Related Categories

Related Articles

Articles

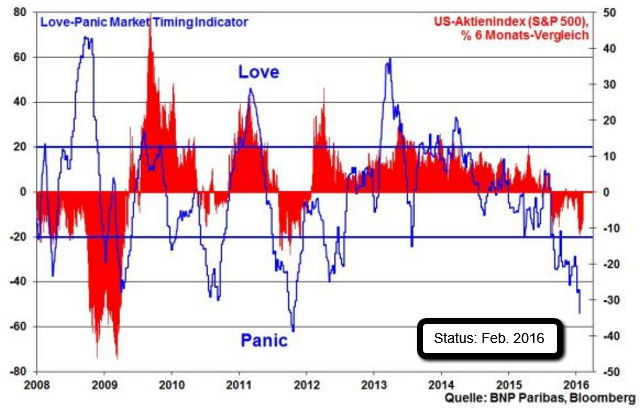

Love-Panic Sentiment (Feb. 2016)

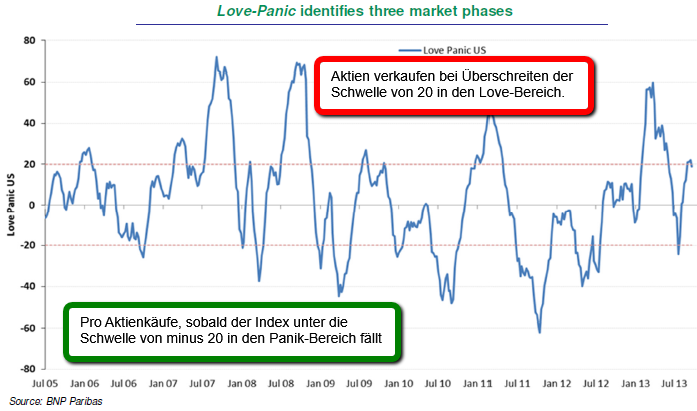

Love panic is a sentiment indicator created by BNP and gives an idea if the equity market is in a phase that is either love, neutral, and panic. This is a contrarian indicator so a high reading would be considered too much love which can signal a market high.

Uniqueness:

Love panic is actually a sentiment indicator created by BNP and can therefore be a useful addition to risk management tools. Gerry Fowler, who is Global Head of Equity & Derivative Strategy for BNP Paribas, notes that many entities have approached creating a sentiment indicator and that these usually focus on the equity market. These indicators are nice, but usually do not tell an investor what to do.

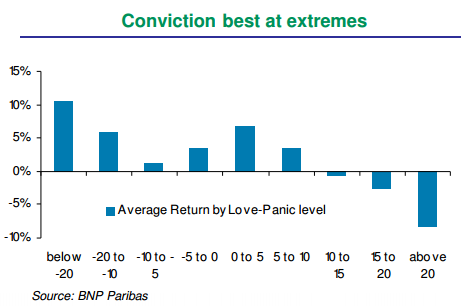

But here, the Love-Panic is constructed through various indices (that are subjectively related to sentiment) with 3-yr z-scores negatively correlated to 6-month forward equity returns! In other words: The Love-Panic indicator has an inverse correlation with six month forward equity returns.

The BNP Love-Panic indicator uses twelve factors including the small cap outperformance of large cap stocks, the CBOE put/call ratio, fund flow in to US equities, and State Street Investor Confidence. The result is a contrarian indicator so a high reading would be considered too much love which can signal a market high. Updated data is available each Monday on Bloomberg terminals. There are actually three versions – US markets (ILUVUS), European market (ILUVEUR) and Emerging Markets (ILUVEM).

Love-Panic is constructed through various indices (that are subjectively related to sentiment) with 3-yr z-scores negatively correlated to 6-month forward equity returns!

Each of the individual factor a individually weighted and vary frm 0-11% of the total index calculation:

Factors for the Love-Panic US include (following a testing period 2006 to May 2010):

Flow into high growth equities

US Fundflows into Global and International Equities

Positione of commercial traders on US indices

Small Caps outperformance over large caps

AAII bullish less bearisch %

Commodity composite bullish index

CBOE VIX Index

CBOE Put/Call Ratios

NYSE short interest ratio

State Street Investor Confidence

ISE Sentiment Index

Nasdaq to NYSE Monthly Trading Volume

Sentix Expectation to S&P 500

AA7 - 10Y ($) - Redemption Yield

Fund flow into equities

US Economic Surprise Indicator

On the other side, for the Love-Panic EU further specific indicators are added - here some selected positions:

IFO Business Expectations

IFO Current Assessment

Eurozone composite PMI

Economic Surprise Indicator Europe

Economic Surprise Indicator UK

ECB Main Refinancing Rate

Fund Flow into European equities

CHFUSD

EURUSD

EC Economic SentiMent Indicator Eurozone

EC Manufacturing Confidence

"Manual"/Recap (in German: Gebrauchsanleitung):

definition-source:

http://www.cboeoptionshub.com