Related Categories

Related Articles

Articles

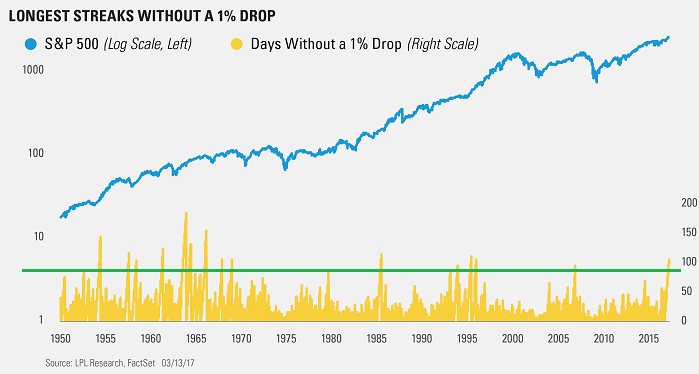

S&P 500 Streaks without a 1%-drop

Is A Lack Of Volatility A Sign Of Complacency?

The S&P 500 Index has gone 104 days in a row without a 1% close lower! In fact, the S&P 500 hasn't moved in a daily range of more than 1% for 59 days in a row, the longest such streak going back 50 years and...

...trouncing the previous record of 34 from 1995. Of course, 1995 wasn’t the worst time to be long equities for the next several years.

Per Ryan Detrick (from LPL), "The lack of volatility is historic in its own right, but is it bearish? History would say we can expect more volatility eventually, but this doesn't mean to be on the lookout for a major correction either. In fact, after a streak of 100 or more days without a 1% drop has ended, the S&P 500 has been up a very impressive median return of 14.4% a year later and higher 75% of the time. In other words, a lack of big down days or a lack of volatility by itself isn’t a warning sign."