Related Categories

Related Articles

Articles

Dogs of the Dow (Strategy)

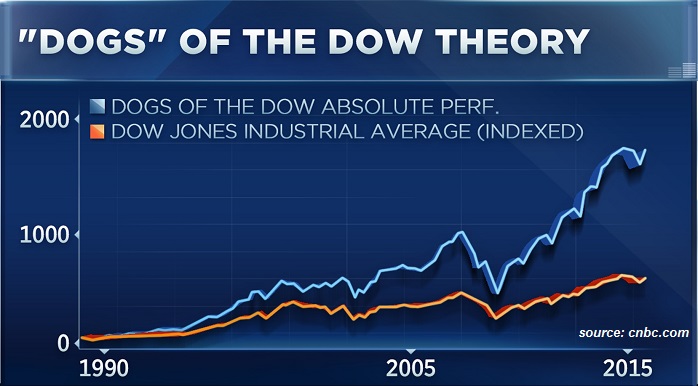

The dogs of the Dow theory is a classic investment strategy where one invests in the 10 Dow stocks with the highest dividend yield at the end of each year and hold those stocks for exactly one year. The strategy has yielded nice gains through the years.

So how have the high dividend paying Dogs of the Dow and the Small Dogs of the Dow performed? The following table should answer that question. The following table presents the total returns for various calendar years 2012 up to 2016:

Quite impressive? wuff...

What the data shows is that, over the longer-term, but also in single years both the Dogs of the Dow and the Small Dogs of the Dow (Strategy, which I will not explain here in detail ; -) have performed admirably. For example, since the turn-of-the-century, the Dogs of the Dow had an average annual total return of ca. 8.6%. This compares favorably to the average annual total return of the Dow Jones Industrial Average of 6.9%. The Small Dogs of the Dow have fared even better - gaining slightly more than an average of 10% per year - an impressive performance considering that the time period involved included both the dot-com bust as well as the historic financial crisis (performance-computations as per 31st Dec. 2016)!

Will history repeat itself (?) - well, who knows...