Related Categories

Related Articles

Articles

The Power of Compounding

The Magic of starting early and INVESTING LESS!

At the beginning of the 21st century most young people are told that social security won't be there for them when they retire from the work force. Thus, in order to be able to completely retire from the...

...workforce, a person has to invest as early as possible in order to take full advantage of the power of compounding.

NO FINANCIAL ADVICE here !

For Illustration purposes let's follow the story of Sophia and Leon:

They both grew up on the same street in the same city. Their mothers gave birth to them at almost the same time. Sophia and Leon went to the same high-school, after which their paths separated.

They lost contact with each other for the next 40 years, at which point they found each other on the Social Media-platform "Tracebook", and met to reminiscence their childhood and talk about grandkids.

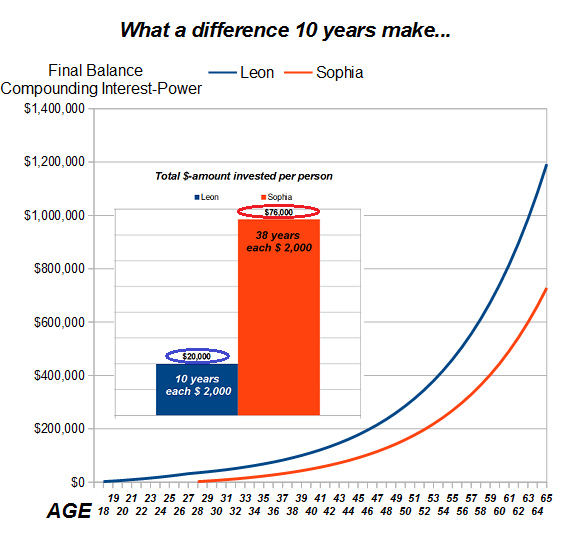

They quickly started talking about their retirement and the amount of money each had at the time of their retirement. Leon who always saved the extra money he earned from jobs at college and his first job after college, started investing $ 2,000 a year in dividend stocks starting at the age of 18 and kept saving and investing the same amount until he was 28:

At that point he had so many expenses in order to pay for the needs of his growing family that he couldn't save anymore. Despite the fact that Leon couldn’t contribute any more to fund his retirement, he was very good at picking solid dividend growth stocks, and was able to generate annual returns of 10% for the next four decades.

Sophia on the other hand had decided that she didn't want to work in college since she wanted to concentrate on her studies while also enjoying the whole college experience. She then decided to go ahead and get a masters degree after which she was able to get a very good job with one of the largest companies in the world.

She did accumulate a large amount of student debt in the process, which she diligently paid off in a record time after she got her first job.

After learning about the importance of saving for your own retirement, she started investing $ 2,000 per year in dividend stocks, and was able to also generate 10% in annual returns. We then fast forward to the age of 65. At age of 65, Leon's net worth is $ 1,192,257.81. Sophia's networth is $ 728,086 at the age of 65.

Final conclusion

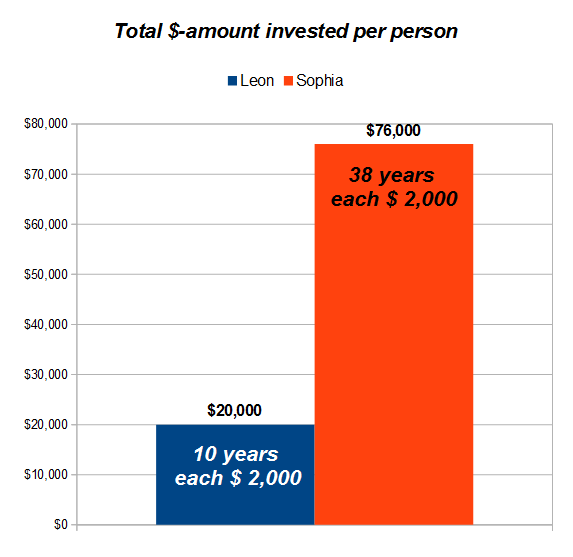

Despite the fact that Loen had invested only $ 20,000 in total, versus $76,000 that Sophia had invested, he was able to achieve a higher amount of wealth because he had taken a full advantage of the power of compounding by investing his hard earned money as early as his freshman year in college.

Takeaway

Even though Sophia contributed money for over 37 years her nest egg was $ 400,000 lower than Leon's, because she had ten years less to utilise the power of compounding.

link to the original article-idea:

www.dividendgrowthinvestor.com/2008/08/importance-of-investing-for-retirement