Related Categories

Related Articles

Articles

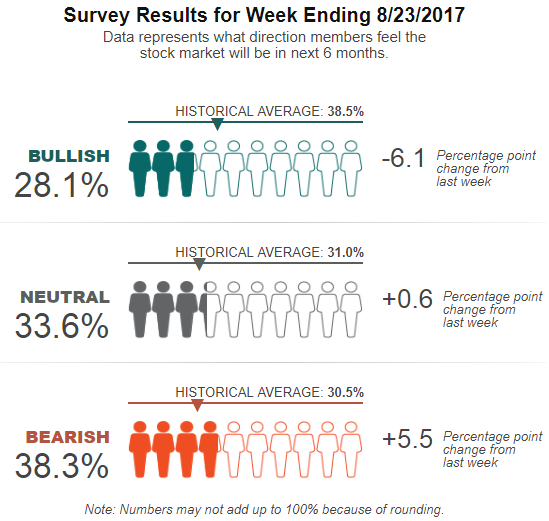

The latest AAII Sentiment Survey shows pessimism among individual investors being at its fifth highest level of the year. The jump in pessimism occurred as optimism dropped. Bullish sentiment, expectations that stock prices will rise over the next...

...six months plunged 6.1 percentage points to 28.1%. Optimism was last lower on 31st May 2017 (26.9%). This is the 26th consecutive week and the 31st time out of the last 32 weeks that bullish sentiment is below its historical average of 38.5%.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, rose by a modest 0.6 percentage points to 33.6%. The rise keeps neutral sentiment above its historical average of 31.0% for the 17th consecutive week and the 22nd time out of the last 23 weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, surged 5.5 percentage points to 38.3%. Pessimism was last higher on 19th April 2017 (38.7%). This is the fourth consecutive week with a bearish sentiment reading above the historical average of 30.5%.

Recent weakness in the major indexes along with concerns about high valuations are combining to dampen the short-term outlook for stocks among many individual investors. Bearish sentiment has been climbing throughout this month.

Optimism is below 30% for the first time in six weeks. At its current level, bullish sentiment is right at the border between the range of typical readings and unusually low readings.

While this year's record highs for the major indexes continue to encourage some individual investors, many others have expressed concern about the possibility of a pullback and/or the prevailing level of valuations. The Trump administration remains at the forefront of many investors' minds and it is having a significant impact on sentiment. Other factors playing roles are valuations, earnings and interest rates/monetary policy...

Recap on Historical averages:

Bullish: 38.5%

Neutral: 31.0%

Bearish: 30.5%

Further Infos on/from: www.aaii.com/sentimentsurvey