Related Categories

Related Articles

Articles

Artificial Intelligence and the

Investment process

Using Artificial Intelligence (AI) in investment management is a possibility; But there are many aspects in the investment process where AI can and cannot function as a support. Even the most sophisticated machine learning...

...technologies can't replicate human creativity and ingenuity. As machines take over routine tasks, employees will have more time for work that demands uniquely human talent. Artificial intelligence can make humans vastly more productive. When machines take care of crunching data, conducting micro-analysis, and managing workflow, humans are free to focus on the bigger picture.

Real-life example: Consider Kensho, a financial analytics AI system. According to a Harvard Business review, the program can answer 65 million possible question combinations - even off-the-wall ones like "Which cement stocks go up the most when a Category 3 hurricane hits Florida?"

Kensho doesn't replace human wealth managers, who must still use their reasoning and intuition to invest wisely. But the program ensures (well, at least: helps) that they make the most informed decisions possible.

(sometimes even I, Ralph Gollner, check new data-crunching info provided and presented by Kensho in a neat way, via Videos, Graphs - distributed on the "Kensho-Website")

AI may be more efficient at number crunching and pattern analysis than humans, but it isn’t as daring. Machines can "learn" from past iterations to improve future outputs, but they struggle to come up with completely fresh material that challenges the status quo.

But before digging a little bit deeper into "how to combine AI and the Investment decision process" another reminder (but well known): Smart business leaders recognise that AI improves human decision-making but can't replace it. In the end, AI is only as goodas the employees acting on the data...

THE MODERN INVESTMENT PROCESS (in the making)

1.

Capital Market Characteristics

Market participants need to accept the characteristics of capital markets: they are complex systems whereby its dynamics are driven by a large number of heterogeneous market participants with imperfect information and bounded rationality.

Finance is first and foremost a social science. Financial market participants can optimize their interactions by more accurately understanding the behavior of other market participants, while understanding their own behavior. This understanding of how market participants can optimize their own investing behavior comes as a rather recent phenomenon. IT support tools are playing a significant role in this optimization. Artificial Intelligence is a special case as it carries, through its deep learning engine, the potential of going beyond an IT support tool, entering the field of "Autonomous Intelligence". The primacy of the human investment decision maker is being questioned.

2.

Artificial Intelligence...Promises Salvation

Like in the early 20th century, we are living in a time of rapid technological change, in which our research breakthroughs are ahead of our ability to use them inclusively and responsibly. It should therefore come as no surprise that tools like Artificial Intelligence or Distributed Ledger Technology (i.e. Blockchain) offer a projection surface for a diverse set of aspirations. While both are, at their core, disruptive to many areas of our lives, their development, their implementation and their societal acceptance cannot be achieved abruptly.

Artificial Intelligence - Status Quo

The World Economic Forum summarizes our current understanding of AI implications as follows: "Recent studies, including one from McKinsey and another from the OECD (...) look at specific, repetitive tasks instead of whole jobs and find that, for most of us, some fraction of the work we do each day could be done better with AI, (...) enabling us to spend more time on creative problem-solving and on the parts of our jobs that involve complex human interactions and relationships."

Still, The asset management industry is known for being conservative in adopting new technologies. For instance, in the PwC 2016 Data & Analytics Survey of over 2.100 senior executives, the asset management industry stood out in its dependence on human judgment in investment decision making.

However, especially fund managers with long-proven track records delivering alpha over longer periods (!) are working intensively on exploiting the use of AI to the maximum. At the forefront, just to name two: Renaissance Technologies and Bridgewater Associates.

3.

Primacy Of Human Investment Decision Maker

The AI conclusion from above allows to revert to the still dominant human factor in the investment decision process. Over the last 35 years, behavioral economics and financerelated research has led to the insight that neither are market participants rational, nor are markets efficient. However, being as rational as possible in applying a market participants specialization leads to a competitive edge due to minimizing cost and behavioral gap penalties.

3.1

Thinking - A Full-Body Exercise

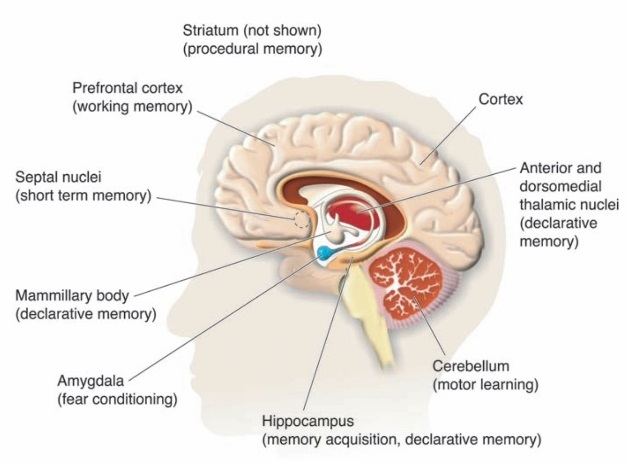

According to the standard model in cognitive neuroscience (Roth, 1994), the thinking process is a full-body exercise, for which the rational element can, but not necessarily has to play a role. The sequence of a thinking process begins and ends with our limbic system, the central evaluation system of our brain, orchestrating our emotions by, for instance, managing our hormonal balance.

3.2

Ambiguity Aversion

Ambiguity Tolerance as Key Trigger for Rationality

The dominance of our limbic system when taking decisions is plausible from an evolutionary perspective. Throughout the evolution of our species it increased our survival probabilities when gaining immediate clarity on whether a fight or flight response is more suitable. Ambiguous and/or complex situations do not allow immediate clarification on a preferred choice. The overwhelming character of ambiguous/complex situations leads our limbic system to switch to anxiety mode, limiting the exposure of Prefrontal Cortex (PFC, see below) and Orbitofrontal Cortex (OFC) to a decision making process and (as written by Hartley/Phelps, 2012).

With our limbic system (see figure above) being at the centre of decision making, we are at constant risk of being exposed to cognitive dissonances that lead to cognitive biases that might lead to cognitive dissonances, and so on. If this spiral is triggered, it results in an increased gap between "knwon" market reality and market perception of the decision maker, where the gap-induced blind spots create self-fuelling momentum (herding, groupthink, pro-cyclical investment behavior, etc.).

3.3.

Possible solutions for Maximizing Rationality in Decision Making

In a non-trivial system like capital markets, market participants are constantly exposed to the risk of being overwhelmed. To maximize the rational element in decision making, the limbic system needs to be stimulated so as to maximize the contribution of PFC and OFC. In other words, we need to minimize the likelihood of our limbic system getting overwhelmed by ambiguity and complexity aversion. When becoming more ambiguity and complexity tolerant, intellect, reason (consciousness) and intuition (preconscious heuristics) increase their relevance in the decision making process. In conclusion, the following imperatives can be defined to maximize rationality.

Rethinking the possible use of Artificial Intelligence:

a) As thinking is a full-body exercise, stimulate the limbic system as such to maximize the contribution of intellect, reason and intuition for more rational decision making.

b) Proactively manage heuristics - primary focus on preconscious heuristics, secondary focus on unconscious heuristics.

Then last, but maybe not least:

c) Becoming familiar with / Utilize latest technology, explicitly including AI, to proactively manage heuristics. Summarising it with the words of Dan Ariely, Professor of Psychology and Business Economics, Duke University: "Algorithms create some kind of discipline in how we are going to approach the world, rather than allowing us to take each situation separately, fully on gut intuition. We basically are forced to be more systematic about our decisions."

All these points mentioned are leading to a modern Investment Decision Architecture.

Summarising the findings so far: the art of managing assets most rationally in an evidence-driven, rule-based investment process depends on proactively managing the heuristics of investment decision makers ("ambiguity tolerance"), which are to be supported by quantitative tools (i.e. "artificial intelligence"). The concluding investment decision architecture provides a framework within which the invesment manager can specialize to develop or maintain his/her competitive edge.

Refresher / some points about the LIMBIC SYSTEM

The limbic system plays a powerful role in creating different emotions and feelings. In fact, some even call it "the emotional switchboard" of the brain.

Some functions:

- associated with memory especially the hippocampus

- associated with pleasure and rage

- the limbic system, via the hypothalamus is able to influence many aspects of emotional behavior.

These include particularly also the reactions of fear and anger and the emotions associated with sexual behavior.

Because of the hypothalamus's functions, the limbic system is directly in control of your "stress response" and these key functions:

♦ Heart rate

♦ Blood pressure

♦ Breathing

♦ Memory

♦ Stress levels

♦ Hormone balance

♦ Moods

Investing can therefore sometimes (in extreme situations) feel like an emotional Rollercoaster for Newbies, Greenhorns and the kind who did not take the needed steps back from "the markets" when financial markets crash without (seemlessly) any stop...

links:

https://draxe.com/wp-content/uploads

www.slideshare.net/DrMohammadMahmoud

https://venturebeat.com/2017/05/14

.pdf www.panthera.mc/wp-content/uploads/2017/10/PS-Research-AT-beats-AI-EN-lres.pdf