Related Categories

Related Articles

Articles

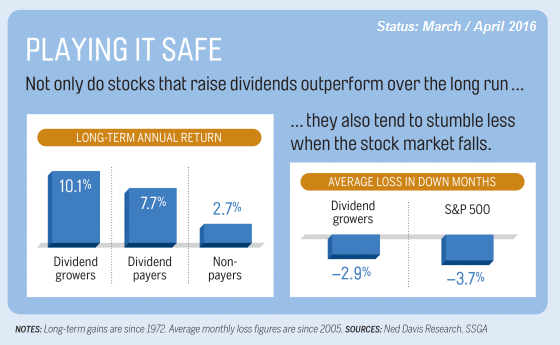

Dividend GROWERS ! (not only payers)

Dividend GROWERS ! (not only payers)

Some ideas: Quality & Dividends (Dividend Growers); Follow Buffett's lead (maybe?). Look for companies with competitive advantages in their industries - what Warren Buffett calls "wide moats" - that keep rivals at bay. Then you may look for...

...businesses with strong balance sheets marked by little or no debt and solid cash flow and earnings. One profit measure one may rely on is return on equity, which gauges how efficient companies are at generating net income. The historical average ROE for U.S. stocks is roughly 10%, so you want to look for stocks above that.

link: http://time.com/money