Related Categories

Related Articles

Articles

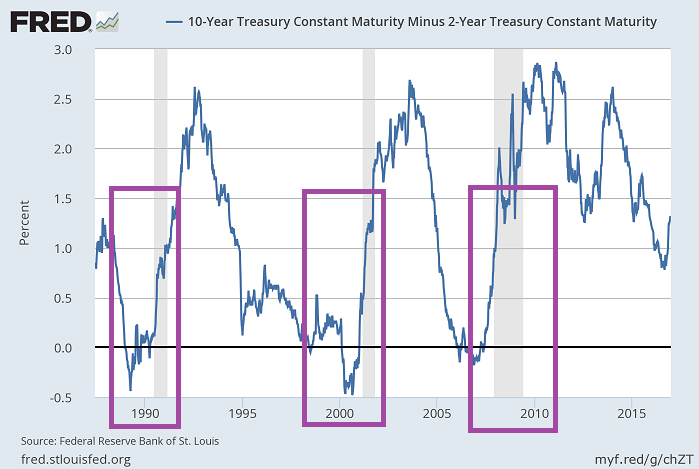

10year US, 2year US (study on FX-impact)

Very theoretic, but good to think about it; most recent yield steepness observed (rising since several weeks already). For information purposes: Shaded areas indicate U.S. recessions in the last decades.

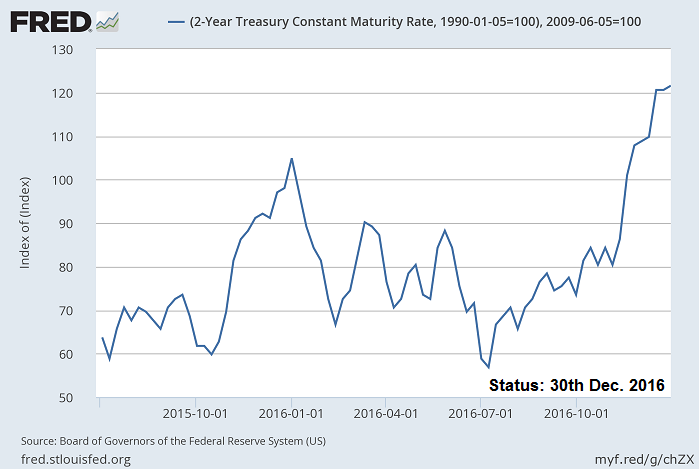

Important to know also, that from a rising interest-rate environment, not only banks should profit, but the whole overall economy - indicating the positive judgement of the Central Bank about the health of the economy (otherwise they would not raise the rates - OR would be extremely fearful of exploding inflation numbers - "Remember Mr. Volcker decades ago...).

I wanted to pull these 2 charts (Long-Term and relatively short-term overview of the US-Short Term rates, 2YR) in order to give you an idea, how the Market sees the possible effects of the Central Bank policy. Rising Market rates should either indicate a positive feeling of the market participants about the future of the economy and/or rising inflation figures on the horizon...

Eventally I will give you a link to check out a study regarding the possible "link" between Interest-rate-differentials and movement in the Foreign-Exchange Market: