Related Categories

Related Articles

Articles

AAII Sentiment

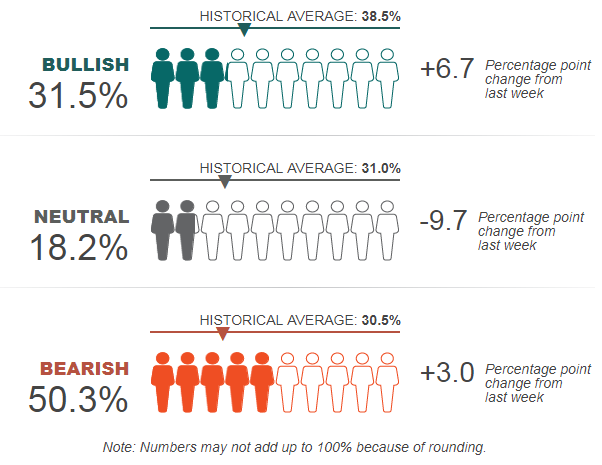

Survey Results for Week Ending 26th Dec. 2018

Data represents what direction AAII-members feel what direction the stock market will be in next 6 months.

Half of individual investors now describe themselves as "bearish" for the first time since 2013. The latest AAII Sentiment Survey shows greater polarization, with neutral sentiment falling to an eight-year low.

Bullish sentiment, expectations that stock prices will rise over the next six months, rebounded for a second consecutive week, rising 6.7 percentage points to 31.5%. Even with the big increase, optimism remains below its historical average of 38.5% for the 14th time in 16 weeks.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, plunged 9.7 percentage points to 18.2%. This is the lowest reading since November 11, 2010 (14.0%). Neutral sentiment remains below its historical average of 31.0% for the eighth time in nine weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, rebounded by 3.0 percentage points to 50.3%. Pessimism was last higher on 11th April 2013 (54.5%). The rise keeps bearish sentiment above its historical average of 30.5% for the 12th consecutive week and the 15th time out of the last 16 weeks.

Since we started the AAII Sentiment Survey in 1987, bearish sentiment has only been at or above 50% approximately 60 times. Put another way, this week’s bearish sentiment reading ranks in the top 4% of all weekly readings. Neutral sentiment is also extraordinarily low, ranking in the bottom 100 out of nearly 1,640 weekly results.

Historically, unusually high levels of bearish sentiment have been followed by slightly better-than-median returns in the S&P 500 index over the following six- and 12-month periods. Unusually low levels of neutral sentiment have been followed by worse-than-median returns for the S&P 500. However, it's important to note that there have been past periods when neutral sentiment was unusually low and bullish sentiment was unusually high.

Cash allocations reached a 33-month high last month according to the AAII-November (2018) Asset Allocation Survey.

Market volatility and worse-than-anticipated returns are influencing individual investors' outlook for the stock market.

Also having an influence are Washington politics (including President Donald Trump and the change in House leadership), tariffs (particularly the ongoing trade war with China), corporate earnings, the Federal Reserve, valuations and concerns about the pace of economic growth.