Related Categories

Related Articles

Articles

BOFA Fund Manager Survey (Oct. 2016)

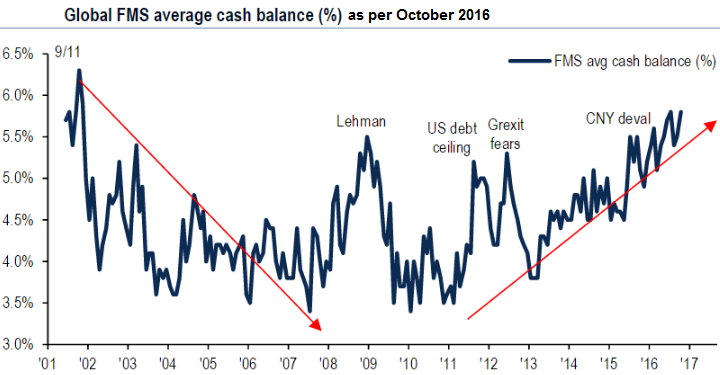

Cash Allocations are Close to 15-Year Highs

Cash levels jumped from 5.5% in September to 5.8% in October 2016. Investors' average cash balance was last this high in July 2016 (post-Brexit vote) and in Fall 2001.

More precise: The share of cash hasn't been higher than that since November 2001, shortly after the terrorist attacks in the U.S.

"This month’s cash levels indicate that investors are bearish, with fears of an EU breakup, a bond crash and Republicans winning the White House jangling nerves," said Michael Hartnett, the bank's chief investment strategist. Elevated cash balances potentially sets the stage for a stock-market rally, according to the Bank of America analysts.

"When average cash balance rises above 4.5 percent a contrarian buy signal is generated for equities. When the cash balance falls below 3.5 percent a contrarian sell signal is generated," writes Hartnett's team in their report.

In the three months following 9/11 and the Brexit referendum, the S&P 500 rose by 4.1 and 2.4 percent, respectively. Merrill Lynch suggests greater clarity on U.S. and euro-area political developments, signs of corporate-earnings momentum and confidence that bond-market repricing will happen in an orderly manner would buoy global stock markets. The survey also highlights that inflation expectations are at a 16-month high, while stagflation fears have reached their highest level since April 2013, with the latter perhaps, in part, driven by events in the U.K.

Further Highlights:

♦ With inflation expectations at a 16-month high and perceptions of developed market equity and bond valuations at record highs, investors are no longer underweight in commodities for the first time since December 2012.

♦ Allocation to EM equities rises to the highest overweight in 3.5 years, from 24% last month to 31% in October.

links: