Related Categories

Related Articles

Articles

“Individuals who cannot master their emotions are ill-suited to profit

from the investment process.”

Quote by Benjamin Graham (Father of Value Investing and Warren Buffett's teacher at Columbia Business School)

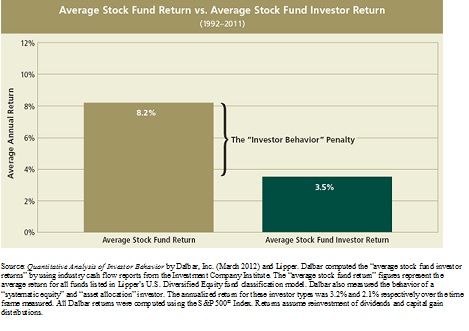

A study by Dalbar underscores the importance of controlling emotions and avoiding self-destructive investor behavior. From 1992–2011, the average stock fund returned 8.2% annually while the average stock fund investor earned only 3.5%. We call the gap between these results the “investor behavior penalty.” Why have investors historically sacrificed more than half their potential return? Driven by emotions like fear and greed, they succumbed to negative behavior such as:

• Pouring money into the latest top-performing manager or asset class, expecting the winning streak = to continue

• Avoiding areas of the market that have performed poorly, assuming recovery will never occur

• Abandoning their investment plan by attempting to successfully time moves in and out of the market, a near impossible feat

Successful investors throughout history have understood that building long-term wealth requires the ability to control emotions and avoid self destructive investor behavior.

source: http://csinvesting.org

Average Stock Fund Return vs. Average Stock Fund Investor Return (further data-series)

1994-2013: 8.7% vs 5.0%

1992-2011: 8.2% vs. 3.5%

1988-2007: 11.6% vs. 4.5%