Related Categories

Related Articles

Articles

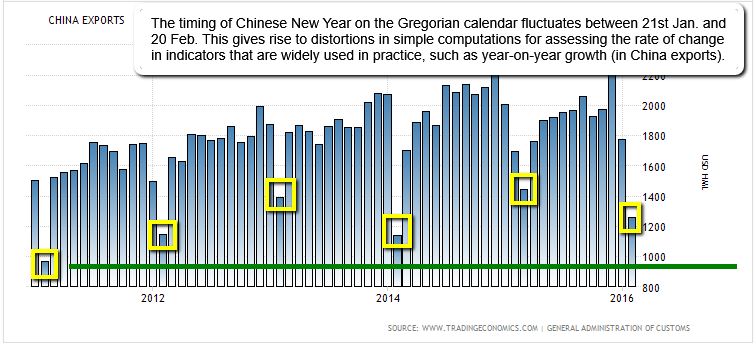

China Exports (New Year-effect, Feb. 2016)

The export crash is misleading in this case because the Jan. & Feb.-months host China’s biggest holiday, the Chinese New Year, when factories rush to meet orders before business shuts down (see yellow boxes in the last years):

Disclaimer "upfront": China’s growing importance in the global economy and significance as a source of demand for commodities produced by many countries, has focused increasing attention on high-frequency Chinese macroeconomic data. Yet the signal from these data is often distorted by traditional holidays whose timing varies from year to year on the Gregorian calendar.

China's exports fell 25.4 percent on-year in February 2016, while imports declined 13.8 percent, clocking far bigger slides than expected by analysts. According to Reuters, the on-year decline in exports in February 2016 was the steepest since May 2009.

According to Julian Evans-Pritchard, an economist at Capital Economics in Singapore, the severe fall in exports largely reflected changes in the timing of the Lunar Year in China this year.

"In 2015, the holiday fell unusually late which meant that more of the pre-holiday rush to meet orders and less of the post holiday disruptions took place in February, causing exports to jump 48.9 percent year-on-year," he said.

It will be another month till we know how bad things are. Short wrap-up: In renminbi terms, the Feb.-drop was the biggest year-on-year drop ever. But panicking now might be early. It’s worth noting that neither the Chinese stock market nor its currency have reacted much to the news.

But to re-emphasise: This year’s figures are still not favorable. The combined January and February export decline this year was 18%, the worst start to a year since 2012, according to HSBC. But the real test for trade will come next month, when China’s struggling export sector gets a favorable baseline comparison to last March, when exports fell 15%.

In the link below a paper shows that seasonal adjustment procedures (such as the US Census Bureau’s X-12-ARIMA and the Bank of Spain’s SEATS) can assist in the timely interpretation of a range of commonly used Chinese macroeconomic indicators, including industrial production, trade, credit and inflation.

paper-download (.pdf), adjusting for Chinese New Year: http://www.rba.gov.au/publications (.pdf)

News/links: http://www.cnbc.com