Related Categories

Related Articles

Articles

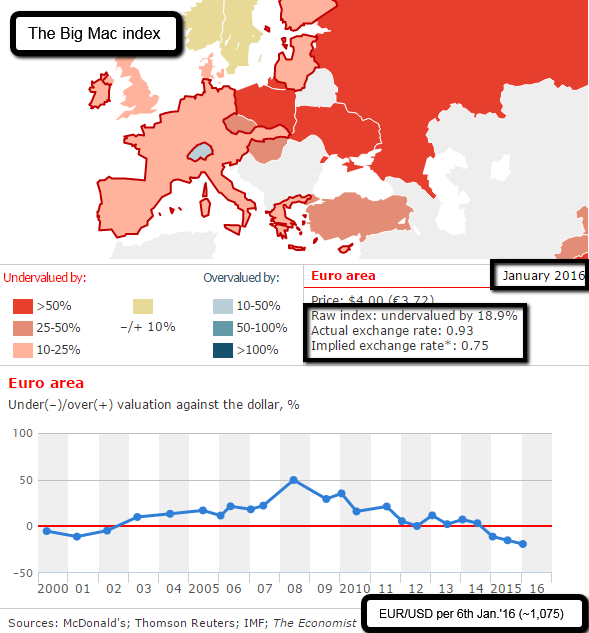

EUR/USD & Purchasing Power Parity (01/2016)

THE Big Mac index was invented by The Economist in 1986 as a lighthearted guide to whether currencies are at their “correct” level.

As can be seen in graph above a currency always floats (!) in the long run (!) around its "fair value". From the beginning of the paper-money EURO until now (Jan. 2016), the EUR/USD-rate was either strongly overvalued or undervalued, in some years even fairly valued (but this is still a subjective assessment!).

The Big Mac index is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (in this case, a burger) in any two countries.

Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible. Yet the Big Mac index has become a global standard, included in several economic textbooks and the subject of at least 20 academic studies. Currently the EUR/USD is floating in a tight band since Dec. 2015:

economist-source (updated calculations): http://www.economist.com