Related Categories

Related Articles

Articles

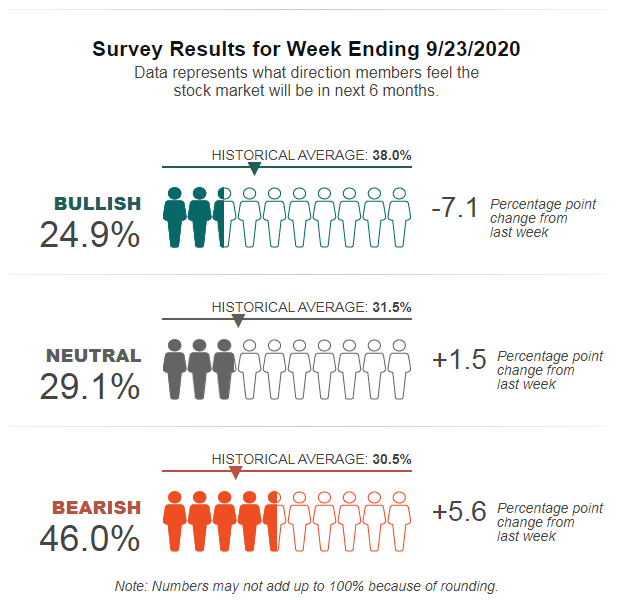

AAII Investment Survey (24th September 2020)

Since 1987, AAII members have been answering the same simple question each week. The results are compiled into the AAII Investor Sentiment Survey, which offers insight into the mood of individual investors. Optimism experiened...

...its largest weekly percentage-point drop since June 2020 and is now back at an unusually low level. The latest AAII Sentiment Survey also shows higher levels of neutral and bearish sentiment.

Bullish sentiment, expectations that stock prices will rise over the next six months, dropped by 7.1 %points to 24.9%. Bullish sentiment remains below its historical average of 38.0% for the 29th consecutive week and the 34th week this year.

Bearish sentiment, expectations that stock prices will fall over the next six months, increased by 5.6 %points to 46.0%. Bearish sentiment is above its historical average of 30.5% for the 31st consecutive week and the 33rd time this year!

Optimism is back at an unusually low level (more than one standard deviation below its historical average). Pessimism continues to stay at an unusually high level. Pessimism is above 40% for the 26th time out of the past 29 weeks.

The persisting high level of pessimism reflects concerns about the coronavirus pandemic, the economy and the upcoming election. The recent decline in the Nasdaq composite may have also played a role. Other factors influencing AAII members' sentiment include the economy, valuations and interest rates...