Related Categories

Related Articles

Articles

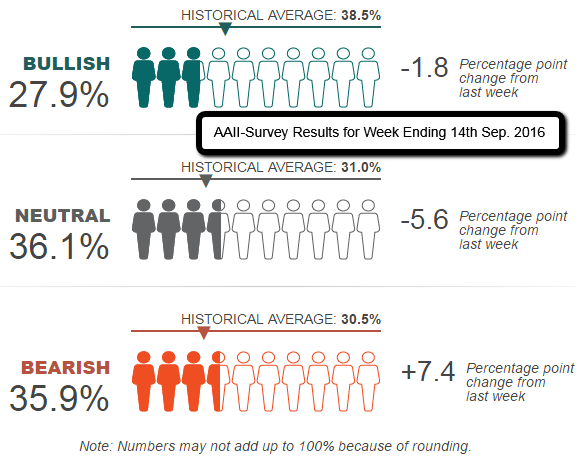

AAII Investor Sentiment (Sep. 2016)

The AAII Investor Sentiment Survey has become a widely followed measure of the mood of individual investors. Pessimism rose to its highest level since last June, while neutral sentiment fell to a level not seen since February 2016.

Pessimism jumped to a three-month high as more than one out of three individual investors described their short-term outlook as "bearish" in the latest AAII Sentiment Survey. At the same time, neutral sentiment fell to its lowest level since February 2016. Bullish sentiment is also lower. Please find following details, especially the info on Bullish sentiment is very informative to me (me often being a so-called Contrarian...):

♦ Bullish sentiment, expectations that stock prices will rise over the next six months, fell 1.8 percentage points to 27.9%. The decline puts optimism at its lowest level since June 22, 2016 (22.0%). The decline also keeps bullish sentiment below its historical average of 38.5% for the 78th week out of the past 80.

♦ Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, plunged 5.6 percentage points to 36.1%. Neutral sentiment was last lower on February 17, 2016 (32.1%). Nonetheless, neutral sentiment remains above its historical average of 31.0% for the 33rd consecutive week.

♦ Bearish sentiment, expectations that stock prices will fall over the next six months, jumped 7.4 percentage points to 35.9%. Pessimism was last higher on July 15, 2016 (37.5%). This week’s rise puts bearish sentiment above its historical average of 30.5% for the second time in three weeks.

This week's special question asked AAII members what they thought about the NASDAQ setting a record high last week. Responses were mixed. About 21% thought the new record high was a positive event. Another 5% said the record high was expected to eventually occur.

direct link: http://www.aaii.com