Related Categories

Related Articles

Articles

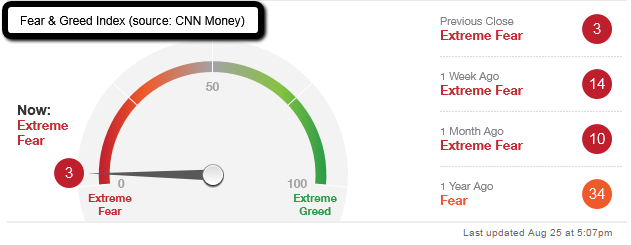

Fear & Greed (Index)

The last time the Index was near such low readings (3) was during the last correction in the US Financial markets, occuring in Oct. 2014. That time it took the index about one week to get out of that negative sentiment (such a quick turnaround may not be the standard).

In Oct. 2014 it took the US-markets about 7 trading days to come back to "normality". As mentioned such a speedy recovery may not be the norm and one has to remember the famous phrase Keynes said (the famous LTCM-fund & its Nobel laureates ignored that fact); Keynes had learned a valuable but painful lesson – markets can act perversely in the short-term. Of this, he later famously commented:

“The market can stay irrational longer than you can stay solvent.”

If you know what you are doing remember one of the famous quotes of the most famous investor of our times (W. Buffet):

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

I should also mention here, that the US-Markets may not be dirt-cheap according to Standard-valuation-metrics (SPX @ ca. 1,900 points, Dow Jones @ ca. 16,000), but one also has to put the investment-alternatives into perspective when valuing equities. In this respect one can compare low yielding bonds to equities with dividend payments (partly over 2% or even 3%). Again: in such emotional times everything is possible - Risk Management has top priority!

the daily updated fear index can be found here: http://money.cnn.com