Related Categories

Related Articles

Articles

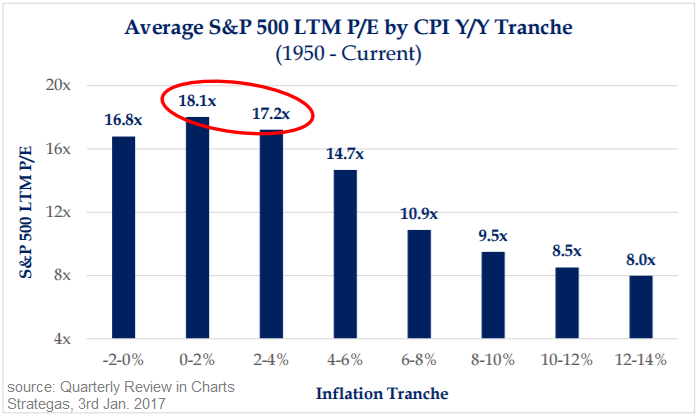

Valuation S&P 500 (P/E under Inflation)

In the context of the inflation outlook in the U.S. and the developed world, there appears to be little risk for earnings multiples in the short term. Historically, zero to 2% inflation has remained the sweet spot for valuations. Even slightly...

...higher readings, say 2-4%, don't appear to lead to meaningful multiple erosion. It's only when investors see signs of deflation (< 0%) or greater than 4% inflation that multiples appear mostly greatly at risk.

♦ 130.89 x 18.1 = 2,369 points S&P 500

♦ 135.14 x 18.1 = 2,446 points S&P 500

♦ 135.12 x 18.1 = 2,445 points S&P 500 (Forward 12-Month EPS/source Factset, 7th April 2017)

links:

www.diamond-hill.com/valuing-u-s-equities

.pdf

www.trpropresearch.com/pdf

.pdf

www.yardeni.com/Pub/peacockfeval.pdf

(7th April 2017 .pdf)

https://insight.factset.com