Related Categories

Related Articles

Articles

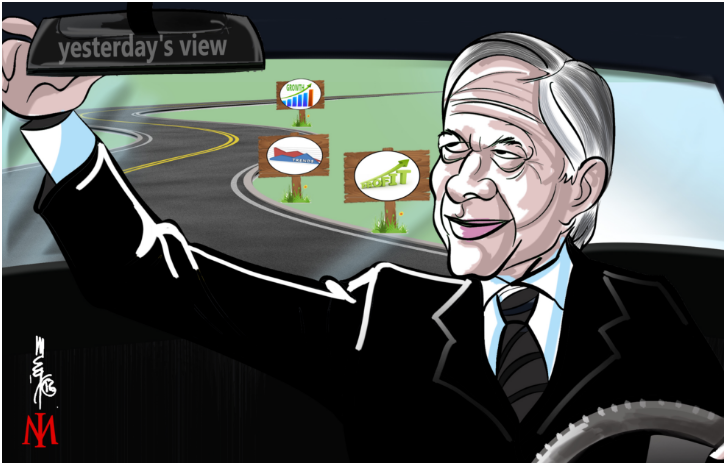

Investing in the Rearview Mirror

(Hindsight-Bias)

"In the business world, the rear view mirror is always clearer than the windshield." W. Buffett; "You can't see the future through a rearview mirror" Peter Lynch; "Too often, investors are more inclined to look at the rearview mirror...

...than the windshield." Francois Rochon; "Anchored in the present, one of the great ironies is that investors imagine the future to be what they see in the rear-view mirror. The windshield is simply too foggy." Quote by Frank Martin

"You cannot look at the future by naïve projection of the past" Nicholas Taleb

"There is a danger of expecting the results of the future to be predicted from the past." John Maynard Keynes

"All investors by nature are conditioned by their memories. If they have only been investing for a short period of time and don't have a lot of combat experience, they are particularly vulnerable to what has just happened to them. It is very important not to fall into the attractive trap of extrapolating the most recent past into the future. If you do, it is like steering a sports car up a mountain road, with a steep drop on one side, by peering through the rear-view mirror." Barton Biggs

"The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically high past returns simply imply that an asset has become more expensive and is poorer, not better, investment." Ray Dalio

"Studies show that what has worked well lately in investing is likely to underperform in the future, while what has lagged is likely to rebound. In the words of the Roman poet Horace, "Many shall be restored that now are fallen and many shall fall that now are in honor". But such contrarian thinking is always in short supply on Wall Street." Seth Klarman

"The investor of today does not profit from yesterday's growth." Warren Buffett

"Overweighting assets that produced strong past performance and underweighting assets that produced weak past performance provides a poor recipe for pleasing prospective results. Strong evidence exists that markets exhibit mean-reverting behaviour, a tendency for good performance to follow bad and bad performance to follow good." David Swenson

The next paras summarise some thoughts on hindsight bias and overconfidence; From the book: "Investing Psychology, The Effects of Behavioral Finance on Investment Choice and Bias " (Tim Richards, 2014)

Hindsight Bias, our tendency to believe we can predict the future because we think (incorrectly) that we predicted the present in the past, is virtually ineradicable.

It's a pervasive human bias that is seemingly impossible to eliminate. And from hindsight bias comes overconfidence, and nothing hurts an investor more than an unwarranted belief in their own abilities, because when we invest in stock markets we are playing with uncertainty.

One of the best papers on this subject may be "Managing Overconfidence", by the strategic management experts J. Edward Russo and Paul Schoemaker, and includes a Confidence Test, which has a nasty tendency to reveal to us exactly how biased we are. We are all generally far more confident than we have any right to be: as the research paper points out, we really ought to know how much we don't know. Unfortunately, as copious amounts of research continue to reveal, we often have very little appreciation of how foolish we really are.

As Russo and Schoemaker showed and as lots of other research confirms, experience does go some way toward reducing overconfidence (sometimes) and the effects of hinsight, but only a little, and levels of overconfidence, even in areas in which we are supposedly experts, are still dangerous high.

Addressing this isn't easy, but one surefire way of reducing the effects is to force people to face up to their errors. Three groups of professionals have been shown to be reasonobly good forecasters. In each case these groups get constant, unrelenting feedback about their forecasts!

This may be because of the business area of because of corporate policies, but either way it's clear that the feedback is effective at improving accuracy - although it should also be noted that the visibility of this feedback means that people who aren't able to adapt to the demands of the situation are likely to find themselves investigating alternative career opportunities fairly quickly: this is evolutionary style self-selection at work!

The fact is, feedback works, if you can tolerate it. Unfortunately most people can't, because it's too painful...