Related Categories

Related Articles

Articles

Since 2009 the market has paid less attention to traditional value factors like price-to-earnings (P/E) ratios and dividend yields - despite the fact that these factors have provided sizable return premiums over the long term.

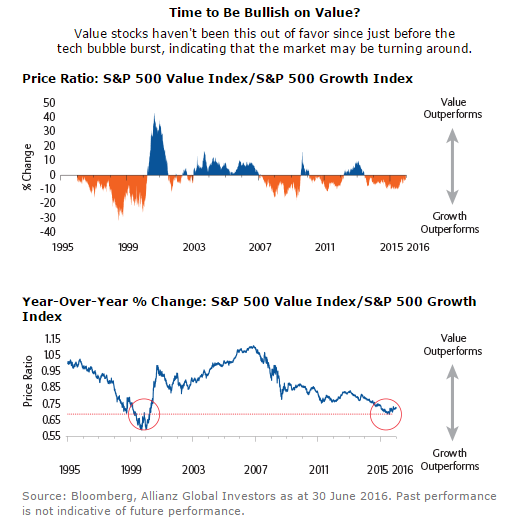

Clearly, everything has its season, and it is fair to say that it has been a long, cold winter for value investors who are committed to the style. Indeed, value has not been this out of favor since the high-flying days of the tech bubble in the late 1990s.

It is important to remember, however, that growth/value cycles tend to be mean-reverting and, on average, have lasted between seven and 10 years from trough to peak. With the growth style now in its ninth year of relative outperformance, the current phase of this cycle may be drawing to a close, and we may soon be likely to enter an environment that once again favors value investing.

Once the shift from "Growth to Value"/in the market occurs, as shown in the accompanying charts, yesterday’s laggards could become tomorrow’s leaders — and investors may want to be positioned accordingly. Of course, no one has a crystal ball that says exactly when the cycle will flip, but there are some signs that a shift may already be occurring, including:

Some positive signs:

♦ Higher U.S. interest rates

History shows that shortly after an initial rate hike, value stocks have outperformed in a persistent and pervasive manner. It is worth noting that “liftoff” for the current rate-hike cycle occurred in December 2015.

♦ A weakening U.S. dollar

Value indexes are skewed toward market segments like energy, industrials, and “old tech”, which derive significant revenue abroad. The U.S. dollar DXY, -0.80% has been losing value, which may provide these companies with an earnings tailwind.

♦ Strengthening commodity markets

Value outperformance is positively correlated with rising commodity prices.

Given today’s market conditions, it seems prudent to keep exposure to value-oriented investments focused on income from dividends and low-valuation P/E multiples.

Furthermore, the current picture of the Small Cap Stocks and its performance regarding the "subsectors" Value versus Growth since the turnaround (February 2016) is pretty impressive and indicates a possible outperformance of VALUE-Stocks versus Growth Stocks in the medium term (at least), please see below! But one should also keep in mind, that the real tailwind for Value-Stocks might come up from January 2017 onwards, where "Value" tends to outperform "Growth" until April (Seasonality according to data from E. Fama and R. French covering a timespan from 1927 up to 2014).

RUJ indicates the Russel Value Index versus the RLG (Russel Growth Index):

links:

www.cnbc.com/2014/04/07/2-charts-tell-the-whole-story-of-value-vs-growth