Related Categories

Related Articles

Articles

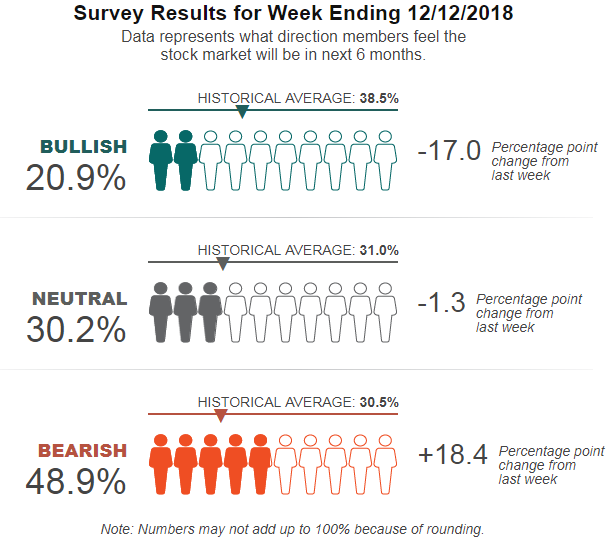

Pessimism among individual investors jumped to its highest level in more than five and a half years in the latest AAII Sentiment Survey. Optimism plunged, and neutral sentiment declined.

Bearish sentiment, expectations that stock prices will fall over the next six months, spiked by 18.4 percentage points to 48.9%. This is the highest level of pessimism registered by the AAII-survey since 11th April 2013 (54.5%). The large increase keeps bearish sentiment above its historical average of 30.5% for the 10th consecutive week and the 13th out of the last 14 weeks.

At current levels, pessimism is unusually high and optimism is unusually low. Historically, both have been followed by higher-than-median six- and 12-month returns for the S&P 500 index, particularly unusually low optimism...