Related Categories

Related Articles

Articles

Banking Stocks (US)

Banks are the backbone of every economy. It is very important that banks remain healthy financially, otherwise a financial crisis can hit a country leading to a recession like the US in 2008.

"The banks are the lifeline of the economy and play a catalytic role in activating and sustaining economic growth"! (original remark by the deputy governor of the Reserve Bank of India, S Mundra)

Snapshot as per Q4-2015: Credit quality has improved for the US-banking industry, but increased growth and profitability remain challenging in a low interest rate environment. The net interest margin for banks was 3.02% in the first quarter of 2015, which was a 30-year low according to the FDIC.

Forbes turned to Charlottesville, Va.-based financial data provider SNL for raw numbers that shed light on growth, credit quality and profitability for the 100 largest banks and thrifts. Forbes used 10 metrics to rank America’s Best Banks (the data was drawn from regulatory filings through 30th Sept. 2015). The TOP 10 of this list are ranked here:

If data is not reported at the holding company level, the unitary banking subsidiaries data was used.

If data is not reported at the holding company level, the unitary banking subsidiaries data was used.

Data based on regulatory filings of public banks and thrifts, for the period ended Sept. 30, 2015

NPAs = Loans 90 days or more past due + Nonaccrual Loans + OREO, excluding the guaranteed portion of those loans and OREO under FDIC loss-share plans. Source: SNL Financial

Remark on #1 on the list: The top-ranked bank this year is Ontario, Calif.-based CVB Financial. CVB is the holding company for Citizens Business Bank, which has serviced Southern California as well as the Central Valley area for more than 40 years. It is the 93rd-biggest bank in the U.S. and ninth-largest headquartered in California, with USD 7.6 billion in assets. CVB has been incredibly consistent, logging 154 straight quarters of profitability, even through the depths of the financial crisis, and 105 consecutive cash dividends.

#2: One bank that has bulked up on acquisitions is Los Angeles-based PacWest Bancorp, which ranks second overall. The holding company for Pacific Western Bank has made 28 acquisitions since 2000 and now has USD 21.3 billion in assets (the listed asset figure of $16.8 billion reflects the 30th Sept. number before the close of the company’s Square 1 deal). PacWest scores top five ratings on four metrics: revenue growth (48%), return on average assets (1.8%), net interest margin (5.8%) and efficiency ratio (40%).

#3: Prosperity Bancshares, headquartered in Houston, moves up four spots to No. 3 this year. The USD 22 billion bank has the highest return on average tangible common equity at 22%. The average for the 100 largest banks is 12%. Prosperity also fares well for its efficiency ratio, return on average assets and low level of nonperforming assets.

Resumé: Bank loan data seem to be past their worst levels, and one can believe there are reasons for cautious optimism, other positive points:

♦ Banks are showing a greater willingness to extend consumer loans.

♦ Bank loan quality has continued to improve, implying a tailwind to bank earnings and a

♦ ..possible turn in the deleveraging cycle.

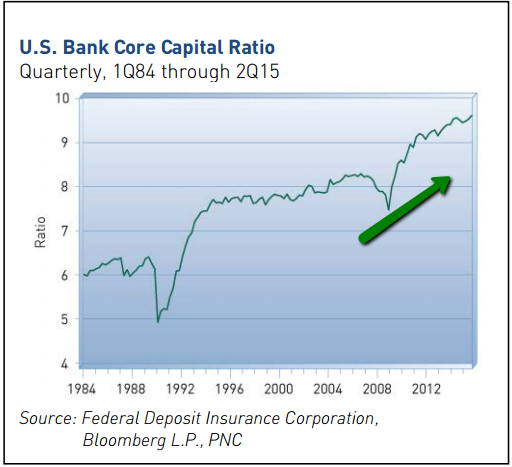

♦ Bank capital ratios have more than recovered, which should allow for loan growth and

♦ furthermore: likely help prevent relapse of financial crisis within the banking industry.

Final remark on the Banks-list and stock-returns: Last year’s top 50 banks returned 7.2% on average in the stock market, twice the return of the bottom 50. Puerto Rico’s Doral Financial, which ranked last three straight years, was one on the eight banks to fail last year. It was the largest U.S. bank failure since 2010. Doral was plagued by improper accounting and Puerto Rico’s nearly decade-long economic slump.

"best banks" 2015: http://www.forbes.com

full list "TOP 100": http://www.forbes.com/sites/kurtbadenhausen/2016/01/07/full-list-rating-americas-100-largest-banks

2016-preview (.pdf): https://www.pnc.com

short pres./Indian banks: http://de.slideshare.net/KotakSecurities/5-key-challenges-faced-by-indias-banks