Related Categories

Related Articles

Articles

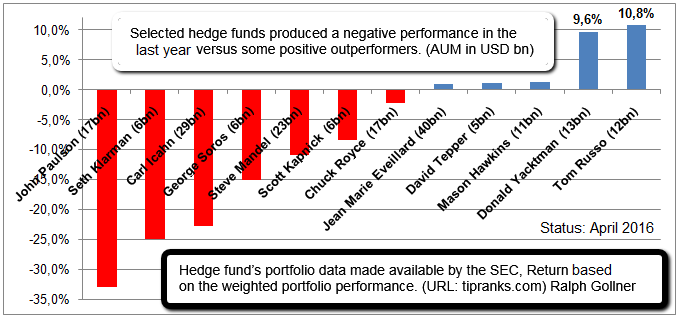

Selected Hedge-Fund performance (2015)

Selected Hedge-Fund performance (year 2015)

In the following overview you can find last years' performance of selected Hedge-Fund Managers, ATTENTION: Last years' return-calculation is based on the weighted portfolio performance:

The more than a dozen (pretty well known) mentioned Hedge-fund Managers were overseeing Total-Assets of > USD 185 billion as per Q1/2016. Unfortunately some of the famous names also produced big losses in the year 2015 ranging from minus 2% up to a loss of even minus 33% in one year (Paulson & Co).

| Asset company | Asset Manager | Last year as per 04/2016 | AUM* |

| Paulson & Co Inc | John Paulson | -33,0% | 17 |

| Baupost Group LLC | Seth Klarman | -25,0% | 6 |

| Carl Icahn C | Carl Icahn | -22,7% | 29 |

| Soros Fund Mangment LLC | George Soros | -15,1% | 6 |

| Lone Pine Capital LLC | Steve Mandel | -10,9% | 23 |

| Highbridge Capital Management LLC | Scott Kapnick | -8,3% | 6 |

| Royce & Associates LLC | Chuck Royce | -2,2% | 17 |

| First Eagle Investmt. Management LLC | Jean Marie Eveillard | +0,9% | 40 |

| Appaloosa Management LP | David Tepper | +1,1% | 5 |

| Southeastern Asset Management Inc | Mason Hawkins | +1,3% | 11 |

| Yacktman Asset Management LP | Donald Yacktman | +9,6% | 13 |

| Gardner Russo & Gardner LLC | Tom Russo | +10,8% | 12 |

*AUM = Assets under Management (Portfolio Value) as per Q1/2016

sample-link: https://www.tipranks.com/hedge-funds/john-paulson