Related Categories

Related Articles

Articles

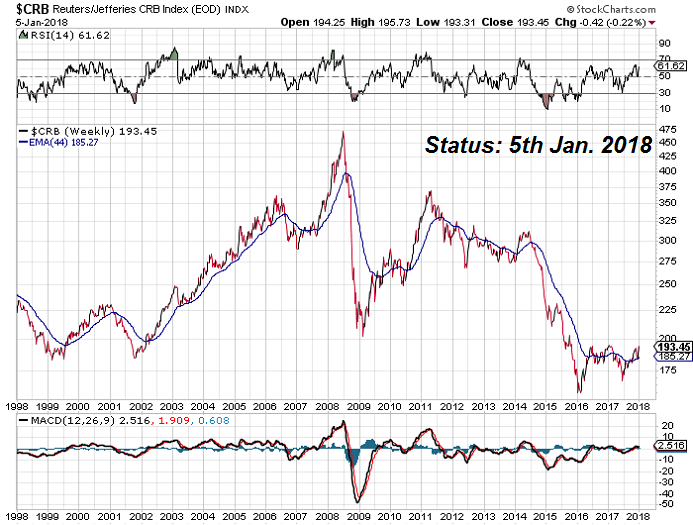

Thomson Reuters/CoreCommodity CRB Index

(near the 200-points level)

The commodities-Index (a basket of "different commodity-prices") is slightly below the "magic" 200-point level. If the index would be able to break-out (substantially) above this level, there might be some room...

...to go. So now et's go on with some info on the...

...METHODOLOGY of the index / Selection

The inclusion or removals of commodities are determined by the Thomson Reuters/CoreCommodity CRB Index Oversight Committee. The Committee take various factors into account when considering inclusion or removal:

♦ Requisite liquidity as demonstrated by suitable levels of open interest, trading volumes, bid/ask spreads

♦ Global economic significance; such as consumption, production levels and trends

♦ Commodity sector correlations, relationships and properties

♦ Contribution to strategic properties commonly associated with commodities as an asset class, e.g., inflation protection, diversification to traditional financial assets, etc.

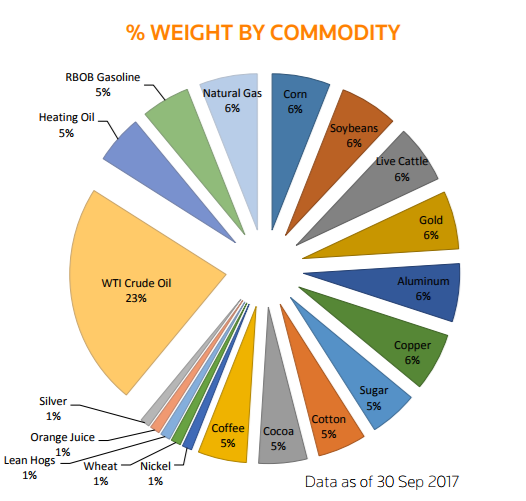

Index Components: Aluminium, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, RBOB Gasoline, Silver, Soybeans, Sugar and Wheat

Weighting scheme: Commodities are organized into 4 groups based on liquidity:

♦ Group 1: Petroleum products - capped at 33%

♦ Group 2: Seven highly liquid commodities (equal weighted at 6%) - capped at 42%

♦ Group 3: Four liquid commodities (equal weighted at 5%) - capped at 20%

♦ Group 4: Five commodities (equal weighted at 1%) - capped at 5%

link / .pdf

https://financial.thomsonreuters.com/content