Featured Articles

Irrational Exuberance (Book)

Robert J. Shiller, Co-Winner of the 2013 Nobel Prize in Economics published a New York Times Bestseller:

Irrational Exuberance is about something far more important than the current situation in any given market because the book explains the forces that move all markets up and down. It shows...

Latest Articles

Best Places to work (also to invest?)

Best Places to work (also to invest?)

NO FINANCIAL ADVICE

Since 2009, Glassdoor has released a yearly ranking of the "best places to work" based on their own data collected from employees. Investing in Glassdoor's best places to work would have more than doubled your money...

...compared ...

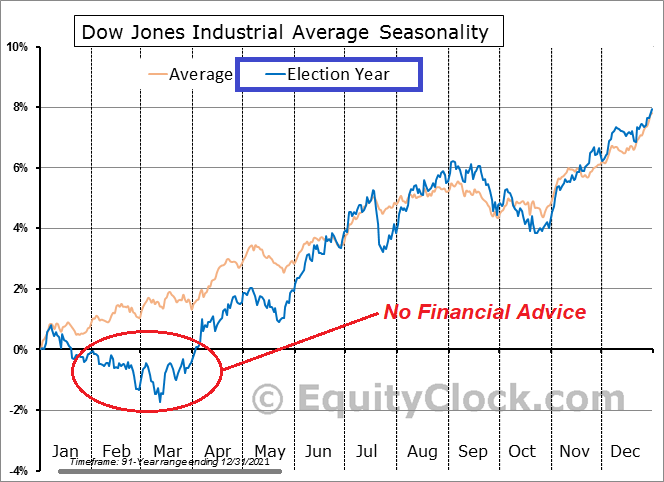

Dow Jones (Election Year Seasonality)

Dow Jones (Election Year Seasonality)

According to the 2021 Dimensional Funds report, the market has been favorable overall in 20 of the 24 election years from 1928 to 2020, only showing negative returns four times. When you further examine the years between elections,...

...however, it ...

Dow Jones might look juicy (to me)

Dow Jones might look juicy (to me)

I really like the pattern, the Dow Jones Industrial Average (Index consisting of only 30stocks) built over the last 2years. It seems to me, that momentum is building up and that might lead to some more upward moves. No Financial Advice!

If the "DOW" is ...

Charlie Munger - RIP

Charlie Munger - RIP

With 99 years of age Charlie Munger, the right Hand of Warren Buffet passed away on the 28th Nov. 2023. Following short 33-Minutes long podcast (pl. click here below) was recorded in the year 2015, where Ten Griffin give us -also- some insights into the thinking of ...

MSCI World - interessantes Chartbild

MSCI World - interessantes Chartbild

Persönlich finde ich den Kursverlauf vom Weltaktienindex "MSCI World" sehr interessant. Relativ stabil kämpft sich der Index seit Jahresanfang Richtung Allzeithoch zurück. Es wird nun spannend, ob der Index sein Level auch über...

...die Sommermonate ...

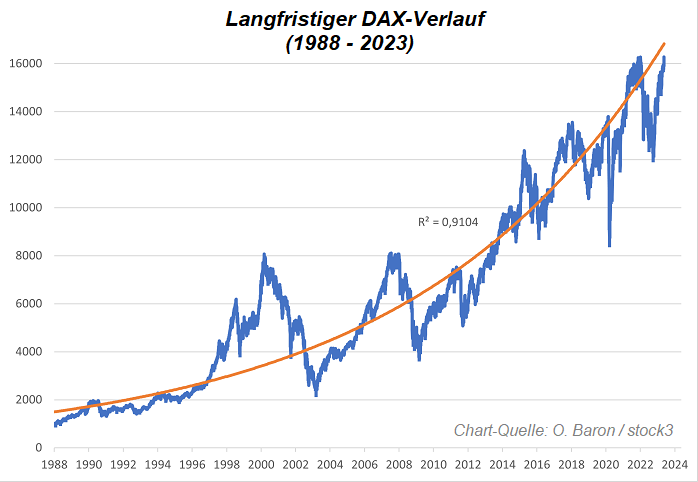

DAX bis in das Jahr 2050 hinein

DAX bis in das Jahr 2050 hinein

(Status 2023)

Ein Blick in die Vergangenheit reicht völlig: die Erfahrung der vergangenen Jahrzehnte und Jahrhunderte zeigt, dass die Kurse breiter Aktienindizes auf lange Sicht exponentiell steigen. Wie langfristiges exponentielles Wachstum der...

...

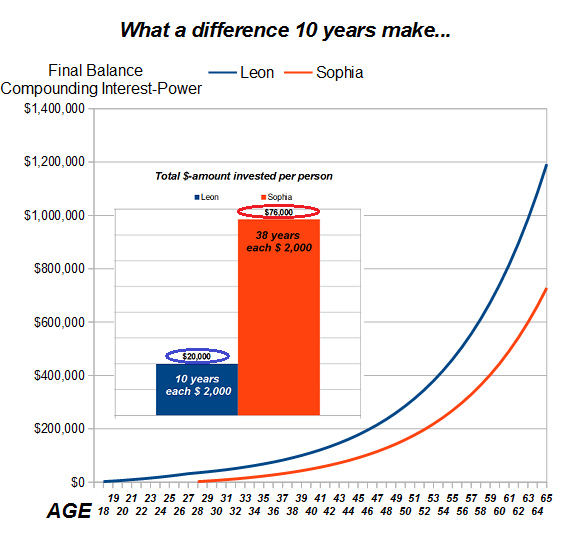

Investing: Starting early!

The Power of Compounding

The Magic of starting early and INVESTING LESS!

At the beginning of the 21st century most young people are told that social security won't be there for them when they retire from the work force. Thus, in order to be able to completely retire from the...

...workforce, ...

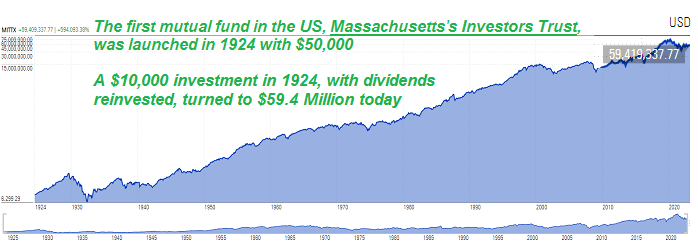

First mutual fund in the US (year 1924 onwards)

Long-Term Compounding (1924 onwards ;-)

The first mutual fund in the US, Massachusetts's Investors Trust, was launched in 1924 with $50,000. A $10,000 investment in 1924, with dividends reinvested, turned to $59,419,337 today!

>> That's the power of long-term compounding in action <<

From ...

2022 - one of the worst years

2022 - one of the worst years ever...

While the S&P 500's 18.1% decline was painful, it was only the fourth-worst stock market year in the last 50 years, only half as bad as the 37% decline in 2008, and better than the 22.1% decline in 2002 and 25.9% decline in 1974.

Yet in each of those ...

Yet in each of those ...