Related Categories

Related Articles

Articles

Carl C. Icahn (Investor)

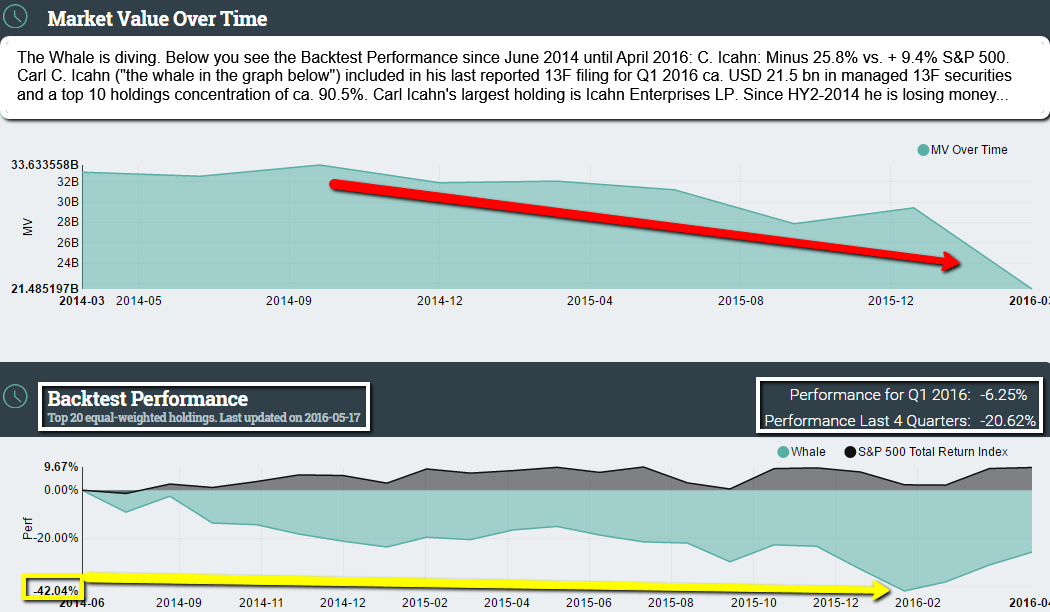

C. Icahn has, unequivocally, shown superior skill as an investor. Consider this: Icahn has returned 31% annualized between 1968 and 06/2015. BUT since 2014 everything got a little bit more difficult...

Still: Based on the weighted portfolio performance he achieved an annual return +12.36% in the last 3 years until 18th May 2016 (based on a total of 27 stocks/source: tipranks.com; data made available by the SEC.)

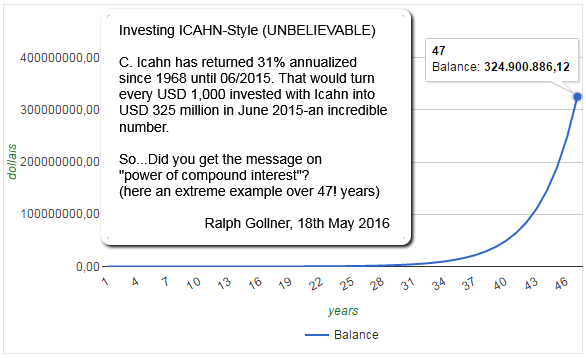

Recap/To put the 31% annual return since the year 1968 into persepective, look at this graph I made: That would turn every USD 1,000 invested with Icahn into USD 325 million by June 2015 – an incredible number:

Buffett, on the other hand, returned 19.5% annualized during virtually the same time period.

Buffett’s growth rate over that length of time is indeed amazing too. Over the same period, the book value of Buffett's Berkshire Hathaway grew 20% annualize, but due to the power of compounding, the wealth creation of Buffett, from pure investment returns, pales in comparison to that of Icahn.

source: http://whalewisdom.com

source: http://whalewisdom.com

♦ So how has Icahn been able to outperform W. Buffett (& the stock market) by so much and for so long?

Of course, Icahn is a dogged shareholder activist and often an agitator of corporate management. Key to his playbook is using power and influence to control his own destiny on stocks he invests in. When we look strictly across the stocks in his portfolio, without necessarily the story-lines, we can see some portfolio traits that have made Carl Icahn the world’s greatest investor.

Trait #1: Over the past 20 years, the stocks in Icahn’s portfolio have a win rate only a tad bit better than a coin toss. But he puts himself in position, so that when he wins, he has the chance to win big! This is the concept of asymmetrical risk to return, a concept often found in the wealth creation of billionaires. They like to invest in opportunities with limited risk and huge potential return.

Among Icahn’s stocks, his winners were almost twice that of his losers.

Trait #2: Icahn became rich by taking concentrated bets throughout his career. As Buffett has famously said, “you only need one or two great ideas a year to get rich.” This is exemplified in Icahn’s portfolio. His big win on Netflix garnered a 463% return in just 12 months, between 2012 and 2013.

Trait #3: Patience is king. You don’t have to go to Harvard or have a Goldman Sachs investing pedigree to have patience. And many times, that can be the difference between making money and losing money in investing. Icahn has an average holding period of over two years.

Trait #4: Risk! When you hunt for big returns, you must be willing to accept drawdowns and losers. Icahn has multiple stocks over the past 20 years that have been full losers (i.e. they went to zero). But when you have a portfolio full of stocks with big potential, in the end the big winners can more than pay for the losers.

♦ Modest origins

People have always underestimated Carl Icahn. Almost 60 years ago, he was told that he would never get into Princeton. No one from Far Rockaway High School, located in New York's now hurricane-ravaged Rockaway peninsula, ever had. Plus, he made the stakes even higher by seeking a full scholarship. He got in - and he got the grant.

After making a fortune in options and arbitrage (the practice of taking advantage of price discrepancies in different markets) in the 1960s and '70s, Icahn became one of the nation's preeminent practitioners of greenmail, a screw-the-shareholder form of activism of dubious morality. A greenmailer would buy stock in an undervalued company and threaten a takeover or some other radical change. Either the company would eventually be acquired or the greenmailer would promise to leave it in peace if his shares - and only his - were purchased at a premium price. When the greenmailer received his payoff, the shares would typically fall.

But greenmail is dead, and Icahn is now a solid corporate citizen. Like Berkshire, Icahn Enterprises is both an investment vehicle and a conglomerate. It is the majority owner of, among other companies, CVR Energy, a refiner and fertilizer producer; Federal-Mogul, an auto-parts supplier; American Railcar Industries, which sells and leases railroad cars; and Tropicana Entertainment, the casino operator.

Temperament

Like Buffett, Icahn believes that it takes a certain temperament to beat the market. And he says it's crucial that investors not confuse luck with success. "When victorious generals came back to Rome," he says, "they used to have a man behind them saying, ‘All glory is fleeting.' "

Perhaps Icahn would be better known and more admired if he had left a brilliant paper trail akin to Buffett's annual letters to Berkshire shareholders. Icahn seems less interested than Buffett in enlightening other investors.

link to C. Icahn - fund: https://www.tipranks.com/hedge-funds/carl-icahn

Forbes-article: http://www.forbes.com