Related Categories

Related Articles

Articles

Why Invest in Women?

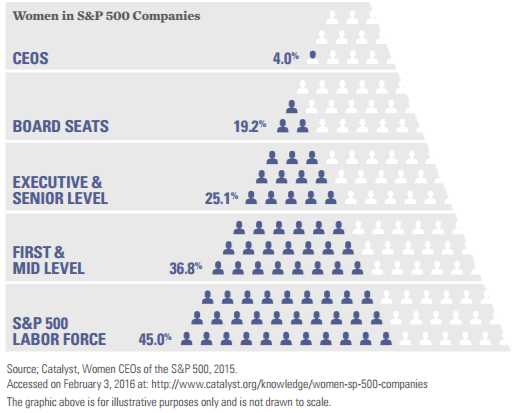

Research shows that companies that embrace gender diversity on their boards and in management often experience improved performance and profitability as a result. Consider the following: Invest in companies with women in CEO, board, or senior level positions, thereby...

...encouraging more companies to support a gender diverse workforce.

An Exchange-Traded-Fund (ticker: "SHE") seeks to help address gender inequality in corporate America by offering investors an opportunity to create change with capital and seek a return on gender diversity, says Kristi Mitchem, executive vice president and head of the Americas Institutional Client Group for SSGA (StateStreet Global Advisors).

But the fund/ETF (ticker: "SHE") isn't just based on blind optimism and human faith. State Street Global Advisors is banking on research from the McKinsey Global Institute and the MSCI that shows companies with a strong female leadership outperform peers in overall returns in equity. In a 2015 MSCI study, companies with at least three female board members outperformed others by an average of 36%.

Further research confirms the positive outcome for businesses also by following performance indicators:

♦ A 2016 Peterson Institute survey of 21,980 firms from 91 countries suggests that the presence of women in corporate leadership positions may improve firm performance. The study found that having greater diversity in the executive suite is positively and significantly correlated with measures of financial performance, such as gross and net margins.

♦ A 2014 Credit Suisse study assessed the level of women in senior management at 3,000 companies and found that more diversity in management coincides with better corporate performance and higher stock market valuations.

♦ A 2013 Harvard University study, "Does the Gender of Directors Matter," concluded that the ROE (Return on Equity) and net profit margin of companies with at least three women directors was significantly stronger than companies with boards that did not have such diversity.

♦ A 2012 Credit Suisse Research Institute report reviewing 2,360 global companies found that companies with women directors outperformed those without women directors in ROE, average growth, and price/book value multiples. And companies with at least one woman director had better share price performance than those with no women directors.

♦ A 2011 Catalyst study of companies over the 2004-2008 time period showed that companies with three or more women corporate directors (in at least four of the five years) outperformed those with no women on the board by 84% on return on sales (ROS), 60% on return on invested capital (ROIC) and 46% on return on equity (ROE) - please see visual above!

The current holdings of the ETF with the

nice ticker "SHE" are as following:

Disclosure/Disclaimer: Ralph Gollner hereby discloses that he directly owns some of the securities mentioned above (as per 3rd March 2017): Pfizer, PepsiCo, 3M Co, Mastercard and US Bancorp.

links, further studies:

www.mckinsey.com/global-themes

.pdf www.ssga.com/investment-topics

http://fortune.com/2016/03/07/etf-women

www.paxellevate.com/fund/why-invest-in-women

"SHE" Portfolio-holdings http://portfolios.morningstar.com/fund