Related Categories

Related Articles

Articles

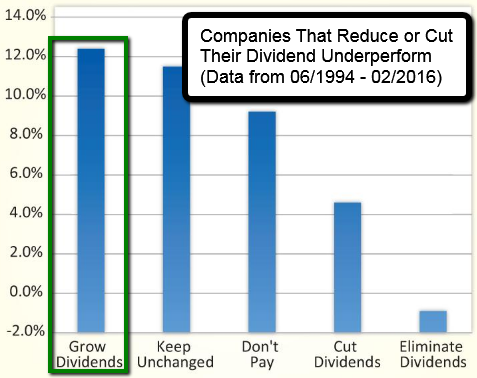

Dividend Growers outperform "the rest"

There is the existence of a return penalty for seeking out too high of a dividend-yield. Why would this be the case? Yield can be a proxy for risk. Stocks with the highest yields are those most likely to be perceived as risky by investors...

Source: "Investment Strategies for Non-Dividend Payers,"

Source: "Investment Strategies for Non-Dividend Payers,"

Ned Davis Group. Data from June 30, 1994, through February 29, 2016

...the perception becomes justified when such companies encounter business or financial problems.

Should those problems result in the dividend being cut, the return suffers. Ned Davis Research calculated that shares of dividend cutters realized a 4.6% annualized return from June 1994 through February 2016 compared to a 12.4% annualized return for stocks where the dividend was raised ("Investment Strategies for Non-Dividend Payers," March 2016). Eliminating the dividend is even worse, with such stocks incurring a –0.9% return. The diagram above shows the return differential between stocks with rising dividends and those with flat or cut/suspended dividends.

original-full-link/AAII-Article: www.aaii.com/journal/article