Related Categories

Related Articles

Articles

Asset management in China

(years 2018 - 2030)

Asset management in China is a young industry and, as a consequence, Chinese investors, intermediaries and asset managers are not constrained by legacy infrastructure, regulatory frameworks and...

...investment approaches. New thinking can be seen in the proliferation of investment strategies, products and distribution approaches.

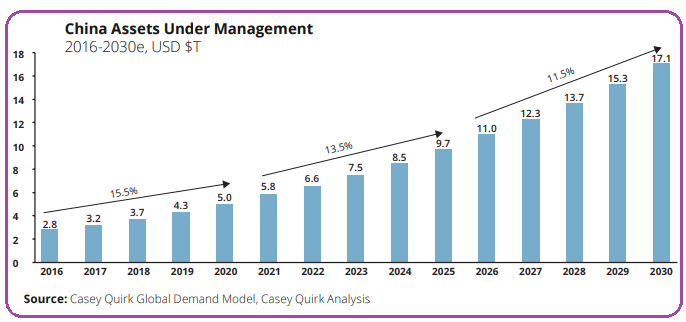

China is the only large, multi-trillion dollar market that has seen net new flows in excess of 30% per year. One can expect Chinese growth rates to average 15% per year through 2025, moderating to 12% per year for 2025 to 2030. In total this will result in USD 8.5 trillion in new assets flowing into the industry from Chinese investors from now on (2018) and 2030. Put another way, China should account for about the same amount of net new flows as all other global markets between today and 2030.

One should expect that as China's demographic profile continues to become wealthier and older, asset management will see a sustained period of growth which will outpace overall Chinese GDP growth.

On top of the sheer scale of growth, China's unique attributes and conditions mean that bold thinking and pushing boundaries are needed. For Chinese firms, this means comfort in experimenting with new products and distribution methods, mindful of the power of scale.

For foreign firms, this requires assigning responsibility for their China strategy to senior management (not the regional sales

organisation only), and collaboration with local players.

Link:

www.marketwatch.com

Online-pdf:

www.caseyquirk.com/content/whitepapers