Related Categories

Related Articles

Articles

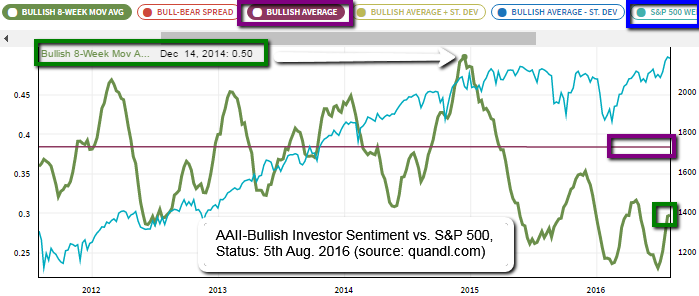

AAII-Bullish Investor Sentiment vs. S&P 500

(07/2011 - 5th Aug. 2016)

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 1.5 percentage points to 29.8% as per 4th August. Optimism was last lower on 29th June 2016 (28.9%).

This is the 39th consecutive week and the 72nd out of the past 74 weeks with a bullish sentiment reading below its historical average of 38.5%!

Neutral sentiment is back at an unusually high level. At the same time, fewer than 30% of individual investors describe their short-term outlook as "bullish," for the first time since the end of June 2016. Concerns about valuations and the presidential election are having an impact.

In addition to prevailing valuations and the election, global economic uncertainty (including Brexit) and disappointment with corporate earnings growth are giving some individual investors reasons to be cautious or pessimistic. Others feel that the perceived lack of viable investment alternatives, economic growth and generally upward momentum in stock prices will result in higher stock prices over the next six months.