Related Categories

Related Articles

Articles

Stock Market Returns (Rolling Periods)

US stock market returns don't look that extreme relative to history

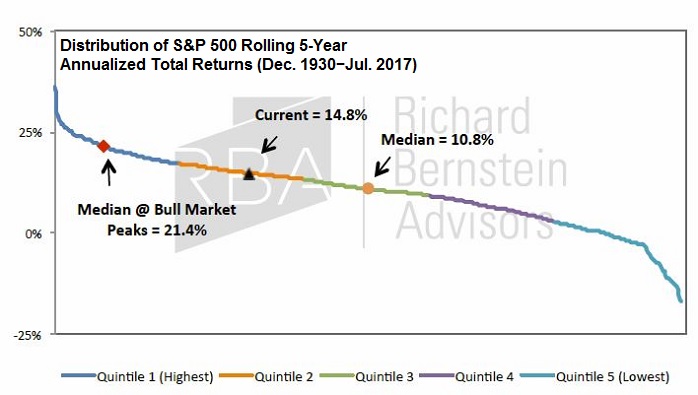

Stock market returns are not as extreme as some might suggest. Following chart contrasts the current five-year return of the S&P 500 with the historical distribution of five-year returns.

Of course, the recent experience is above the median because there is a bull market. However, one should immediately recognize that the last five years' return falls far short of the typical end-of-cycle, "blow off" rally.

The last five years' return of 14.8% is well short of the median return of 21.4% that occurred in the five years leading up to the peak of bull markets.