Related Categories

Related Articles

Articles

AAII Investment Survey (29th July 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism among individual investors about...

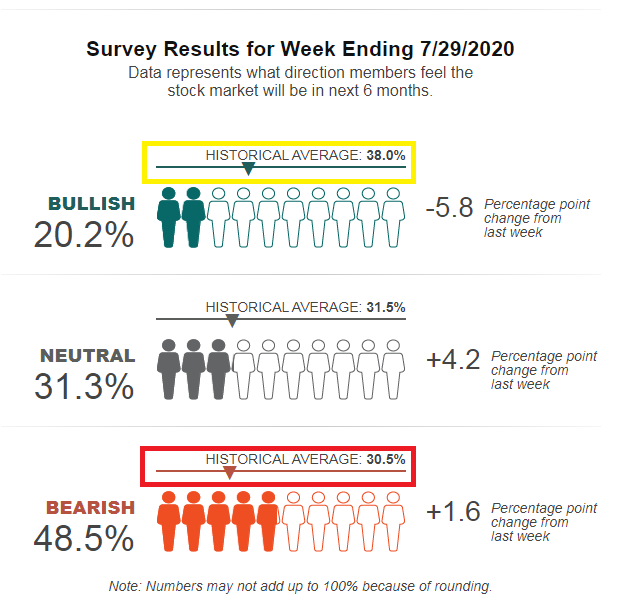

...the short-term direction of the stock market is at its lowest level in over four years. The latest AAII Sentiment Survey also shows higher levels of neutral and bearish sentiment. Bullish sentiment, expectations that stock prices will rise over the next six months, fell 5.8 percentage points to 20.2%. This ranks among the 40 lowest readings ever recorded by the AAII Sentiment Survey. Optimism was last lower on 25th 2016 (17.8%). The drop keeps bullish sentiment below its historical average of 38.0% for the 21st consecutive week and the 26th week this year!

Neutral sentiment, expectations that stock prices will stay essentially unchanged over the next six months, rose 4.2 percentage points to 31.3%. The historical average is 31.5%.

Bearish sentiment, expectations that stock prices will fall over the next six months, rose 1.6 percentage points to 48.5%. essimism is above its historical average of 30.5% for the 23rd consecutive week and the 25th time this year.

As noted above, this bullish sentiment ranks among the 40 lowest readings out of more than 1,700 weekly results! Meanwhile, bearish sentiment remains at an unusually high level for the 19th time out of 21 weeks. Historically, both have generally been followed by above-average and above-median returns for the S&P 500 index(!), though the link is stronger for unusually low optimism than it is for unusually high pessimism.

Data-source and text: www.aaii.com