Related Categories

Related Articles

Articles

Hippocampus and the

"Whole-Brain State"

Imagine this: You've just had your largest loss ever (or big one), and you are feeling incredibly risk averse, almost to the point where nothing looks good to invest your money "now". With each new opportunity that comes, you find yourself...

...still recalling that big loss and hesitate, or fail to pull the trigger.

This common experience amongst investors (or traders, of which the majority might be playing a loser's game...) has a biological root, and most often creates a negative psychological effect on you. These biological and psychological causes can have a tremendous impact on your mindset regarding Risk-Taking, perhaps writing the future history for your investing career. The good thing is, your brain and trading future can be changed.

Biological Reactions to Stress in an Investment environment

Losses no doubt can have an effect on your Investors' psychology, but also your biology and brain. Cumulative losses can create a huge increase in cortisol in your system. Too much cortisol over a long enough period can cause neurons to fire, where you can no longer concentrate effectively to make a good, reasonable decision.

But take a huge loss, and now your brain is likely re-wired for more losses.

What Happens When You Take A Huge Loss?

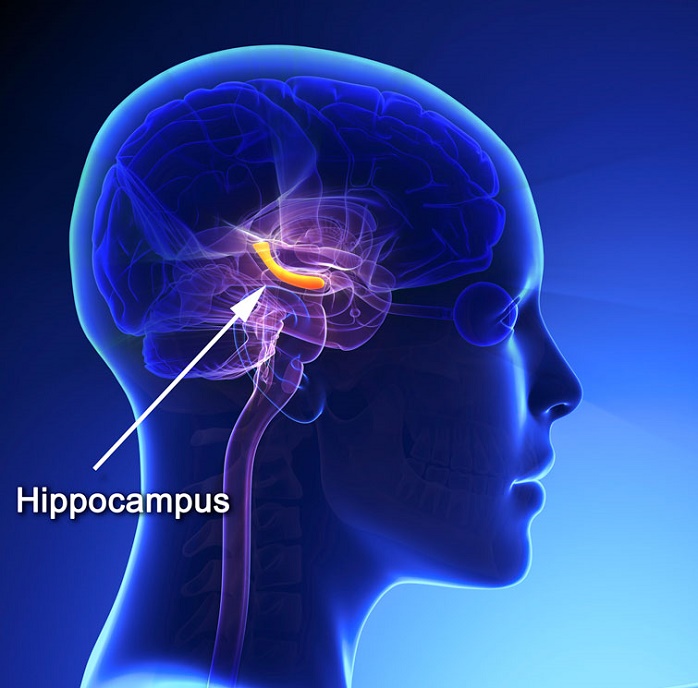

There are two regions of the brain that work together in remembering stressful events. They are the "hippocampus" and "amygdala". You will find some postings about the amygdala in articles on my website here and how it impacts your investing-attitude (please see Section "Behavioral Finance").

To clarify between the two, the hippocampus will record the factual details of the big trading loss, while the amygdala will encode the emotional significance of it. Both of these are affected by stress, which releases stress hormones that can heavily affect brain performance.

Now as stress and cortisol levels rise, with continued exposure, our tendency to recall any trading events stored during this neurological state increases.

For a really good graph about performance and a stress curve, please find the following graph below:

Getting back to the big loss, the experience becomes quite intense emotionally, almost as if it was burned into your brain. This is because of the intensity of thosehormones present during this loss. This imprinting in your mind becomes corrosive to your trading, particularly your mindset.

You start to remember negative experiences, that may or may not have anything to do with your investments. Just recalling these memories will affect your performance, but there are additional consequences.

Anytime you are analysing Investment opportunities, you will with greater intensity, draw upon those negative feelings and memories, one of them being the big loss itself. This only makes you increasingly risk averse and afraid to lose, almost to an irrational level. This could happen despite a high-quality Stock selling for a bargain (not being a Value trap hopefully...).

In essence, you become paralsed by this risk aversion, unable to pull the trigger (purchase an inital position).

Another scenario could be that you are "shell-shocked" from the trading loss, yet still are able to make a trade. Unfortunately, your Investment decisions are (then sometimes) totally off kilt. You think you see setups, and start making trades, only later to realize there was no price action setup at all. While reviewing your invesments, you actually see now there was no pattern, no reasonable decision-trigger for that purchases at all.

This is from a biological reaction to the stress you experienced. In some Investors, without the proper tools, it becomes so damaging, that it affects them for weeks, months, perhaps even years. Some Investors and/or traders may never even recover from this. Even though that huge loss was ions ago, you still remember it vividly and often recall it when thinking about investments. Has this ever happened to you before?

If so, do not worry, as most have had this experience.

Can You Change This?

The good thing is you can re-wire your brain, almost like re-writing your hard drive on a computer. Neural connections can be rebuilt and tuned for success. You can also build new connections which overpower this experience, to regain your confidence and make great trades.

One Way to Change Your Brain for Success

One of the best ways to re-wire your brain for success, and erase these negative (trading) experiences is to enter a "Whole-Brain State". This is where your brain operates in an integrated balance. Your left and right hemispheres are working well together. You are not pumping unnecessary stress hormones into your system. You avoid entering a "fight or flight" response, or being overly emotional, or too intellectual.

In essence, your brain operates in a balance which the Whole Brain State induces. When you think about it, which state would you want to be in for making reasonable decisions? A fight or flight state? Being too intellectual or emotional? Having massive amounts of stress hormones pumping through your brain? Or be in a balanced whole brain state?

Some ideas: Yoga and meditation are notorious for helping to put you into a whole brain state, while tuning your central nervous system. Or jogging or getting engaged in having several hobbies (Sports !).

Let's recap and some bits on the "Whole-Brain State" - topic

While most investors (and traders) will never discover this, there are two traders inside you. Actually, there are many, but two that come out most frequently. On one hand, there is a trader we most often engage, and that is one not borne from an optimal brain state. This is one that is overwhelmed by fear, greed, doubt, lack of confidence, an inability to pull the trigger or make a decision, to close out a losing position we know we should, or stay in a good runner.

On the other hand, we have one which is confident in the face of losses, focused in a drawdown, directing energy towards the process, disciplined in the fire, and pulling the trigger when needed.

It is this latter trader most don't engage, simply due to training. It is this latter trader that naturally arises when we are in a whole brain state.

What Is The "Whole-Brain State" really about?

The whole brain state is an optimal state whereby both halves of the brain are communicating and in sync with each other. The left-right brain myth really created a dichotomy, leading us to believe we are better off in one side or the other for specific tasks.

But what science has now demonstrated through decades of studying meditation is when both hemispheres are working in sync, we have greater access to clarity, higher cognitive functions along with calmer/more focused brain-waves, all of which improve performance on skill-based tasks (Investing, trading, etc.).

NOTE: When they sliced open Einstein's brain, they noticed he had an immense amount of connectivity (and thus communication) between both hemispheres of the brain, well beyond the norm.

High Performers

This whole brain state is most often what athletes and high performers are in when they are "in the zone." The problem for us Investors (especially as traders) is we haven’t been taught to recognize, build or maintain this state.

On the other side of the whole brain state and this "zone" we have the "stress response" or "fight-or-flight" state. This is something we commonly engage in when trading,

yet need to avoid.

In this state, our mind-body system automatically prepares for self-preservation. Survival is one of our strongest instincts, and it is quickly activated with little/no critical "thinking" involved.

NOTE: From an evolutionary standpoint, this is the brilliance behind nature and our bodies. Being chased by a tiger in the jungle, better not be having any energy go towards digestion. Best you have an increase in oxygen to our muscles, and you better have it fast.

Death Blow For Trading Success

But for us as Investors (traders), the "fight-or-flight" stress response is a death blow to critical thinking and successful Investing. When you are in this state, you cannot access higher cognitive functions and the PFC (pre-frontal cortex). Most of the energy in the brain is happening around the brain stem (oldest part of our brain).

Everything perceived as a negative becomes/feels like a threat.

Now, this may sound familiar, but ever been in an investment nicely in profit, then have it suddenly turn a few percentage points against you, and you start to think, "Oh No, it's going to turn against me, I have to exit"? Has this happened to you before?

If so, you are experiencing evolution, and you are most certainly NOT experiencing the whole brain state. In such a stress response, you have approximately a zero percent chance of investing successfully in the long run...

Simply put, evolution is a strong impulse that dominates our brain states (and thus mindset). Investing was (initially) not part of our evolution, and it is this wiring we have to retrain our minds to avoid.

The way out of this is to train your mind and brain to be in a whole brain state, as often, and as much as you can during the investment decision process. Doing this gives you an exponential edge vs. the fight-or-flight "attitude" you often step into, giving you the best chance to wire successful habits in and make profitable investments.

In Closing

With that being said, have you ever done something in your investing carreer which you "know" is the worst thing to do, yet you did it anyway, almost like you couldn't control it?

Have you ever looked back at some of your losses wondering, "What was I thinking?" The truth is, you weren't really "thinking." You were reacting to ever increasing stress responses. And you were definitely not (!) in a whole brain state.

Below are three critical questions regarding performance & your neurological states when making and eventully taking investment decisions:

♦ Do I recognise some of these "fight-or-flight" moments, and how was my performance? (Reflect !)

♦ If I had to quantify it, how often am I in a non-optimal mind state when trading? (Reflect again !!)

♦ What do I do to prepare myself mentally and get myself in an optimal state for trading? (Prepare yourself !)

Answers to these questions likely will point to why your performance is where it's at. The good thing is, you can change this and rewire your brain for success by learning to be in the whole brain state.

Fantastic, isn't it?

links: