Related Categories

Related Articles

Articles

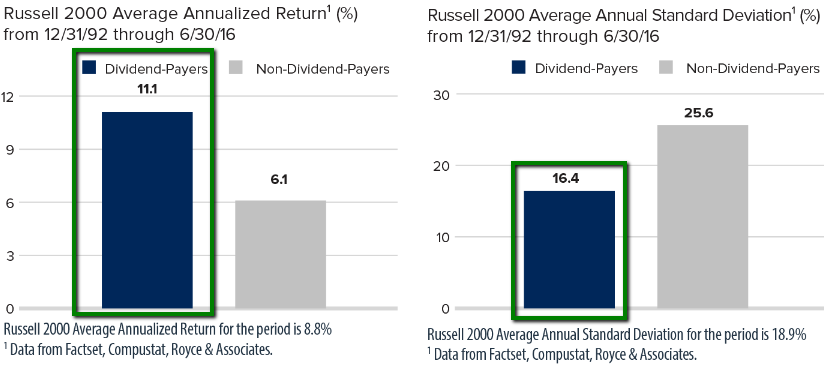

Dividend-Paying Small-Caps outperformed...

Dividend-Paying Small-Caps (Russell 2000-components) outperformed...

Non-Dividend-Paying Small Caps WITH LOWER VOLATILITY! Standard deviation is a statistical measure within which total returns have varied over time. The greater the standard deviation, the greater a stock's volatility.

If you look at the Russell 2000 (Small-Cap-Index) over time and you slice it into the companies that pay dividends and the companies that don't pay dividends, over time the dividend-paying companies have done better. The dividend-paying companies have had less volatility. And particularly in the down markets, you've had much better performance from the dividend-paying stocks.

Image-Source: www.roycefunds.com/insights