Related Categories

Related Articles

Articles

Default Rates US-Consumer

(2010 - 2016)

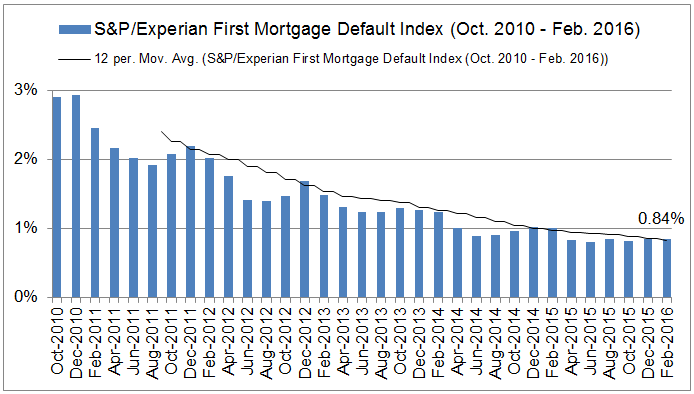

Some years ago S&P Indices launched an index series designed to provide an insightful gauge into the financial health of the American consumer. In the following chart I gathered the two-month interval data showing the improvement since Q4-2010:

Co-developed with Experian®, the S&P/Experian Consumer Credit Default Index Series seeks to measure several critical credit components of consumer balance sheets and track their rolling default behavior.

The S&P/Experian Consumer Credit Default Indices are designed to measure default behavior across a representative sample of Experian’s consumer loan database. The Indices include a loan balance-weighted composite index and four sub-indices that seek to track the default rates associated with:

-) First lien mortgages (represented by the chart above and the long-term chart here below)

-) Second lien mortgages

-) Automobile loans

-) Credit cards

Granularity of the index data:

-) By geography; the Indices can be broken-down by metropolitan statistical area (“MSA”).

-) By credit type; as already mentioned the Indices cover the three major areas of consumer credit: bankcards (the “Bankcard Index”), auto loans (the “Auto Index”) and mortgages (first liens - the “First Mortgage Index” and second liens - the “Second Mortgage Index” collectively, the “Mortgage Indices”). The split among these groups can be traced in the chart below.

-) Comparability: by tracking the marginal default rates monthly, the Indices are designed to gauge consumer behavior.

Furhter insight into the Bankcard Default Index, easily showing the alarming development in 2008 & 2009:

Interested about the significance/volume of debt in each sector? Let us dig into history and the construction of the US-American consumer-debt. The First Mortgate sub-index is by far the largest and most important sector:

Remember Subprime? Representing a small part of the overall-debt (timespan 2004 - Jan. 2010):

Please find further details on this factsheet (.pdf):

Please find further details on this factsheet (.pdf):

http://www.bondsonline.com/files/SandP/ExperianWP_2010_May.pdf

A perfect final resumé about the Overall-consumer-loan market in the US (looks much better than in the last decades!):