Related Categories

Related Articles

Articles

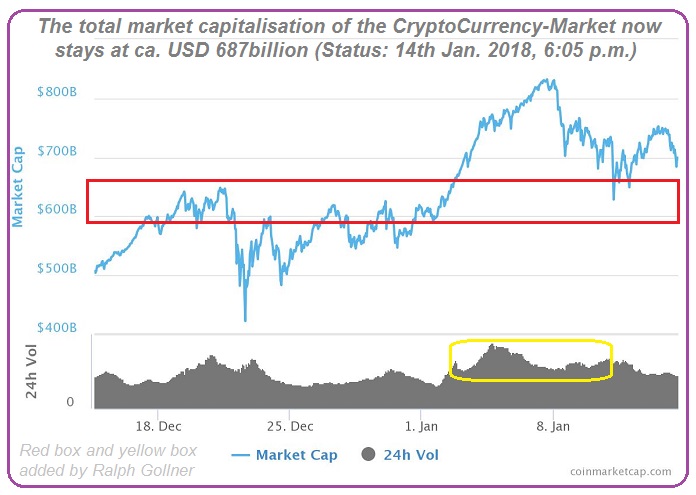

Cryptocurrencies Total-Market Cap ("now")

The cryptocurrency "Bitcoin (BTC)" is still number one - following the units issued times current market price per BTC. But there are many other cryptocrrencies around. In total they now make up more than USD 680 bn in Market Value:

From the chart above one can see that I (Ralph Gollner) see "special risiks" if the Total Market-Cap of the Cryptocurrency-space falls below the magic USD 600bn-level >>> a Level which has established itself as some kind of relevant support / signal-level to look at.

There are many questions from Newbies, who are interested of knowing how these markets really work, how volatile most of these cryptocurrencies really are, what the chances are out there, but some of them also ask the most important questions like:

Question #1: How risky is this market?

Answer #1: These are highly volatile "instruments". Therefore (new) traders could take the following steps:

♦ Think of stops in terms of a zone, not a single point.

♦ In the stop zone, you could put several stops on several tranches.

♦ Hunt-and-destroy algorithms are often active in the market. Consider not putting stops where it is obvious to professionals.

♦ You could use wider stops.

♦ Well, stops are only your second line of defense.

Q: What is the first line of defense?

A: The first line of defense is the position size.

Q: Why does the market always do this to me? (Stock runs after I get out, my stops hit, my order did not fill, and so on.)

A: Consider changing you mind set. The market does not do anything to you. The market doesn't even know that you exist.

Q: What can be done about this great investment that is now a loss?

A: Look at a vast majority of "Bitcoin- and Blockchain-related Buys" as a trade, not an investment. Your (INITIAL) plan ought to be NOT to lose money, but to take profits "if needed", even if this means to hold it for a short time but still be in Green (instead of Red).

Q: What can be done about cryptocurrencies running after I get out?

A: Consider the following steps:

♦ At the time of entering the trade, have a first target and, when appropriate, a second target.

♦ Think of targets in terms of zones, not a single point ! (see "my RED BOX in the Chart" above)

♦ Scale out instead of getting out at one time.

♦ You could raise stops to protect profits.

Q: What indicators should I use on the chart?

A: This is a complex subject, and it will take a book or seminars, etc. to answer the question. The most important tip is to avoid redundant indicators. For example, RSI (relative strength index) and stochastics may be redundant in many situations.

Most answers to the stated questions above were (initially) taken from Nigam Arora; Nigam Arora is an investor, engineer and nuclear physicist by background and has founded two Inc. 500 fastest-growing companies. He is the founder of The Arora Report, which publishes four newsletters.