Related Categories

Related Articles

Articles

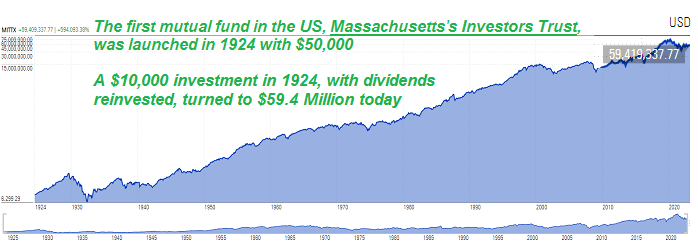

Long-Term Compounding (1924 onwards ;-)

The first mutual fund in the US, Massachusetts's Investors Trust, was launched in 1924 with $50,000. A $10,000 investment in 1924, with dividends reinvested, turned to $59,419,337 today!

>> That's the power of long-term compounding in action <<

From a historical perspective it's fascinating that we will celebrate the first 100 years of the innovation called MUTUAL FUNDS (Investing for the "masses").

In following table one can see and have a sneak inside-view into the portfolio how it was formed in the initial year 1924; Some of these names might still sound familiar to you; Many of the names in the following table must have been taken over and/or merged into new companies or might have even gone bankrupt:

Regarding the performance of the mutual fund one can clearly observe the power of long-term compounding. In the following chart I was able to compare the US Stock Market versus the MFS Massachusetts Investor Trust in a shorter timespan, covering the period 1972 until the most recent month (March 2023). Even though the fund was not able to outperform its benchmark, defined here as the "general US Stock-Market":

Last but not least I wanted to find out what had happened if may parents had invested an amount of $ 10k when I was born (back in May 1978); In fact those $ 10,000 would have turned into $ 1 Million as per March 2023:

Pretty fascinating. To round up this posting I wanted to mention, that the MFS Massachusetts Investor Trust currently manages around $ 6 billion Assets under Management and is open to invest ones money if one wants to.

NO FINANCIAL ADVICE