Related Categories

Related Articles

Articles

Shareholder Yield

(Microsoft)

Dividends are the most common method that a company can use to return capital to shareholders. Dividend growth investors often place significant emphasis on dividend yields and dividend growth as a result. However, there are additional ways...

...for companies to create value for shareholders. In addition to dividends, share repurchases are also an important part of a healthy capital return program. Debt reduction should also be welcomed by investors. Here one example:

Microsoft Corporation, founded in 1975 and headquartered in Redmond, WA, develops, manufactures and sells both software and hardware to businesses and consumers. Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services.

Due to low variable costs, the impact of operating leverage will allow Microsoft to maintain an earnings growth rate that is higher than the revenue growth rate for the foreseeable future. Buybacks are an additional factor for Microsoft's earnings-per-share growth, although this form of capital allocation becomes less attractive with an elevated valuation.

So -to come back to the intro of this posting - the single financial metric that incorporates each of the factors (dividend payments, share repurchases, and debt reduction); It is called (total) shareholder yield - and stocks with high shareholder yields can make very interesting long-term investments; the formula goes like this:

Back to "MSFT":

The markets Microsoft addresses continue to grow, with cloud computing being the most compelling one of these markets. This means that even without any market share gains Microsoft will most likely be able to grow its top line. Thanks to rising margins and a declining share count Microsoft's growth outlook over the coming years looks quite compelling, although not quite as robust as the company's last couple of years.

Looking longer-term, from 2008 through 2018, Microsoft was able to grow its earnings-per-share by nearly 8% annually.

Microsoft is marked by a number of very distinct valuation periods. In the 1990’s and early 2000’s, it was not uncommon to see shares trade north of 30 or 40 time earnings. From 2003 through 2008 shares regularly traded in the 20 to 25 times earnings range. From 2009 through 2014 a 10 to 15 multiple was typical. And lately, 20 times earnings and above has once again become the norm as growth has picked up extensively.

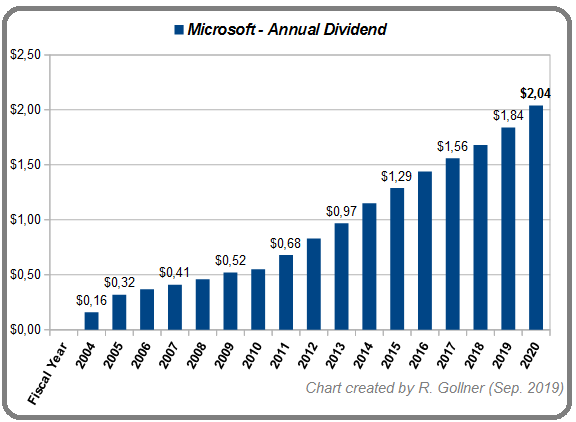

Microsoft has been a solid income investment throughout the last decade. The dividend payout ratio has never risen substantially above 50%, and the fact that Microsoft owns one of the strongest balance sheets in the world means that the dividend is very safe.

Microsoft's share buyback activities boost earnings

Owing to its strong free cash flow and revenue growth, Microsoft has also been buying back stock. Microsoft's board just recently approved a new share repurchase program of up to USD 40 billion. The program has no expiration date and can be terminated at any time. Microsoft bought back USD 19.5 billion, USD 10.7 billion, and USD 11.8 billion in stock in fiscal 2019, fiscal 2018, and fiscal 2017, respectively.

Microsoft's double-digit earnings and sales growth grew its operating cash flow to USD 16.1 billion in fiscal 2019's fourth quarter (ended in June). The company returned USD 7.7 billion to shareholders through share repurchases and dividends in the quarter.

Reminder: Share buybacks lower a company's share count, thereby boosting its EPS. In the table below you can see how the number of Shares Outstanding fell from 8.9 million in year 2009 to 7.68 million in the year 2018.

Earnings: In fiscal 2019's fourth quarter, Microsoft's EPS grew 21% YoY (year-over-year) to USD 1.37. Furthermore, the company's revenue grew 12% YoY to USD 33.7 billion!

How about the (near) future (?):

Microsoft has a great moat in the operating system & Office business units and a strong market position in cloud computing. It is unlikely that the company will lose market share with its older, established products, whereas cloud computing is such a high-growth industry that there is enough room for growth for multiple companies. Microsoft has a renowned brand and a global presence, which provides competitive advantages. The company is relatively resilient against recessions, and its AAA-rated balance sheet makes it a low-risk business.

Growth projections

Analysts expect Microsoft's earnings to grow sluggishly in the next two years, by 10.3% YoY in fiscal 2020 and around 13.5% YoY in fiscal 2021. In fiscal 2019, the company's earnings grew 22.4% YoY. They expect the company's revenue growth to slow YoY in fiscal 2020, to 11.14% from 14.0%, and for it to be flat YoY in fiscal 2021.

Attention: So let's stay tuned and be aware, that MSFT is not hanging around in the low teens with its Price-Earnings ratio anymore ;-)

Disclaimer/Disclosure: Ralph Gollner hereby discloses that he directly owns securities of Microsoft (MSFT), as per 24th September 2019.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Die Aktie Microsoft (MSFT) die in diesem Blogeintrag/Artikel behandelt/genannt wird, befindet sich aktuell/per 24. Sep. 2019 im "Echt-Depot" von Mag. Ralph Gollner.