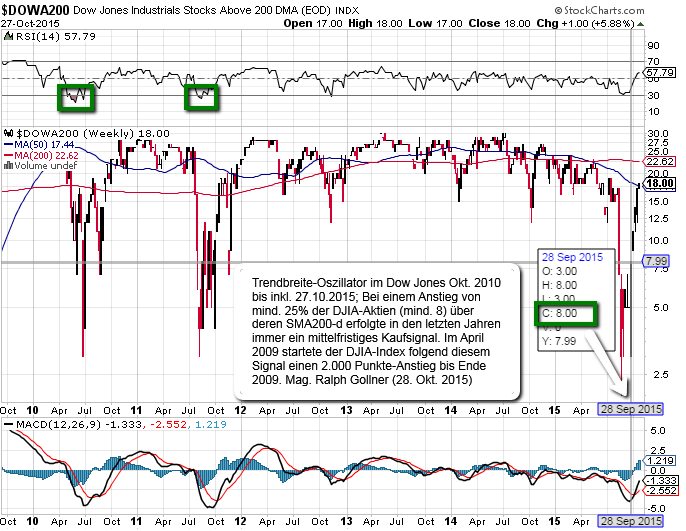

Dow Jones (IA) Trendbreite-Oszillator (kfr. MarktUNTERtreibung ?)

Vereinfacht gesagt wird mit diesem Oszillator die Marktbreite im Dow Jones Industrial Average (DJIA) gemessen.

Allgemein: Sofern eine Aktie über dem 200-Tage-Durchschnitt (SMA200) notiert, wird von einer guten Trendstärke ...

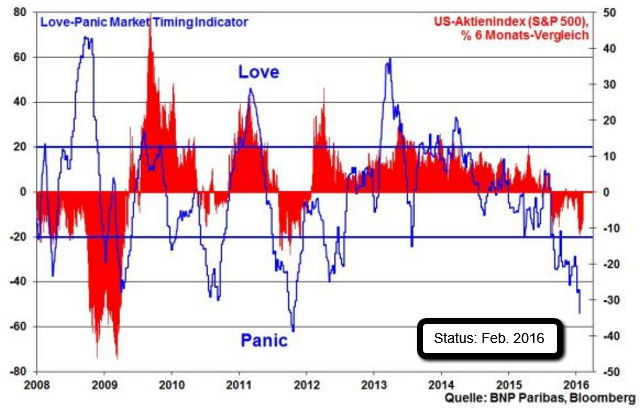

Love-Panic Sentiment (Feb. 2016)

Love panic is a sentiment indicator created by BNP and gives an idea if the equity market is in a phase that is either love, neutral, and panic. This is a contrarian indicator so a high reading would be considered too much love which can signal a market high.

...

...

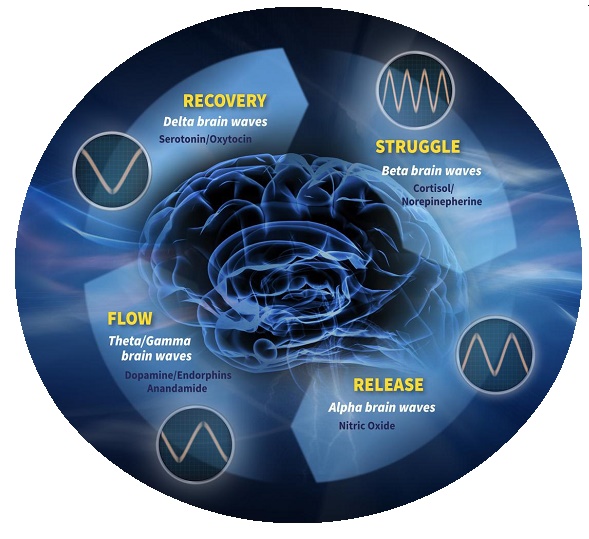

Oxytocin & Co. (Fear & Gier)

Stichworte: Nucleus Accumbens, Dopamin, Oxytocin, Adrenalin, Kontrollverlust

"Unser Gehirn ist süchtig nach Belohnungen"

Wer Geld gespart hat, überlegt, wie er es vermehren kann, etwa an der Börse. Aber unser Hirn kann nicht mit Geld umgehen, findet der ehemalige ...

Recency Bias (Q1/2016)

Recency Bias. We are all prone to recency bias, meaning that we tend to extrapolate recent events into the future indefinitely. Following the January 2016-sell-off period:

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 ...

The peak recommended stock weighting came just after the peak of the internet bubble in early 2001 ...

Mister Market (Psychogram)

In the investment world, we were first introduced to Mr. Market by Benjamin Graham in his 1949 book, The Intelligent Investor. Graham’s mentee, Warren Buffett, still calls this book "by far the best book on investing ever written."

Further he states that "chapters 8 ...

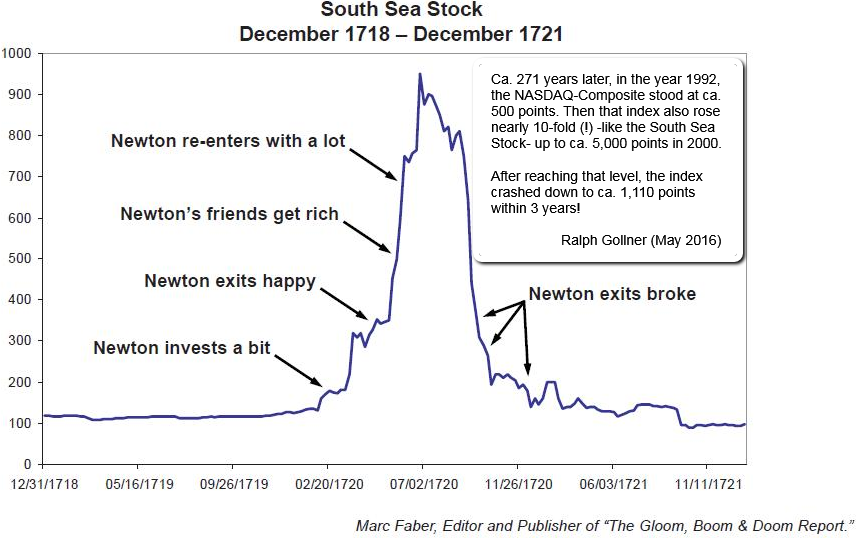

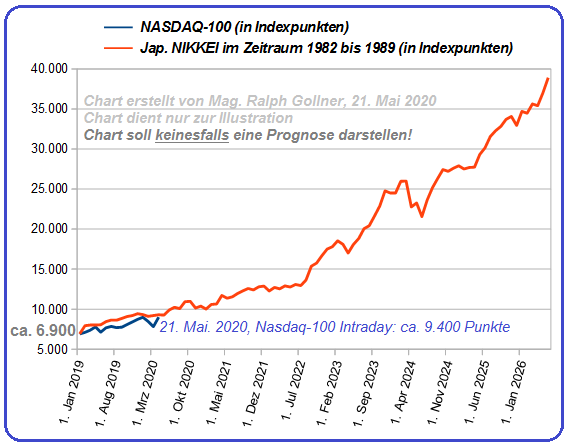

Bubbles (comparison years 1721 versus 2000)

South Sea Stock versus NASDAQ-Comp.

Bubbles can hit anyone! For practitioners of Schadenfreude, seeing high-profile investors losing their shirts is always amusing. But for the true connoisseur, the finest expression of the art comes...

...when a ...

Künstliche Intelligenz

Roboter vermehren das Geld

Wer den Namen Bernhard Langer hört, denkt vermutlich zuerst an Deutschlands berühmtesten Golfspieler. Etliche Anleger kennen aber noch einen anderen Bernhard Langer - er ist Fachmann für computergestützte Anlagestrategien.

Bild-quelle: ...

Bild-quelle: ...

Fear & Greed Index (three indicators selected)

post Brexit (26th June 2016)

Investors are driven by two emotions: fear and greed. Too much fear can sink stocks well below where they should be. So what emotion is driving the market now? CNNMoney's Fear & Greed index makes it clear.

They look ...

Wissen ist nicht gleich "wissen"

Intelligenz bzw. Schläue spielt für uns in der Arbeitswelt eine wichtige Rolle. Doch der höchste Intelligenzquotient und das größte Allgemeinwissen bringen nichts, wenn nicht danach gehandelt wird. „Dumm ist der, der dummes tut“, sagt Forrest Gump...

...in ...

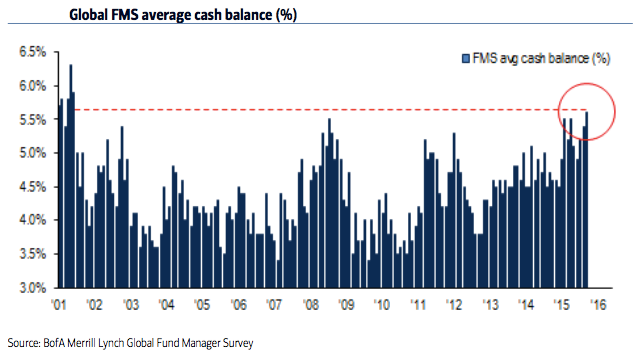

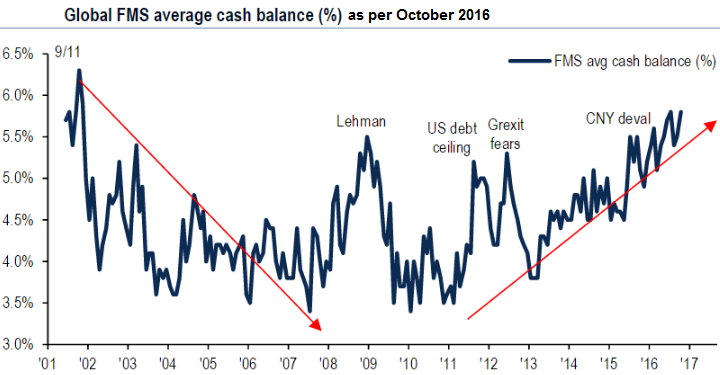

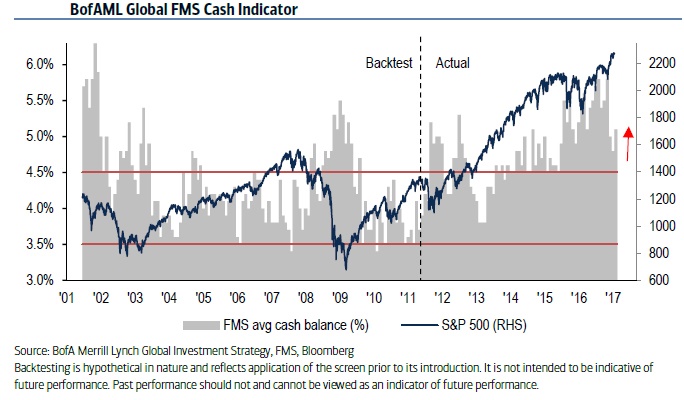

BOFA Fund Manager Survey (July 2016)

Cash levels at a 15-year high

Despite the post-Brexit market rally, fund managers have gotten even more wary of taking risks. Following Long-Term chart still shows the elder, lower reading of 5.6%, the most recent reading is now 5.8%.

The S&P 500 has ...

Viele Crashgurus unterwegs (Aug. 2016)

Aktuelle Stimmen aus der Börsenwelt (Mitte Aug. 2016):

-) Experten bezweifeln, dass der DAX 30 seine Rally nach dem Jahreshoch fortsetzen wird.

-) Das Jahreshoch des DAX 30 ist kaum von Bedeutung.

-) Experten geht die Rally zu schnell...

-) Kurse haben sich ...

Einige Todsünden des DURCHSCHNITTSANLEGERS!

Ausschweifung, Maßlosigkeit, Habgier, Faulheit, Zorn, Neid und Hochmut. Die 7 Todsünden lassen sich auch auf das Anlageuniversum übertragen. FundResearch und Aberdeen Asset Management zeigen warnende Beispiele, die jeder Investor beherzigen sollte.

...

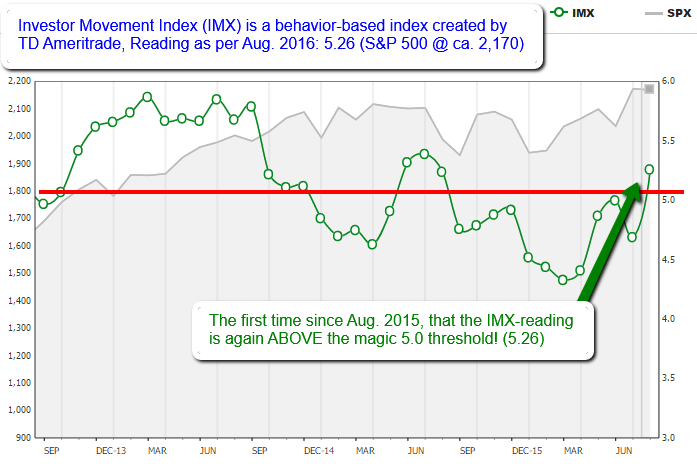

Investor Movement Index (IMX)

The Investor Movement Index, or the IMX, is a proprietary, behavior-based index created by TD Ameritrade designed to indicate the sentiment of retail investors. The IMX saw its largest ever single month increase in August as volatility hit a two-year low!

TD ...

Fear & Greed (43 versus 69)

Now, that the Fear & Greed Index of http://money.cnn.com/data/fear-and-greed has fallen below the "50-points-threshold" this could give the markets the chance to breathe through for regaining momentum for the later months of the year 2016.

As can be seen from the ...

BOFA Fund Manager Survey (Oct. 2016)

Cash Allocations are Close to 15-Year Highs

Cash levels jumped from 5.5% in September to 5.8% in October 2016. Investors' average cash balance was last this high in July 2016 (post-Brexit vote) and in Fall 2001.

More precise: The share of cash hasn't been ...

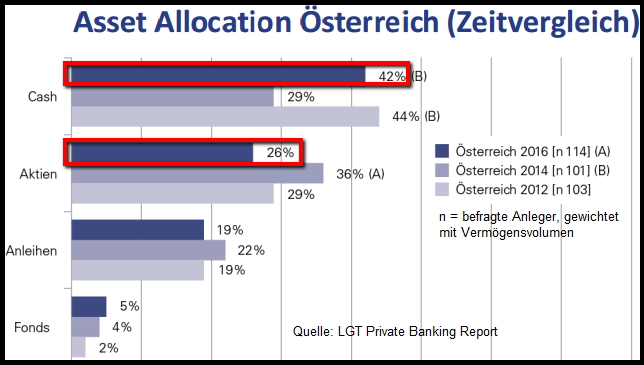

LGT Private Banking Report 2016

Studie im Auftrag von LGT; Durchführung: Abteilung für Asset Management der Johannes Kepler Universität Linz Leitung Univ.-Prof. Dr. Teodoro D. Cocca. Ziel: Befragung zum Kundenverhalten von Private-Banking-Kunden in Österreich, Deutschland und der Schweiz.

...

...

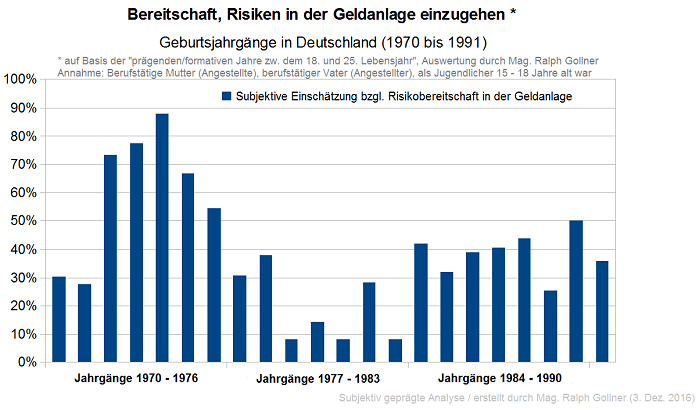

Behavioral Finance versus starrer Regulierungs-Wut?! Plausible/"Korrekte" Einschätzung vom Risiko und Wissen um die eigene Risikoaversion sind bei der Geldanlage unverzichtbare Bausteine, um eine passende mittel- bis langfristige Strategie erstellen zu können, die zur individuellen Person ...

Investing in the Rearview Mirror

(Hindsight-Bias)

"In the business world, the rear view mirror is always clearer than the windshield." W. Buffett; "You can't see the future through a rearview mirror" Peter Lynch; "Too often, investors are more inclined to look at the rearview mirror...

...

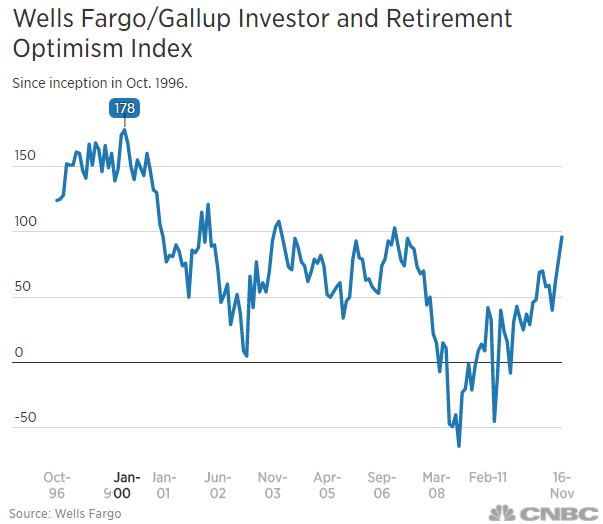

Positive Gallup Surveys (Nov./Dec. 2016)

-) Wells Fargo/Gallup Small Business Index at highest level since January 2008

-) Gallup Investor and Retirement Optimism Index jumps to 9-year high

Individual investor optimism jumped to a nine-year high in November 2016, according to the Wells ...

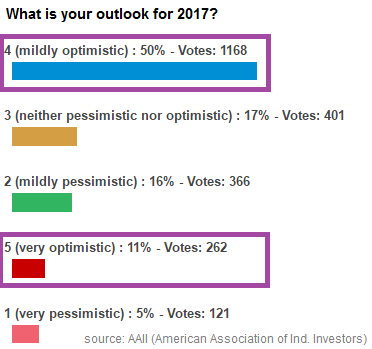

Shiny, happy people (!?)

Optimistic Individual Investors

The American Association of Individual Investors is regularly asking its members for feedback on their surveys. At the start of the year they asked following, more focused: the possible annual return of the S&P 500; But first:

Only 21% ...

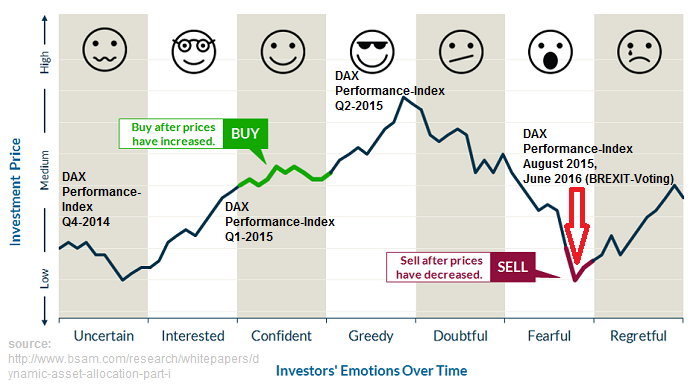

Emotions and DAX-Index

(Q4-2014 - Q4-2016)

A team of personal trainers, scientists and nutritionists can design the most sophisticated diet and exercise plan but it will have no chance of success if it is impractical for most people to follow.

Therefore it is of utmost importance to ...

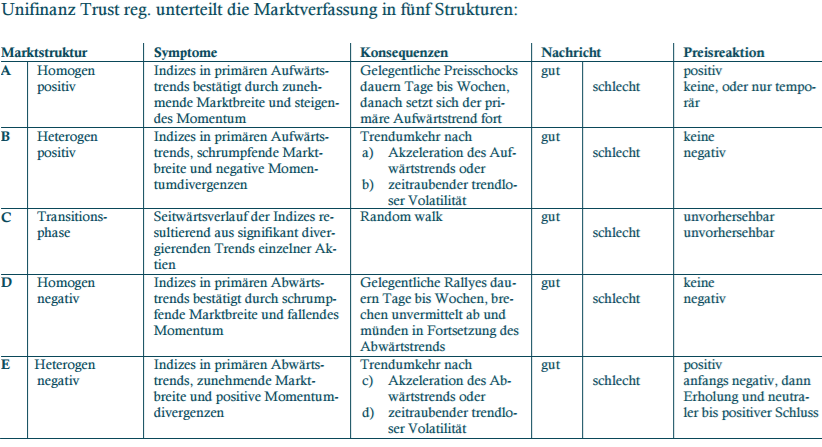

Marktstruktur, Marktbreite

(Phasen A bis E)

Die Aktienmärkte befinden sich evtl. noch immer in einer Transitionsphase (C-Struktur). Diese kann in einen Bullenmarkt münden, wenn es zu einer positiven Überraschung kommt, wie z.B. zu einer technologischen Innovation, die...

...ähnliche ...

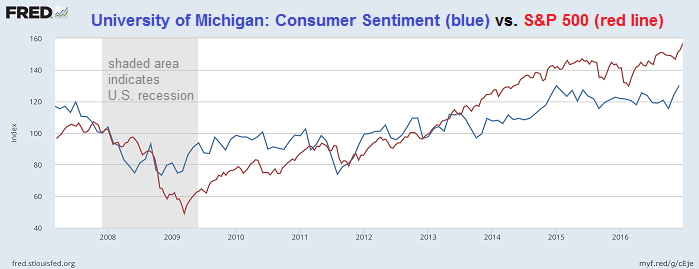

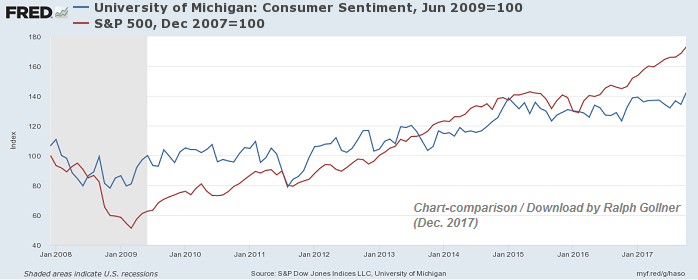

Consumer Sentiment vs. S&P 500

I created a chart comparing the Michigan Consumer Sentiment versus the U.S. Stock market (S&P 500) since the last recession (2008/2009). For the moment (Q1-2017) it seems that the famous "Animal spirits" have taken over...

The final reading of the University ...

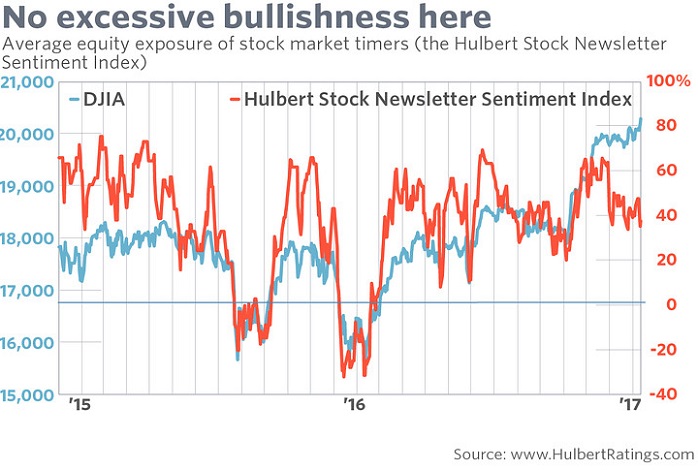

Stock Newsletter Sentiment

(HSNSI, Mark Hulbert)

Stock-market timers grow cautious, and that's good for equities. Market tops are usually characterized by stubbornly held bullishness, but that’s not what we're seeing today. Stock-market timers have been turning remarkably cautious. It's...

...

Cash Indicator and other great stuff from BofAML

(Jan./Feb. 2017)

The BofAML Fund Manager Survey (FMS) is a monthly survey of 200-250 primarily long-only investors. One of the key questions in this survey asks for cash balance as % of assets under management. A low cash balance indicates...

...

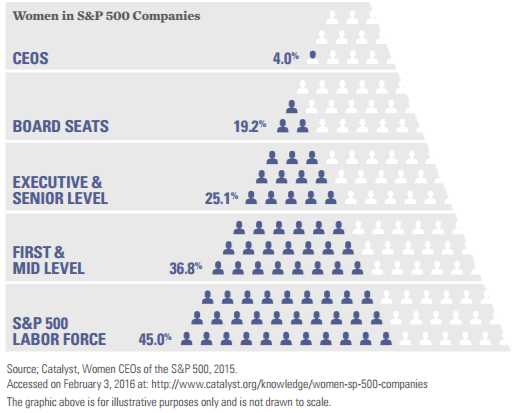

Why Invest in Women?

Research shows that companies that embrace gender diversity on their boards and in management often experience improved performance and profitability as a result. Consider the following: Invest in companies with women in CEO, board, or senior level positions, thereby...

...

...

"Made in Germany"

ist das beliebteste Label der Welt

Für mich ist es glasklar: Warren Buffet hat einen Home-Bias (gerechtfertigt oder nicht will ich nicht beurteilen). Haben wir in Österreich & Deutschland auch einen Home-Bias? Wenn ja, gerechtfertigt? Die US-Wirtschaft würde gerne...

...

"Unser Gehirn kann nicht mit Geld umgehen, daher sind wir Idioten der Kapitalanlage":

So der Ex-Banker Roland Ullrich, der sich nun nach seinem Ausstieg aus der Banker-Welt, der Verhaltensökonomie und Hirnforschung verschrieben hat. Aus dem Literarischen wissen wir vom Rat eines guten...

...

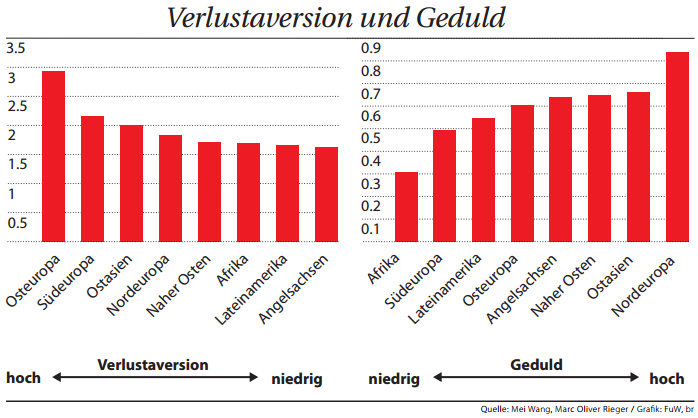

"Wie Kultur die Anleger beeinflusst"

Kulturelle Unterschiede auch in Finanzfragen - Nordeuropäer cool/er (geduldig)

Trotz der fortschreitenden Globalisierung gibt es weiterhin kulturelle Unterschiede. Auf der Welt werden rund 6.500 Sprachen gesprochen, die Essgewohnheiten sind...

...

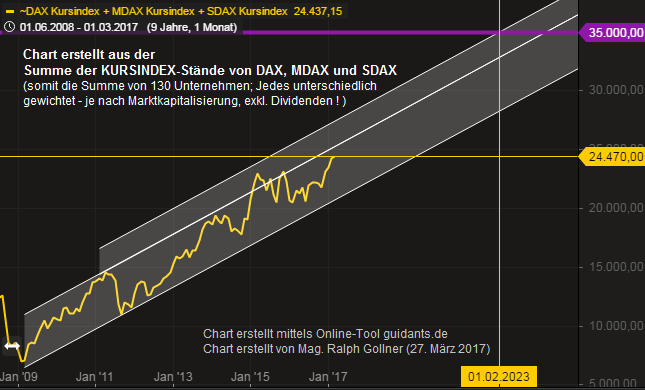

Psychologie & DAX

In persönlichen Gesprächen höre ich in letzter Zeit oft: Die Aktien steigen doch immer die letzten Jahre - "ist ja ganz einfach". Nun, so einfach ist es wohl nicht. You gotta have SKIN IN THE GAME ! Eine einfache Stütze ist jedoch ein langfristiger Anlagehorizont!

"It's ...

Mr. Market

"Remember that the stock market is a manic depressive." (Warren Buffett)

Rules of logic often don't apply SHORT-TERM in investment markets. The well-known advocate of value investing, Benjamin Graham, coined the term "Mr. Market! (in 1949) as a metaphor to explain the stock market.

...

...

Home Bias versus Cosmopolitan

Everyone is guilty of home country bias, let's be different:

Try to invest/be(come) COSMOPOLITAN !

For many people, there's no place like home. But if you're only investing at home, first: you are taking high(er) risks and 2nd sometime you're missing out...

...

Wie viele Gefühle hat der Mensch?

Vorab stellt sich die Frage, wie relevant diese Frage für die "Behavioral Finance" ist? Nun, nicht nur für die Verhaltensökonomie ist die Auseinandersetzung mit Gefühlen extrem wichtig, auch für alle anderen Bereiche! Jeder hat Gefühle, aber...

...für viele ...

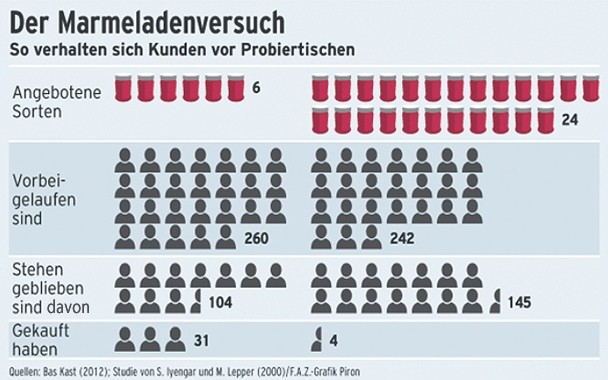

Der Marmeladenversuch oder

"Die Qual der Wahl"

In den Medien machen öfter Artikel die Runde, die zum Gegenstand die Neuroökonomie haben. Solche Artikel tragen zum Beispiel Überschriften wie "Gibt es ein schlaues Verhalten?" Für die Börse ist diese Thematik ein gefundenes Fressen. Denn...

...

Artificial Intelligence and the

Investment process

Using Artificial Intelligence (AI) in investment management is a possibility; But there are many aspects in the investment process where AI can and cannot function as a support. Even the most sophisticated machine learning...

...technologies ...

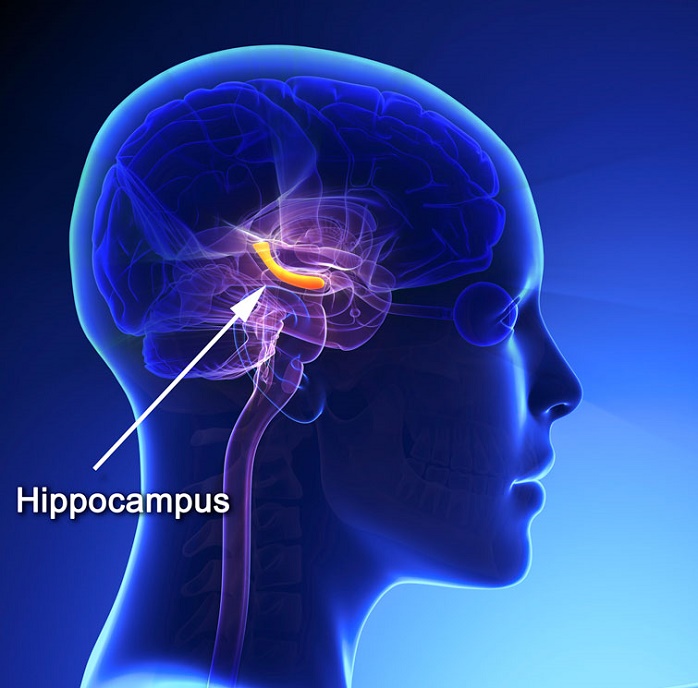

Hippocampus and the

"Whole-Brain State"

Imagine this: You've just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to invest your money "now". With each new opportunity that comes, you find yourself...

...still ...

Herd behavior

This effect is evident when people do what others are doing instead of using their own information or making independent decisions. The idea of herding has a long history in philosophy and crowd psychology.

It is particularly relevant in the domain of finance, where it has ...

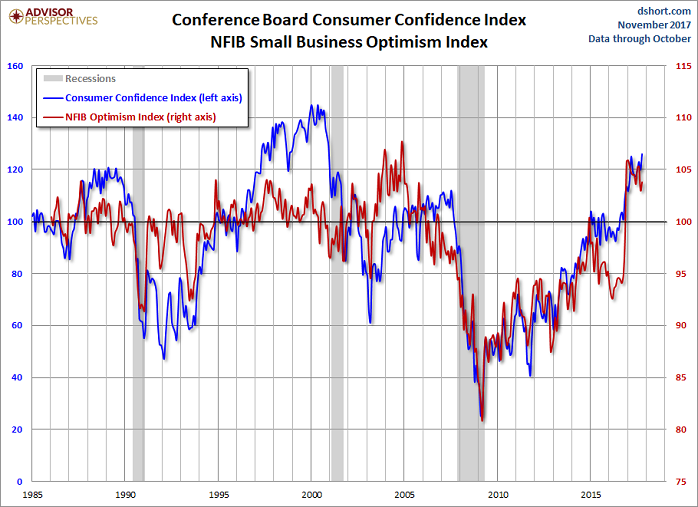

US-Consumer confidence

"Consumer confidence increased for a fifth consecutive month and remains at a 17-year high," said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions improved moderately, while...

...their expectations ...

FLOW

Optimal state of consciousness

(Intelligent Risk-Taking "can" go up, Creativity goes up)

Flow ist ein Zustand höchster Konzentration auf eine Aufgabe. Fast so, als wenn du in einer Blase sitzen würdest; Du nimmst die Dinge um dich herum nicht mehr richtig wahr. Sie werden zum...

...

Konsumentenvertrauen (U.S.A.)

Conference Board-Consumer Confidence (Michigan Consumer Sentiment); Das Conference-Board Verbrauchervertrauen misst das Level des Verbrauchervertrauens in wirtschaftlichen Aktivitäten. Es ist ein leitender Indikator, da es die Verbraucherausgaben...

...

Ein guter Ratschlag von "onemarkets"

Guter Rat ist also doch nicht teuer...

Hier von www.onemarkets.de

Sollten trotz des Hitzewitters die -doch unvermeidlichen- Sommergewitter auftreten, dann bitte nicht vergessen: Obwohl der DAX in den letzten 5 Jahren angestiegen ist, hat er in diesem ...

Volumen bei vier Aktien

(exemplarisch für viele USD-Aktien am Freitag, 15. Mai 2020)

Das Handelsvolumen oder Volumen ist die Anzahl der Aktien, die die Gesamtaktivität eines Wertpapiers oder eines Marktes

für einen bestimmten Zeitraum angibt. Das Handelsvolumen ist ein technischer...

...

Blasen am Aktienmarkt als Zeichen von Kapitalmarktanomalien

(Märkte sind wohl doch nicht so effizient)

In medias res: Rationale/fast rationale Blasen & Intrinsische Blasen sind nur zwei Varianten von grundsätzlich vier "Blasenarten". Wir werden uns diese beiden etwas näher anschauen; Eine...

...

...

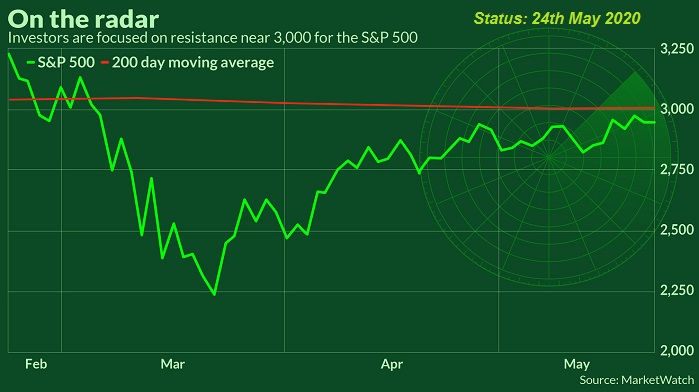

Magic 3k-level (S&P 500)

and 25k in the Dow Jones Industrial Average

Just looking at the market in these times, one thing jumps out across the charts. S&P 500 and the old Dow Jones Industrial Average are near round number-levels today. What I mean is near...

...price levels ending in zero ...

Charlie Munger - RIP

With 99 years of age Charlie Munger, the right Hand of Warren Buffet passed away on the 28th Nov. 2023. Following short 33-Minutes long podcast (pl. click here below) was recorded in the year 2015, where Ten Griffin give us -also- some insights into the thinking of ...