Related Categories

Related Articles

Articles

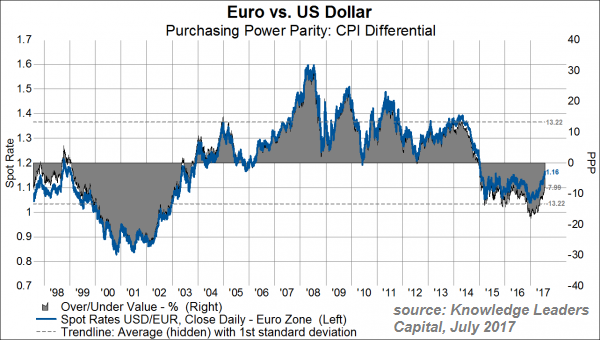

EUR/USD - PPP

(Purchasing Power Parity)

The US dollar might have more room to fall (?)...The USD has been going nowhere but down recently and could be due for a near term reversal or consolidation. However, the fundamentals driving the weakness in the USD persist,...

...namely: monetary policy convergence (or slowing of divergences), relative US economic underperformance, and higher budget deficits in the US.

Furthermore, according to the purchasing power parity (PPP) model -calculated here be Knowledge Leaders Capital- which takes into account price differentials between economies, the USD is still ca. 6-7% overvalued against the euro, ca. 24% overvalued against the yen, ca. 18% overvalued versus the pound, and is sitting right at fair value relative to the yuan.

Given that currencies almost always overshoot their fair value PPP level, the USD could conceivably fall substantially further if it were to reach the other extreme...