Related Categories

Related Articles

Articles

Those who won't go with the time will go with the time

In July 1998 (one month before Warren Buffet turned 68 years; easy to calculate: He was born in 1930 :-) Warren could have gone into pension...I am not sure, if it was really senseful of him or helpful to stay in the investing field...

...after having earned plenty of billions throughout a lifetime-career in the investment - business. Especially after having enjoyed the goldilocks decades of 1980 and 1990 (unfortunately my / Ralph Gollner / first steps in the stock-market appeared in March 2000...).

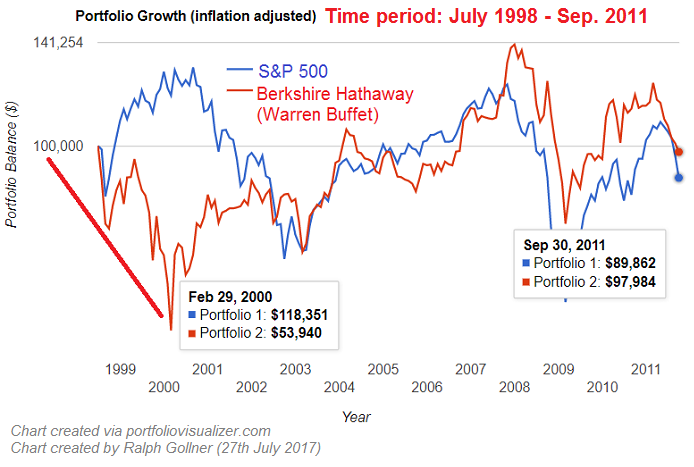

Well, indeed, in the period from July 1998 until September 2011 Warren Buffet and his investment-vehicle Berkshire Hathaway produced no REAL gains. Inflation-adjusted an investment-amount of 100 kUSD invested as per July 1998 turned out to be only worth 97,984 USD in Sep. 2011 - in real terms. But, still, Warren Buffet managed to outperform the S&P 500 during this period.

In nominal terms, to be honest, Warren Buffet managed to achieve an annual return of ca. 2,4% in that period. After inflation (as mentioned above, or in other words: in real terms), the annual return was minus 0.15% per year - therefore destroying some value in a time period of 13 years. Interesting, that I have never ever really read an article about that experience.

Just fyi: in 2015 the stock of Berkshire H. lost ca. 12% of its value, but: In 2016 Warren Buffets' investment vehicle gained again over 23% !

One conclusion might be: In the stock-market one needs to have a Long-Term view and some patience. But you might ask: Is an investment-horizon of 13 years not long enough? Well, afer a "Kindergarden-period" like in the 80s and 90s one might have considered stepping from ones horse and rto elax for a couple of years. I think this approach would have saved Warren nerves or some of his investors some nights of lost sleep...

But the saying goes: In the aftermath everyone knows what might could have worked out - and what not...

Just another thought of mine (Ralph Gollner) regarding the 80s and 90s: I always refer to these years as the KINDERGARDEN-years (easy returns, low risk), which eventually led -according to my humble opinion- to the greed-peak in the year 2008 (Real-Estate Bubble).

Personally I RE-started my Portfolio in the summer of 2015 and I am competing with Berkshire Hathaway, the vehicle of Warren Buffet. I know that Warren Buffet is not investing in Amazon or Facebook or the like, therefore sill relying on traditional Plays like American Express or Coca-Cola...

Well, my personal strategy takes a view, that a mix of VALUE and new Technology companies, yet combined with traditional Technology-Companies may be a possible way, how to invest in the years to come (meaning an investment-decade: 2018 - 2028).

Anyway - we will only see in the future, what returns such a strategy will bring. Furthermore, coming from a Risk-Management-Background I will try to avoid any downturn like the one Warren Buffet took in the year 2008 (Warren Buffet took a hit of MINUS 31% that year !).