Related Categories

Related Articles

Articles

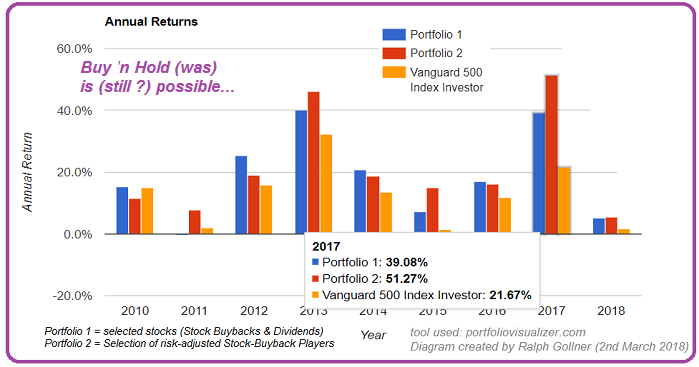

US-Stock Buybacks

(record expected in the year 2018)

S&P 500 companies may buy back a record USD 800 billion of their own shares in 2018, funded by savings on tax, strong earnings and the repatriation of cash held overseas. That will far exceed the USD 530 billion in share buybacks that...

...was recorded in 2017, analysts led by Dubravko Lakos-Bujas wrote in a note. Interesting insight: Stocks with higher buyback yields and new announcements tend to outperform their peers, especially during corrections and recessions. Since they year 2000, those stocks have outperformed peers by 150 basis points (+ 1,5 %) during corrections and 200 basis points ( + 2 %) during recessions, said the note. They are also less volatile than their peers in all market conditions, as buybacks tend to stabilise price weakness.

Companies have already announced over USD 150 billion of buybacks in the year to date (as per 2nd March 2018).

Analysts are expecting a combination of improving economic growth and lower taxes to contribute USD 100 billion of buybacks. Repatriation is expected to contribute about USD 200 billion.

Here also a selection of some of the S&P 500 20 largest companies having executed in Q3-2017 their Stock-Buybacks:

Apple, Walt Disney, Bank of America, Microsoft, Procter & Gamble, Boeing, Wal-Mart Stores, Home Depot, McDonald's, Cisco Systems, Visa and Johnson & Johnson.

But one could also look at companies, which are currently still involved in buying back shares at reasonable amounts like Lam Research Corp., Key Corp. or Intel Corp.

But one also should be reminded about the potential problem of "overpaying": Share buybacks also have their critics, especially when companies announce programs at a time when their stock price is trading close to a high, meaning they are likely overpaying.

Disclaimer/Disclosure: Ralph Gollner hereby discloses that he directly owns securities of Apple (AAPL), Microsoft (MSFT), Procter & Gamble (PG), Wal-Mart Stores (WMT), Home Depot (HD), McDonald's (MCD), Cisco Systems (CSCO) and Johnson & Johnson as per 2nd March 2018.

Disclaimer/Hinweis nach §34 WPHG zur Begründung möglicher Interessenkonflikte: Aktien von Apple (AAPL), Microsoft (MSFT), Procter & Gamble (PG), Wal-Mart Stores (WMT), Home Depot (HD), McDonald's (MCD), Cisco Systems (CSCO) und Johnson & Johnson (JNJ) befinden sich aktuell im "Echt-Depot" von Mag. Ralph Gollner - per 2. März 2018.

link:

www.prnewswire.com/news-releases/sp-500