Related Categories

Related Articles

Articles

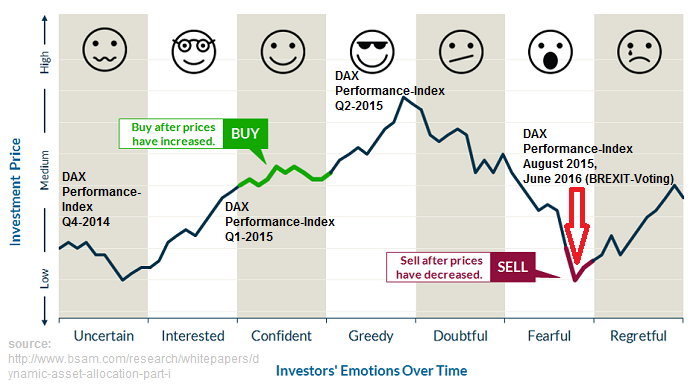

Emotions and DAX-Index

(Q4-2014 - Q4-2016)

A team of personal trainers, scientists and nutritionists can design the most sophisticated diet and exercise plan but it will have no chance of success if it is impractical for most people to follow.

Therefore it is of utmost importance to understand investor behavior. Herein lies the paradox of the active versus passive debate; finding the optimal mathematical strategy is futile unless it factors in typical investor behavior. At the end of the day whether a portfolio is active or passive is therefore irrelevant. A strategy will only deliver results to investors to the extent that they have the appropriate emotional makeup to handle its risk profile across a full market cycle (both bull and bear markets). The optimal strategy is the one that maximizes an investor's realized wealth.

You can start out with Nobel-Prize winning advice and end up far worse than if you had taken a different approach as a direct result of your own actions. Above was the "normal" chart of typical investor behavior.

Investors tend to buy near the top because they don't act until it seems as if everyone is participating in the market. They are often encouraged to hold on through corrections, and when the bear market eventually arrives they tend to hold through the early portion and then exit near the bottom when the masses are experiencing extreme panic and fear. This highlights the flaw in passive investing: it's easy to buy and hold during a bull market since you are making money and so is everyone else, but the bear market is where things go downhill for all investors. Major losses tend to spur investors into action, and they often switch to a more conservative fund or hold large positions in cash at the wrong time.

This highlights an important conclusion: investment managers may be either passive or active, but most investors are active!

The well-known Dalbar report states that "at no point in time have average investors stayed invested long enough to derive the benefits of the investment markets. The emotions of investors often match the gyrations of the market, resulting in fear-based investing." This leads them to significant underperformance versus a passive investment in the index (which clearly is a phantom bogey since few investors can sit on their hands)...

Full article: www.bsam.com/research/whitepapers