Related Categories

Related Articles

Articles

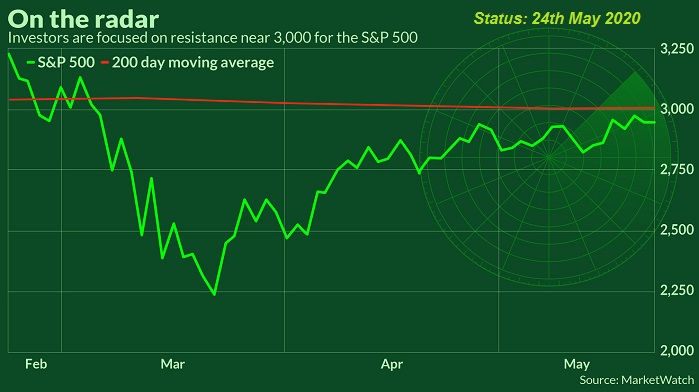

Magic 3k-level (S&P 500)

and 25k in the Dow Jones Industrial Average

Just looking at the market in these times, one thing jumps out across the charts. S&P 500 and the old Dow Jones Industrial Average are near round number-levels today. What I mean is near...

...price levels ending in zero zero zero. '000'.

I have always been entertained when stocks find support and resistance at big round numbers. Some have attributed this phenomenon to a behavioral bias called "round number bias" where people tend to gravitate to big round numbers such as 10, 100, and 1,000 as anchors. In fact, academic research has even recognised price clustering around round numbers.

Why do big round numbers have such an influence on our thinking? One theory is that the addition of another digit (for example, going from 999 to 1,000) is way more significant than a move from 974 to 975. Even though it's the same dollar move in price, the change in the first digit causes us to reflect on the true value of the asset.

One commentary says following: 'Dogfight'

"The fact that the S&P 500 is coming off a 35% rally and that this 200-Day MA lines up with a nice even 3,000 number seemingly makes this area especially important," said Kevin Dempter, analyst at Renaissance Macro Research, in a note last week. But he is also adding a good reminder: "A breakout is not likely to come easily and we expect a dogfight here around the 200-day."

'Trapped between time frames'

At the same time, the Index held above its 38-day moving average, a metric used by some traders (and investors) to gauge an asset's short-term trend. In other words, the S&P 500 is now "trapped between time frames".

Reminder: the rectangle is currently above 2,800 points and below the magic 3k-level:

daily updated chart (please come back to check the new Status-Quo anytime!)