Related Categories

Related Articles

Articles

Dow Jones Industrial Average

(Price-weighted vs. Equal-weighted)

The Dow Jones Industrial Average (DJIA) is by far the eldest of the indexes, with roots dating back over 100 years to Charles Dow's introduction of the index in 1896. The DJIA attempts to use 30 stocks as a proxy for...

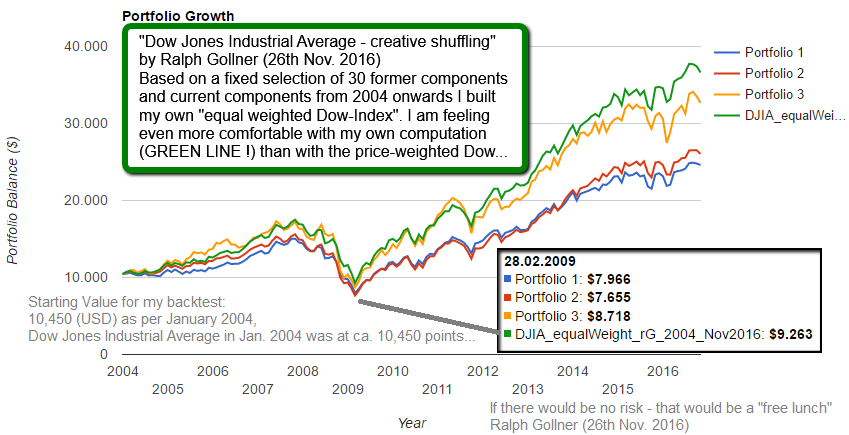

...the U.S. stock market. It does not include transport or utility companies. "But" In this posting and with the illustration above (Backtest from 2004 - Oct. 2016) I would like to outline the difference between a price-weighted index (which is a pretty old-fashioned method of calculating a benchmark), a market-weighted benchmark and an equal-weighted benchmark. In this example above I tried to build a "Buy & Hold"-equivalent EQUAL-WEIGHTED Dow Jones Ind. Average-clone (built with selected stocks as per Jan. 2004) - the green line.

Legend for the chart/backtest:

the other "indices" in this competition (backtest) from 2004 until Oct. 2016 were

♦ S&P 500 Total Return (TR aka Index incl. Dividends) "Portfolio 1", blue line

♦ S&P 400 Total Return (TR aka Index incl. Dividends) "Portfolio 3", orange line

♦ Dow Jones Industrial Average ETF (DIA) -here Dow Jones INCLUDING ! Dividends- "Portfolio 2", red line

The outcome is pretty interesting for the investor who is seeking to achieve a higher return than the standard benchmarks. Although the Price-weighted classic Dow Jones Industrial Average (the well known Index) and my EQUAL-WEIGHTED Dow Jones-CLONE ("my best guess" - each of the 30 components having the same weight in "my" index) are comprised of the same stocks (!), the different weighting schemes result in two indexes with different properties and different benefits for investors! hint: please read the "Handelsblatt"-article at the end of this posting (only in German !)

More specific critics on the Dow Jones Industrial Average-computation

With only 30 companies, it is hard to argue that the DJIA offers a better view of the broad market than the 500 companies in the S&P 500, or the thousands of stocks captured in the Wilshire 5000 index. But the Dow's largest shortcoming could be its reliance on a unique weighting mechanism. The DJIA weights its 30 stocks by price, giving more influence to stocks that have a higher price (adjusted for stock splits). Thus, when Citigroup fell to the low single digits earlier this year, it had relatively little impact on the DJIA. Instead, higher priced stocks like IBM and Exxon have a substantially greater impact, far more so than a much broader line industrial company such as General Electric (the longest tenured member of the DJIA).

Almost all other indexes are weighted by market capitalization, which approximates the size of the company far more than stock price alone. Over 100 years later, the Dow Jones Industrial Average remains a fixture in our daily reporting on U.S. stock market activities. Among professional investors, however, the Dow is more of a historic curiosity than a useful measure of true stock market movement.

links for further reading:

superb article (Must-Read, but in German, Handelsblatt)

"Der teure Irrtum der Indexfonds" www.handelsblatt.com/finanzen/anlagestrategie

German extract from the 'Handelsblatt-Artikel'

"Der teure Irrtum der Indexfonds": Hier werden zahlreiche Studien zitiert, die bestätigen, dass regelmäßige Gleichgewichtungen (regular REBALANCING) zu erheblichen Mehrrenditen führen. So haben beispielsweise drei Statistiker der Rice University die Renditen des US-Aktienmarktes zwischen 1958 und 2014 untersucht. Aus einer Anlage von 100 US-Dollar im S&P 500 wären demnach 5.200 US-Dollar geworden, bei einer permanenten Re-Adjustierung aber 25.600 US-Dollar (vor Spesen) und damit mehr als das Fünffache!