Related Categories

Related Articles

Articles

For every sector there is a season: Identifying opportune times to trade stock market sectors

Markets, sectors, and even individual stocks have shown a tendency to post annual highs and lows around the same time every year. This cycle is known as market seasonality. Like crops, stock sectors have a growing season, a harvesting season, and a period where they may be fallow. Sector seasonality can be a valuable tool for improving trading and investing results.

Identifying sector seasonality

Sector seasonality was featured in the first 1968 Stock Trader’s Almanac, citing a Merrill Lynch study that showed that buying seven sectors around September or October and selling in the first few months of 1954-1964 tripled the gains of holding them for ten years.

Creating a sector index seasonality strategy calendar

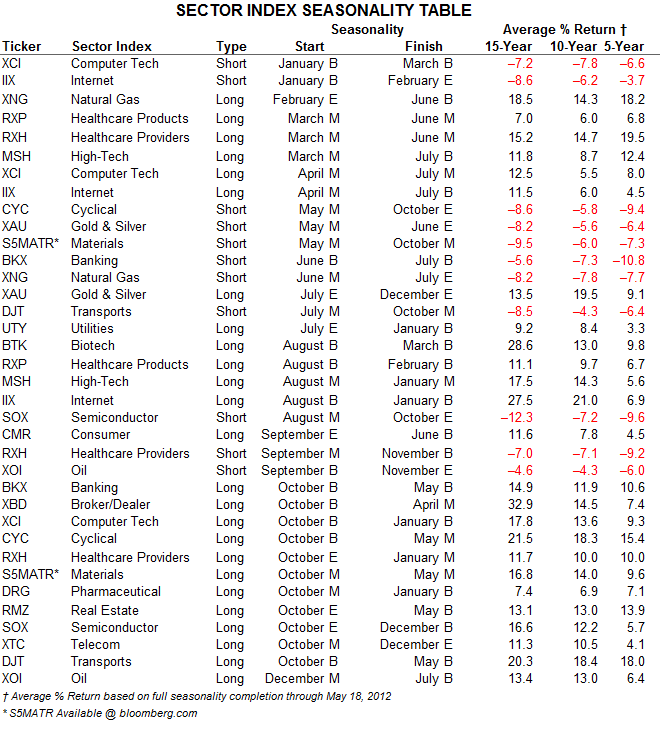

Examination of twenty-one individual sector indices produced the seasonalities listed in Figure 2. This table specifies whether the seasonality starts or finishes in the beginning third (B), middle third (M) or last third (E) of the month. These Selected Percentage Plays are geared to take advantage of the bulk of seasonal sector strength or weakness.

By design entry points are in advance of the major seasonal moves, providing traders ample opportunity to accumulate positions at potentially favorable prices. Conversely, exit points have been selected to capture the majority of the move.

By design entry points are in advance of the major seasonal moves, providing traders ample opportunity to accumulate positions at potentially favorable prices. Conversely, exit points have been selected to capture the majority of the move.

By design entry points are in advance of the major seasonal moves, providing traders ample opportunity to accumulate positions at potentially favorable prices. Conversely, exit points have been selected to capture the majority of the move.

Resumé:

Note the concentration of bullish sector seasonalities during the Best Six Months (November-April), and bearish sector seasonalities during the Worst Six Months (May-October).

JEFFREY A. HIRSCH is editor-in-chief of the StockTradersAlmanac.com and the author of The Little Book of Stock Market Cycles (Wiley, 2012). He is Chief Market Strategist of the Magnet AE Fund.