Related Categories

Related Articles

Articles

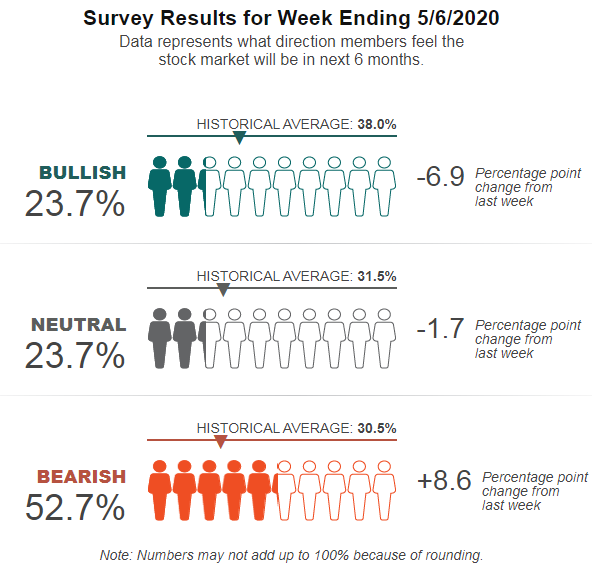

AAII Sentiment Survey (7th May 2020)

The level of pessimism among individual investors about the short-term direction of the stock market is at its highest level in more than seven years. The latest AAII Sentiment Survey also shows a drop in optimism and a decline in...

...neutral sentiment. Bullish sentiment, expectations that stock prices will rise over the next six months, fell 6.9 percentage points to 23.7%. Optimism was last lower on 9th October 2019 (20.3%). Bullish sentiment is below its historical average of 38.0% for the ninth consecutive week and the 14th week this year.

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, pulled back by 1.7 percentage points to 23.7%. Neutral sentiment remains below its historical average of 31.5% for the 12th consecutive week and the 16th time in 17 weeks.

Bearish sentiment, expectations that stock prices will fall over the next six months, rose 8.6 percentage points to 52.7%. Pessimism was last higher on 11th April 2013 (54.5%). The increase keeps bearish sentiment above its historical average of 30.5% for the 11th consecutive week.

Pessimism has been at an unusually high level for nine consecutive weeks. On five of those nine weeks, bearish sentiment has been at or above 50%. Optimism, meanwhile, is at an unusually low level for the second time in three weeks.

The continued high level of pessimism reflects the ongoing bear market and the coronavirus pandemic. However, some AAII members have been encouraged by the rebound in the stock market from its March lows. Other factors influencing AAII members' sentiment include the November elections, corporate earnings, economic growth and valuations.